Appointment details

| Appointment type | Voluntary Administration – 15 January 2019 Liquidation – 23 April 2019 |

| Appointees | Gayle Dickerson |

| Company subject to Administration | Specialty Mens Apparel Pty Ltd Trading as Ed Harry Menswear ACN 149 766 307 |

| Office | Melbourne |

KPMG contact

Background information

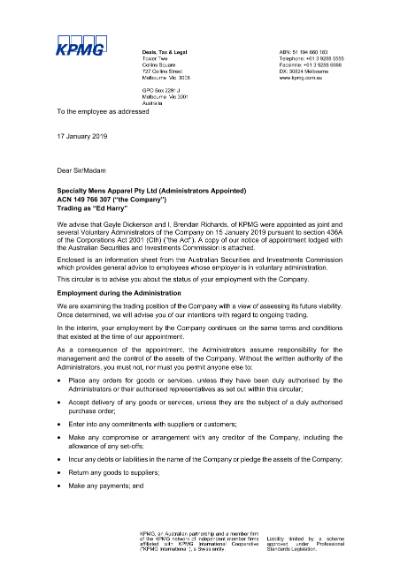

On Tuesday, 15 January 2019, Brendan Richards and Gayle Dickerson of KPMG were appointed as Joint and Several Administrators (“the Administrators”) of Specialty Mens Apparel Pty Ltd (“the Company”) by David Clark, Adrian Crowley, Anthony Hawkins and John Read (“the Directors”).

Brendan Richards resigned as liquidator on 8 June 2023.

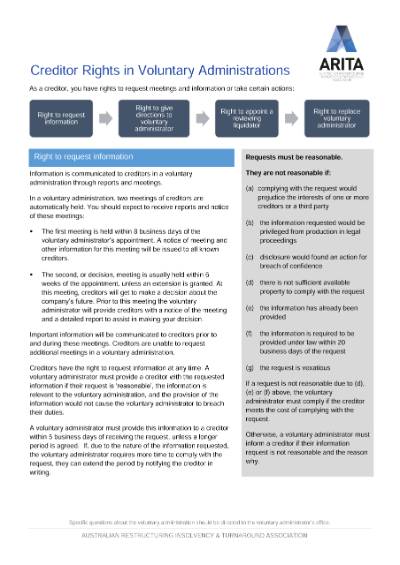

Voluntary administration is a statutory process designed to quickly resolve the future direction of a company, with the aim of maximising the chances of the company’s survival, or as much as possible, its business. In the event it is not possible to save the company or its business, the aim is to administer the company’s affairs in a way that will provide a better return for the company’s creditors than if the company were immediately placed into liquidation.

Please find below relevant links for stakeholders of Specialty Mens Apparel Pty Ltd.

Latest news

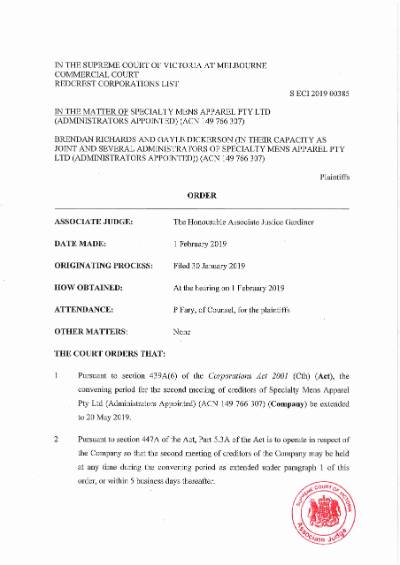

Voluntary Administration update – 4 February 2019

We advise that on 1 February 2019, the Supreme Court of Victoria (“the Court”) granted Orders extending the convening period of the Company to 20 May 2019. The primary reason for seeking an extension of time is to allow the Administrators to explore the possibility of achieving a sale of the Company’s business and/or for a deed of company arrangement (DOCA) to be proposed. Even if a sale of the Company’s business does not eventuate and a DOCA is not proposed, the extension of time will allow the Administrators to continue to trade the Company’s business in order to realise in an orderly manner the stock currently on hand, thereby maximising returns from the sale of stock.

In summary the Court ordered that:

- pursuant to section 439A(6) of the Corporations Act 2001 (Cth) (“the Act”), the convening period for the second meeting of creditors of the Company be extended to 20 May 2019; and

- the second meeting of creditors may be held at any time during the period up to 20 May 2019 or within five (5) business days thereafter.

Creditors will be informed when the second meeting of creditors has been convened pursuant to section 439A of the Act.

A copy of the authenticated Orders is provided in the ‘Other information’ section of this website below.

Second report to creditors – 5 April 2019

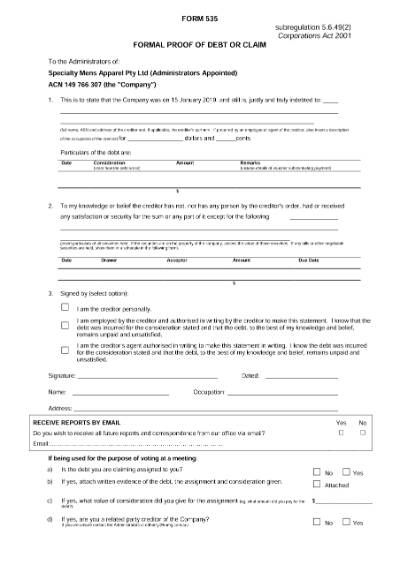

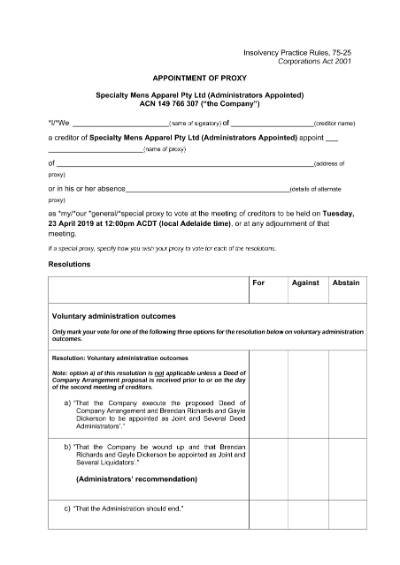

Please find below the Voluntary Administrators report to creditors dated 5 April 2019. This report includes a copy of the Replacement Declaration of Independence, Relevant Relationships and Indemnities (“DIRRI”), Remuneration Approval Report, Appointment of Proxy and Proof of Debt forms and creditor information sheets (“Voluntary Administrators report”).

We have convened the second meeting of creditors for Tuesday, 23 April 2019 at the offices of KPMG Adelaide at 12:00pm ACDT (local Adelaide time), in accordance with section 439A of the Act to determine the Company’s future. A notice of meeting is enclosed in the Voluntary Administrators report.

To participate and vote on the future of the Company at the second meeting, you may need to submit a proof of debt form for voting purposes and proxy form.

Appointment of Liquidators – 23 April 2019

At the second meeting of creditors held on 23 April 2019, creditors resolved that the company be placed into Liquidation in accordance with section 439C(c) of the Corporations Act 2001 (Cth). Brendan Richards and Gayle Dickerson of KPMG were appointed as joint and several Liquidators.

Liquidators statutory report to creditors – 22 July 2019

This report should be read in conjunction with the information contained in our Voluntary Administrators’ Second Report to Creditors (PDF 2.1MB) dated 5 April 2019.

The purpose of this report is to:

- provide you with an update on the progress of the Liquidation

- the results of our investigations into the Company’s affairs, and

- the likelihood of a dividend being paid in the Liquidation.

Should you have any queries regarding the above or any other matter, please contact KPMG by email to edharry@kpmg.com.au.

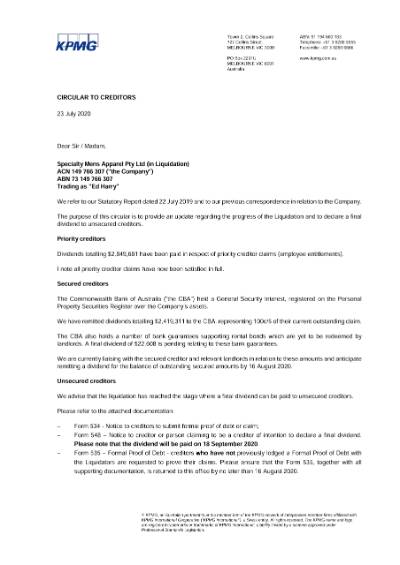

Liquidators update to creditors – 23 July 2020

This report should be read in conjunction with the information contained in our Voluntary Administrators’ Second Report to Creditors (PDF 2.1MB) dated 5 April 2019 and Liquidators Statutory Report to Creditors (PDF 730KB) dated 22 July 2019.

The purpose of this report is to:

- provide you with an update on the progress of the Liquidation

- provide final notice to submit a formal proof of debt or claim by 16 August 2020

- declare a dividend to unsecured creditors on 18 September 2020.

Creditor communications

Information and circulars.

Fair Entitlements Guarantee (FEG)

General information for claimants: Fair Entitlements Guarantee website

ASIC insolvency material

The Australian Securities & Investments Commission provides resources on insolvency for directors, practitioners, employees, creditors and investors.

Support

Coping with the emotional impact of financial distress.

Beyond Blue

The beyondblue Support Service provides confidential, one-on-one counselling with a trained mental health professional.

Phone: 1300 22 4636

Lifeline

Phone: 13 11 14 Australia-wide

Online crisis support chat (7:00pm to 4:00am daily)