The amended Law on Corporate Income Tax (“the Amended CIT Law”) has just been passed by the National Assembly on 14 June 2025 and will be effective from 1 October 2025. One of the key changes included in the Amended CIT Law is a major revision to the basis of taxation for income derived by foreign corporate shareholders from capital transfers, whether directly or indirectly, in the form of shares in non-public joint stock companies or invested capital in limited liability companies in Vietnam.

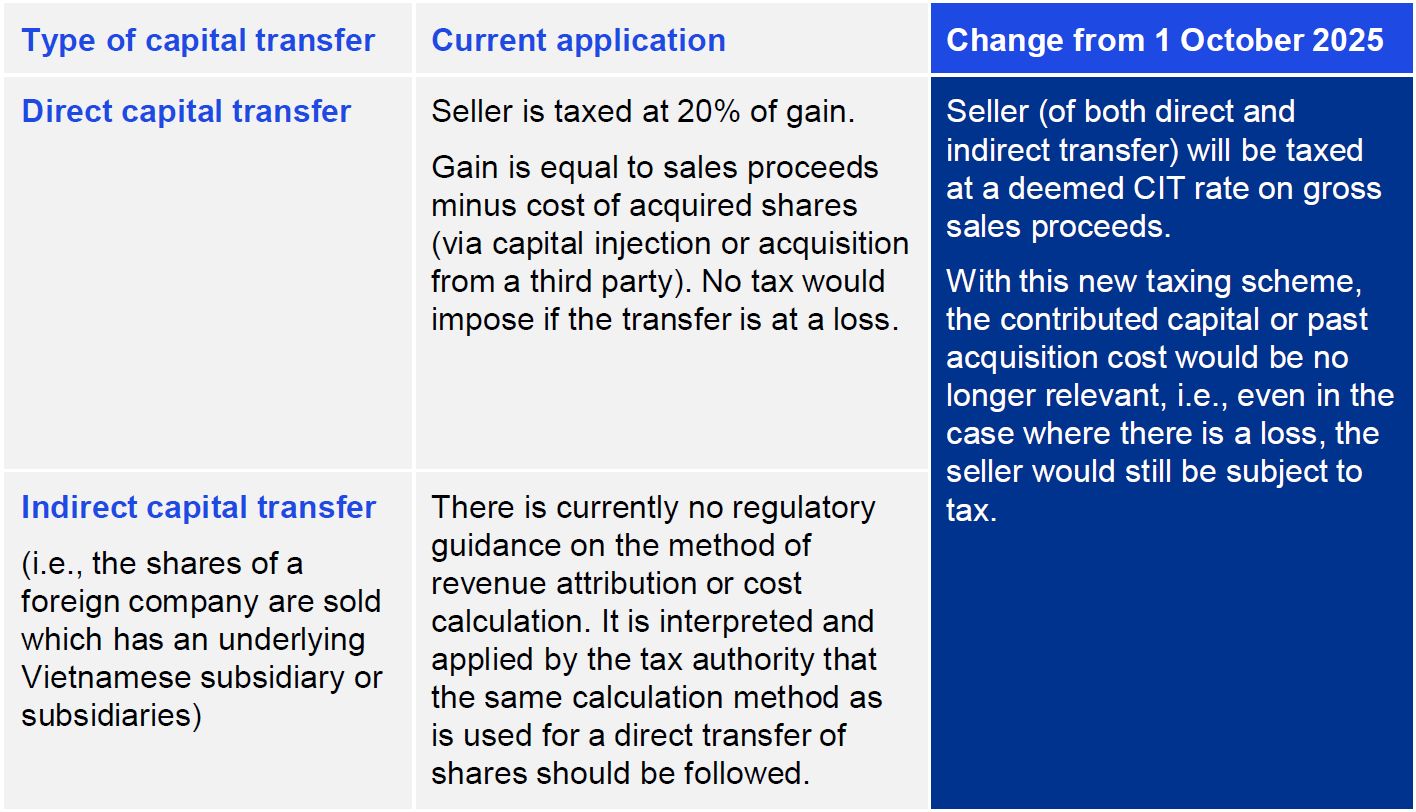

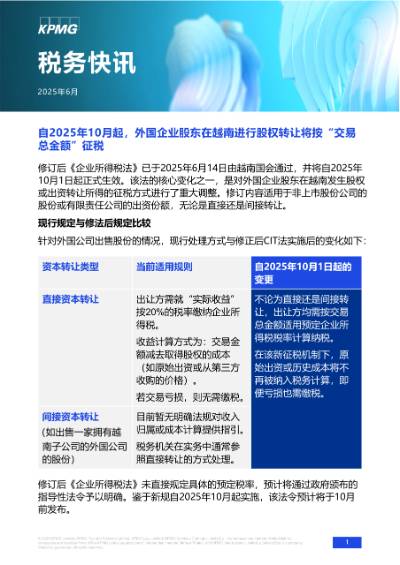

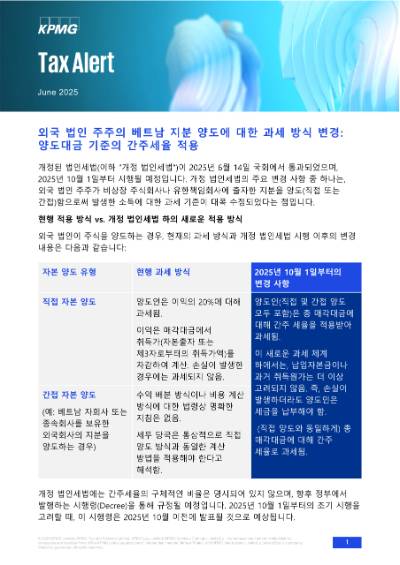

Current application vs. new application under the Amended CIT Law

The current treatment, versus the change under the Amended CIT Law, for a foreign company selling shares is as follows:

The specific deemed rate is not stipulated under the Amended CIT Law but will instead be provided in a decree issued by the Government. Given the early application from 1 October 2025, the guiding Decree is expected to be released before October 2025.

KPMG Comments

This is a welcome change in the respect of providing a clearer and simpler tax implication for foreign corporate sellers. The change is especially helpful for indirect transfers, where calculating gains for the seller and confirming the buyer’s cost base has proved incredibly challenging. With this new basis of taxation, some of these complications will be removed.

On the other hand, this potential change may result in an additional tax liability being incurred for transactions undertaken solely for internal restructuring purposes and/or those that are undertaken at a financial loss.

Please contact KPMG should you require further discussion on this matter.

Download to your devices here

Stay informed

Subscribe to our Tax and Legal Update newsletters for more insights and updates on the latest legislation

Subscribe here