Decree 182/2024/ND-CP on the establishment, management, and use of the Investment Support Fund

According to the policy approved by the National Assembly in Resolution 110/2023/QH15 dated 29 November 2023, in the context of Vietnam applying the Global Minimum Tax rule from 1 January 2024, the Government issued Decree 182/2024/ND-CP (“Decree 182”) on 31 December 2024, regarding the establishment, management, and use of the Investment Support Fund (“the Fund”). This fund aims to stabilize the investment environment, encourage and attract strategic investors, and support enterprises in specific prioritized fields.

Decree 182 takes effect on 31 December 2024 and applies starting from the fiscal year 2024.

Noteworthy points of the Decree are summarized as follows:

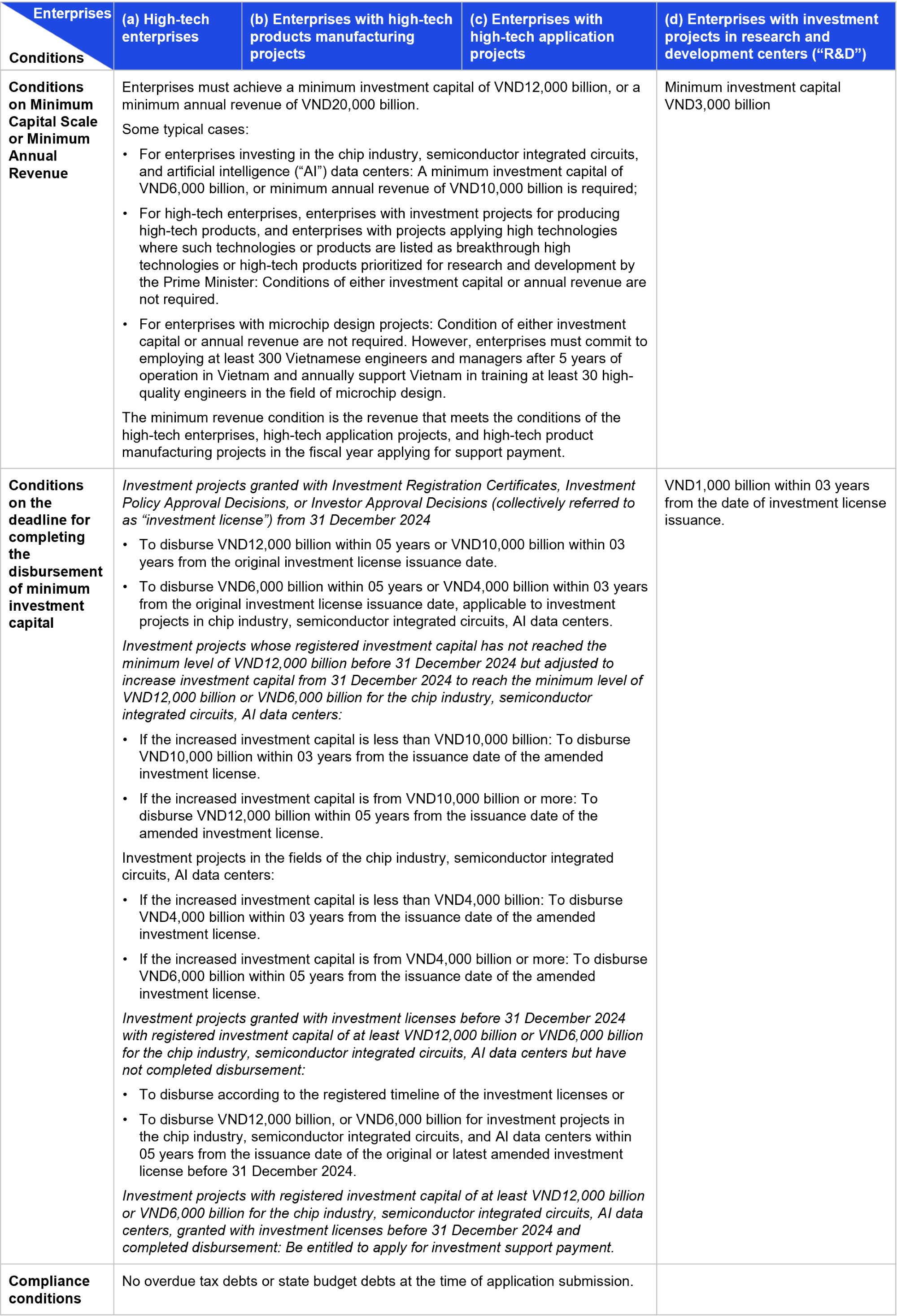

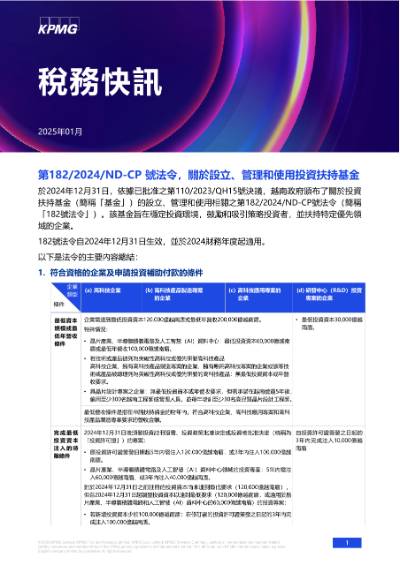

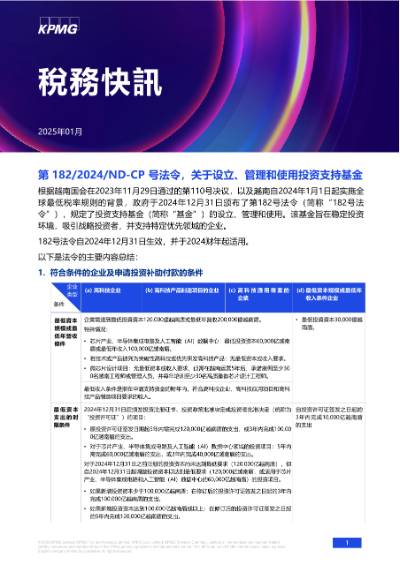

1. Eligible enterprises and conditions to apply for investment support payment

2. Investment Support Policies

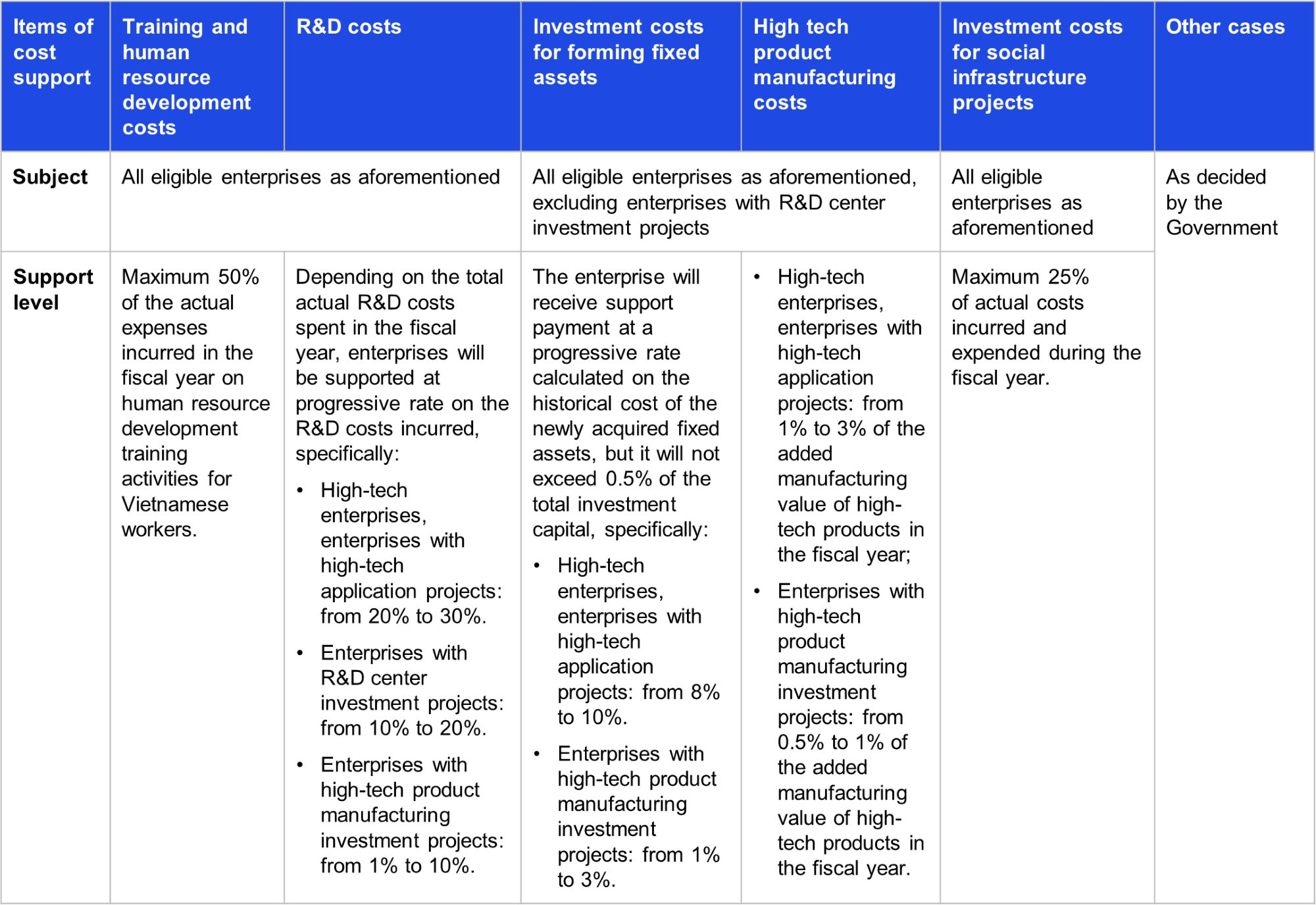

(i) Cost Support

The Fund provides direct cash grant for the following cost items:

(ii) Initial Investment Support

Enterprises with investment projects in R&D centers in the semiconductor and AI that meet specific criteria and conditions may receive support of up to 50% of the project’s initial investment cost, or other support levels as decided by the Government.

3. Principles for applying investment support policies

- Enterprises self-declare and are responsible for the documentation applying for investment support payment. In case of violations, enterprises must reimburse the granted support payment, interest, and administrative penalties.

- Each eligible enterprise and eligible project are supported for a maximum period of 5 years unless extended by the Prime Minister’s decision.

- If an enterprise is eligible to apply for support payment from the Fund and another fund or other supports from the Government for the same cost support item, the enterprise can only choose one type of support unless otherwise regulated by the Government or decided by the Prime Minister.

- If an enterprise is simultaneously eligible to apply for cost or initial investment support, it can only choose one type of support.

- Support payment received from the Fund is not subject to Corporate Income Tax.

4. Procedures and timeline to apply for investment support payment

- Before 10 July of the following year, enterprises must apply as prescribed to the designated Receiving Agency. Based on the enterprise’s application, the investment support request will be further processed by the Fund’s Executive Agency, the Fund Management Council, and the Government, respectively.

- The Government would review and decide on the total investment support amount for the enterprise.

Please contact KPMG for further consultancy on any related issues you are concerned about.

Download to your devices here

Stay informed

Subscribe to our Tax and Legal Update newsletters for more insights and updates on the latest legislation

Subscribe here