Thailand’s electric vehicle (EV) industry is expected to expand driven by supporting government policies, growing consumer demand, and increasing foreign investments, particularly from Chinese Original Equipment Manufacturers (OEMs). As a major automotive hub in Southeast Asia, Thailand is positioning itself to become a leader in the EV market by leveraging its established automotive supply chain, cost-efficient labor, strategic geographic location for exports and supportive regulatory framework and business environment. Over the short term, the potential escalation of international trade war and US reciprocal tariffs are expected to create investment uncertainty but may not directly impact the industry's fundamentals.

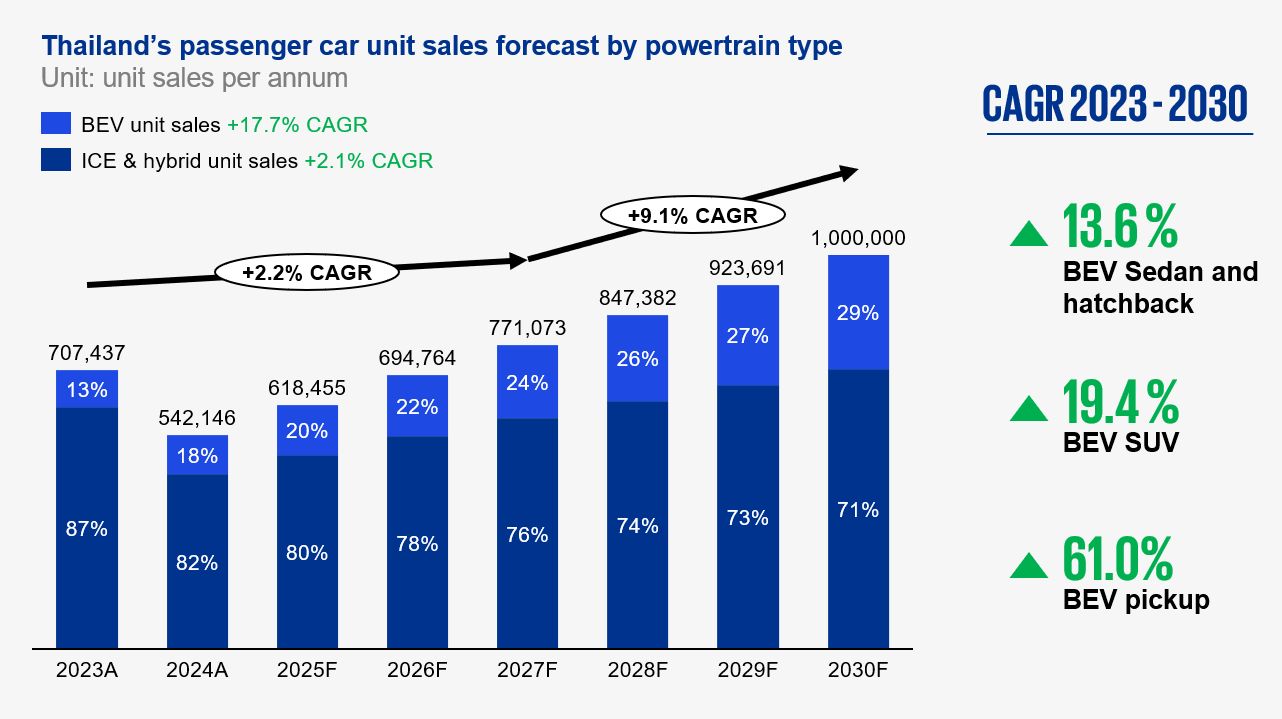

It is expected that the number of battery electric vehicle (BEV) sales will grow at a compound annual growth rate (CAGR) of 17.7%, from 92,576 units in 2023 to 290,000 units by 2030, representing around 29% of total car sales by 2030. Sport utility vehicles (SUVs) are anticipated to be most popular due to their versatility in usage, popularity as primary family vehicles and their adaptability to Thailand's geographical terrain, followed by sedan and hatchbacks. Hatchbacks have also been growing in popularity among consumers due to their compact size and relatively lower entry price points.

Key growth drivers for Thailand’s electric vehicle industry:

Supporting regulatory policies on EVs

The government has introduced cash subsidy programs for EV owners and tax benefits to support uptake.

Extensive automotive manufacturing ecosystem

Thailand has an established automotive ecosystem, including a wide network of parts suppliers and logistics.

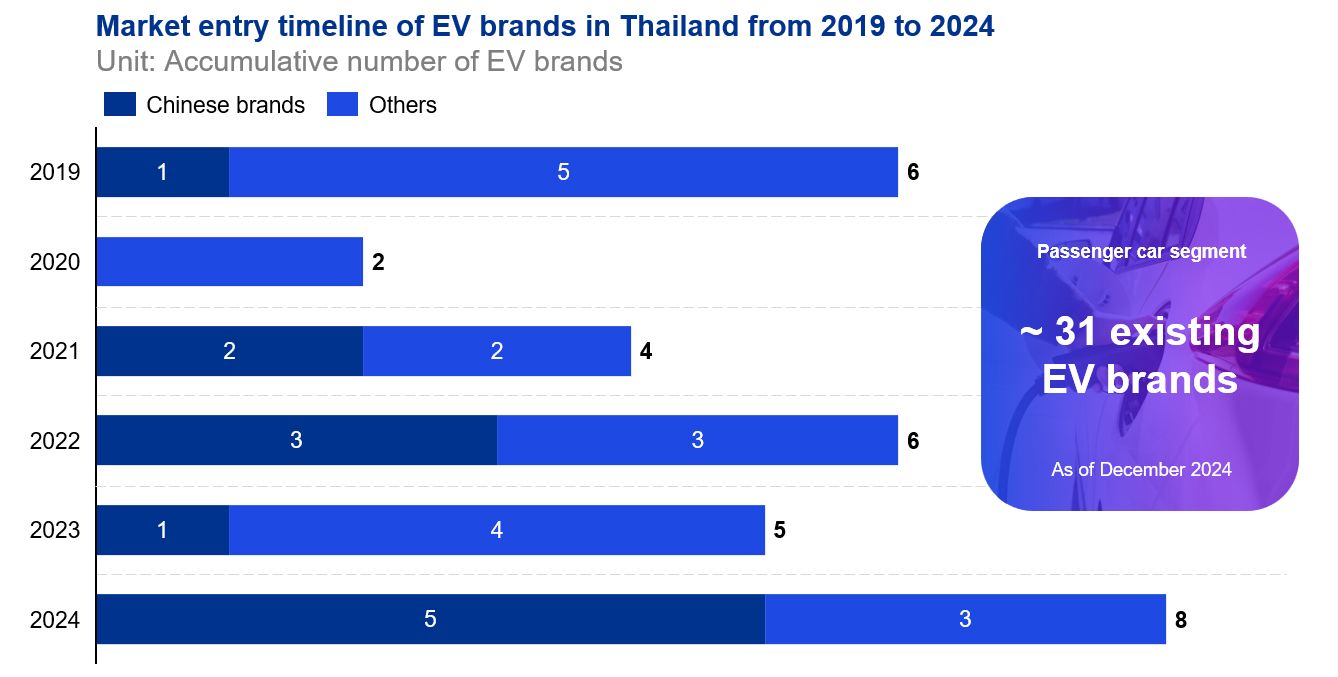

Since 2019, there has been an influx of new electric vehicle players entering the Thai market, posing a challenge to incumbent Japanese automakers. These new entrants include Chinese OEMs with a global market presence and advantages in economies of scale and import duty exemptions, making their imported Completely Built-Ups (CBUs) relatively more affordable than domestically produced vehicle counterparts without tax benefits. These factors, combined with their value-for-money offerings, have enabled them to quickly gain a foothold and establish a strong presence as leaders in Thailand's EV industry within a short period. The following graph summarizes the market entry timeline of 31 leading automotive brands which have introduced EV models in Thailand.

As indicated by the timeline above, there are approximately 12 Chinese automakers among the 31 existing EV brands in Thailand’s EV segment. The primary reason Chinese players are drawn to the Thai market is due to the country’s supportive regulatory environment, which offers systemic advantages for China-based automakers. Except for China and ASEAN countries, the absence of established Free Trade Agreements (FTAs) between Thailand and other major exporting markets, such as the US, Japan, South Korea and Germany, means that these markets do not benefit from import duty exemption on CBUs. This allows Chinese players to set their pricing competitively and subsequently appeal to Thailand's price-sensitive mass consumer market. Examples of key Chinese brands dominating the value-for-money segment in Thailand’s EV market include BYD, GWM, MG, ZEEKR and NETA. In contrast, Western brands such as Tesla, Mercedes-Benz, and BMW primarily compete in the premium segment, appealing to consumers seeking higher-end offerings.

However, as the local production requirements of the EV 3.5 policy take effect, it is anticipated that the cost structure for Chinese automakers in Thailand could become higher compared to mass-produced CBUs from China. Under the requirements of the policy, manufacturers must produce at least two locally assembled vehicles for every imported unit by 2026 and increase to a three-to-one ratio by 2027. This shift to local assembly, combined with lower production volumes compared to China's large-scale operations to support global demand, could reduce the cost advantages that Chinese players currently enjoy. As a result, maintaining the competitive pricing that has driven their success in Thailand’s value-for-money segment may become more challenging in the future.

Source: Publicly available information and KPMG analysis

Thailand’s EV industry is on track for growth as the country strives to become a key regional hub for EV manufacturing. Key trends driving this growth include government policies promoting EV adoption, advancements in battery technology, declining EV ownership costs, and the expansion of supporting services. These factors are expected to create a favorable environment for both consumers and manufacturers.

| Promotion of EV 3.5 policy |

|

| Declining cost of ownership |

|

| Battery advancement |

|

| Growing demand for ancillary products and services |

|

As the transition to EVs accelerates and ownership costs decline, it is expected that there could be growing business opportunities across the EV value chain spanning from battery production to aftermarket services, and other related sectors along the growing number of EV owners, while cost competitiveness will be on-top of mind for consumers.

At KPMG, we bring extensive experience in assisting clients as they navigate the complexities of the automotive and EV industries in Thailand. We have helped clients across the automotive value chain in service areas such as commercial due diligence, feasibility studies, business plan reviews and market assessment to ensure that our clients gain understanding of their potential investments from commercial and strategic viewpoints, while identifying key risks associated with their contemplated investments.

Source: Publicly available information and KPMG analysis

KPMG combines global industry insights, extensive engagement experience and practical expertise to help clients succeed in the dynamic automotive and EV markets in Thailand with the following advisory services:

Growth Strategy

“I want to achieve x% of revenue growth by 20xx.”

Advising clients on how to create a unique, sustainable competitive position.

- New market entry strategy

- Value proposition development

- Go-to-market strategy

- Customer analysis

- Pricing and assortment strategy

- Channel optimization strategies

- New business ventures

- New products/services launch strategy

Deal Strategy

“I want to create an optimal investment option.”

Advising clients on strategic investment/divestment decisions in a range of transaction settings

Pre-deal support

- Strategic option analysis

- Asset/investment portfolio review

- Target search and screening

- Acquisition evaluation

- In-deal support

- Buy-side commercial due diligence

- Sell-side commercial due diligence

- Business plan review

- Operational due diligence

- Value creation assessment

Key contacts

Why work with KPMG in Thailand

KPMG in Thailand, with more than 2,500 professionals offering Audit and Assurance, Legal, Tax, and Advisory services, is a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee.