While M&A is a key growth driver, our experience shows that there is significant ‘implementation risk’ that businesses do not capture the expected value post-deal. Proper planning and execution of the post-deal integration is key to achieving value upside and avoiding unexpected impairment losses.

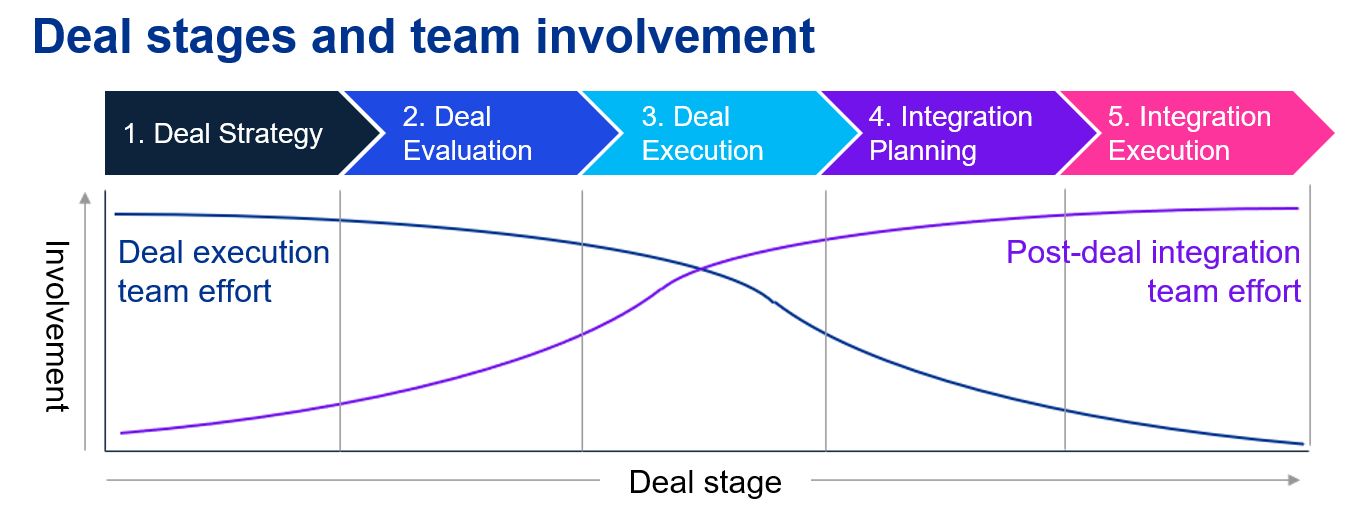

The M&A process requires expertise from various parties, as well as effort from execution and integration teams. For most companies, the business development team handles deal sourcing, transaction evaluation and negotiations until a deal closes, after which a different team manages the post-deal integration.

In such work division, there can be misalignment on the deal value and strategy, as the deal execution team is focused on closing the deal and may not thoroughly consider the post-deal impact or implementation of synergy initiatives. Execution teams may paint an optimistic picture of synergies, as they are incentivised to get deals approved and closed.

Deal execution should be considered holistically as an end-to-end process, involving post-deal integration teams as soon as possible.

1. Deal Strategy

Deal Strategy plays an important role in corporate strategic statements and business aspiration alignment. From an integration perspective, strategic questions, such as expected synergies and market entry strategy, are key considerations for end-state operation as well as integration strategy.

2. Deal Evaluation

This stage is when due diligence and price evaluation commence. In most deals, this is when third-party advisory services are engaged.

Key considerations in this stage include synergy opportunities, integration cost and integration readiness.

Businesses should ensure all synergy and integration cost components are factored into the valuation and are monitored consistently. A deep dive analysis of synergy and integration costs can be performed through an integration readiness assessment.

3. Deal Execution

When the deal approaches completion — the deal execution stage — most meetings are focused on negotiation and concluding the commercial terms. Business strategists/business development teams are mainly involved in this stage. Most of the time, the back-and-forth negotiations pertain to agreement conditions and price. The negotiated pricing factors and any changes in conditions should be updated in the synergy assessment to avoid mispricing. The post-deal integration team should be involved at this stage, if not earlier in the process.

4. Integration Planning

Deal closing is viewed as a milestone of success; however, it is only the beginning, where the acquirer starts to have control over the acquiree. In this stage, the acquirer needs to stabilise the operation while working on business integration for the approaching pre-defined Day 1 integration milestone. The pre-defined Day 1 can be the first day with combined operations or legal amalgamation, which varies according to specific circumstances. Activities and tasks depend on the level of integration, Day-1 requirements and deal strategy.

Key tasks include establishing project governance and setting up the integration management office (IMO). Acquirer and acquiree teams are combined into collaborative workstreams, organised mostly by function. Work plans are developed by the different workstreams. Key agenda items for the joint working teams include change management and communication plans for employees, suppliers and customers.

5. Integration Execution

After a work plan is set by the business, tasks related to integration begin. As Day 1 approaches, more interdependencies and joint-collaboration tasks are identified. Risks and issues are also identified and tracked throughout the process. For Day 1, key tasks are tracked to the hour. This level of detail is to avoid delays.

Separation Consideration

The separation framework is similar to integration but with a different sequence and details. Separation is a process to support a viable standalone operation for a spin-off or carve-out business. Key considerations include transitional service agreements, operation carve-out and separation readiness. The process begins with separation planning, followed by execution and BU divestment.

M&A integration as a framework to increase deal value

Integration and separation planning and execution provide visibility to management and shareholders. Earlier attention to post-deal integration also enhances transaction evaluation, which includes synergy confirmation, human resource considerations and operational improvement initiatives. Better comprehension of issues in the deal evaluation phase helps businesses to achieve greater value from their M&A deals.

Contact our Integration and Separation experts to learn more about the benefits of integration & separation planning and execution or to explore our other service offerings.

Key contacts

Why work with KPMG in Thailand

KPMG in Thailand, with more than 2,500 professionals offering Audit and Assurance, Legal, Tax, and Advisory services, is a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee.