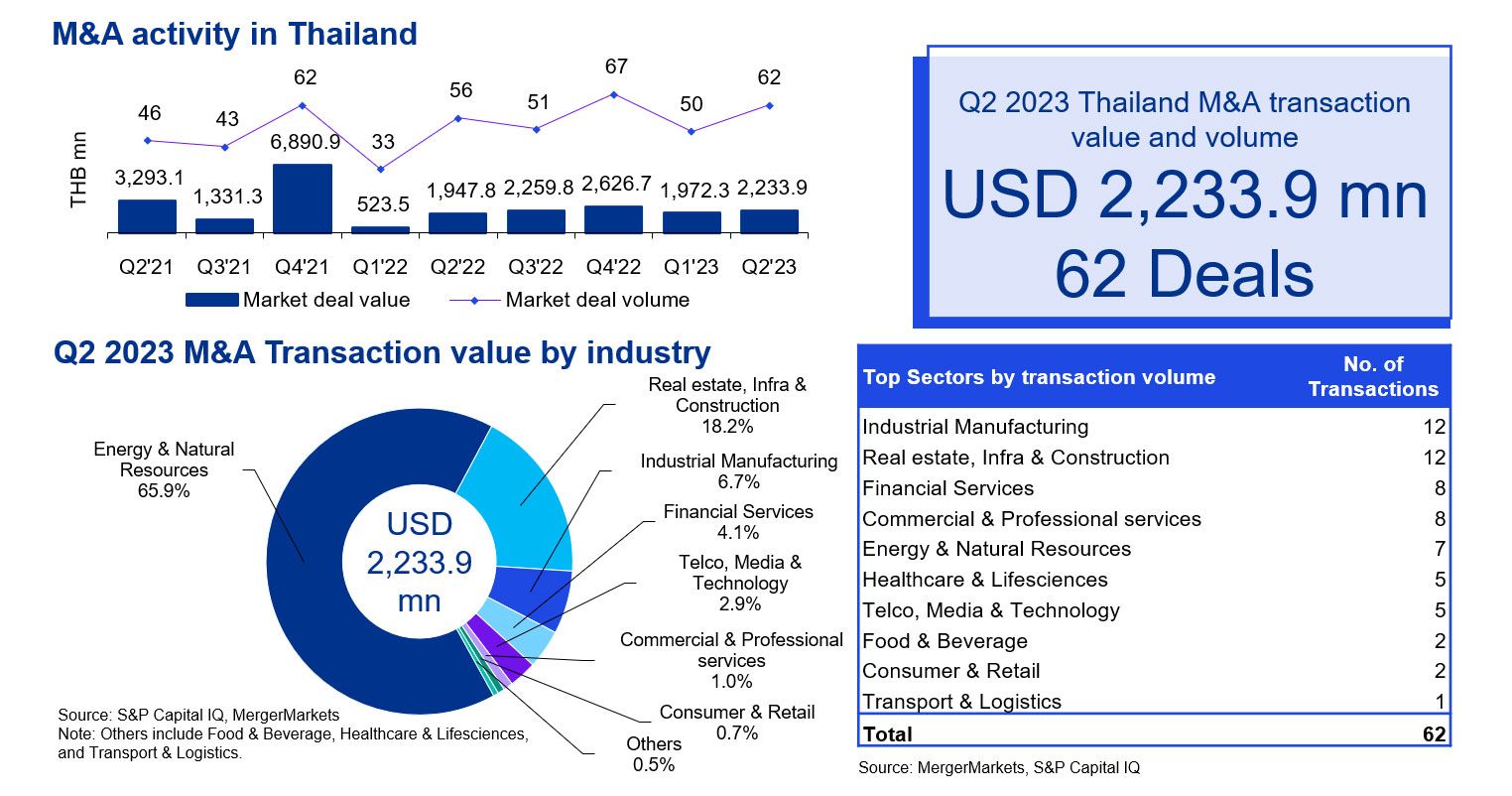

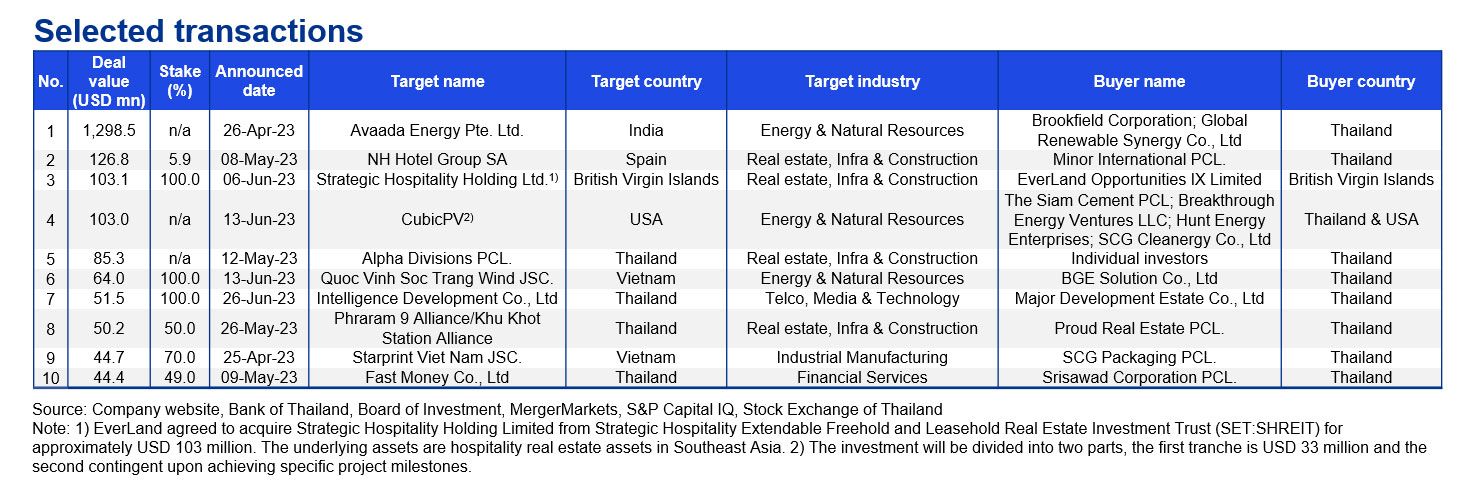

M&A activity in Q2 2023 exhibited strong growth, with 62 deals amounting to USD 2.3 billion, showcasing improvements in both deal value and volume compared to the previous quarter and the corresponding period last year. Investments in Thai companies accounted for 22% of the deal value, while outbound deals represented 78%. The Energy & Natural Resources, Real Estate, and Infrastructure & Construction sectors played a pivotal role, contributing 84% of the total deal value. A mega deal this quarter was Avaada Energy Private Limited’s USD 1.3 billion fundraising, with Global Renewable Synergy Co., Ltd. (GPSC) contributing USD 300 million, along with Brookfield Renewable’s USD 1 billion, to fund the development of three solar power projects in India. This investment advanced GPSC's commitment to increasing the proportion of renewables in its portfolio. Another noteworthy transaction involved Minor International acquiring an additional 5.9% stake in the Spanish hotel group NH Hotel Group SA for USD 127 million.

In recent economic developments, the World Bank acknowledged Thailand’s resilience by upgrading its 2023 GDP growth forecast to 3.9% from 3.6%. The country's trading partners have continued to show positive demand despite the global slowdown, and potential stimulus measures from China are expected to further benefit the Thai economy. Notably, private consumption has risen alongside the steady recovery of the labor market. The ongoing revival of tourism, projected to reach 2019 levels by 2024, has also contributed to the recent growth. However, Thailand faces certain challenges stemming from internal factors, such as higher production costs and high levels of household debt. External factors such as the global macroeconomic environment, geopolitical tensions, and exchange rate volatility may also impact GDP growth prospects.

The Board of Investment (BOI) has witnessed a sharp increase in applications and foreign direct investment, with prominent global companies like HP, Panasonic, and SVOLT choosing Thailand as a manufacturing base for various industries, such as food processing, electronics and automotive, including electric vehicles. Looking ahead, the M&A landscape in Thailand is expected to see a rising trend in partnerships and joint ventures between local companies and foreign investors, offering valuable expertise and scalability.

Data criteria

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million

- All deals included have been announced but may not necessarily have closed

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia