The Bank of Thailand expects GDP to expand by 3.6% this year, driven by recovery of the tourism sector, government stimulus and the weakening Thai baht. The consumer confidence and manufacturing production indices improved during Q1 2023, paving the way for growth. However, export pressures may challenge this growth as global trading partners, facing pressure from the global economic slowdown, reduce demand for products and services.

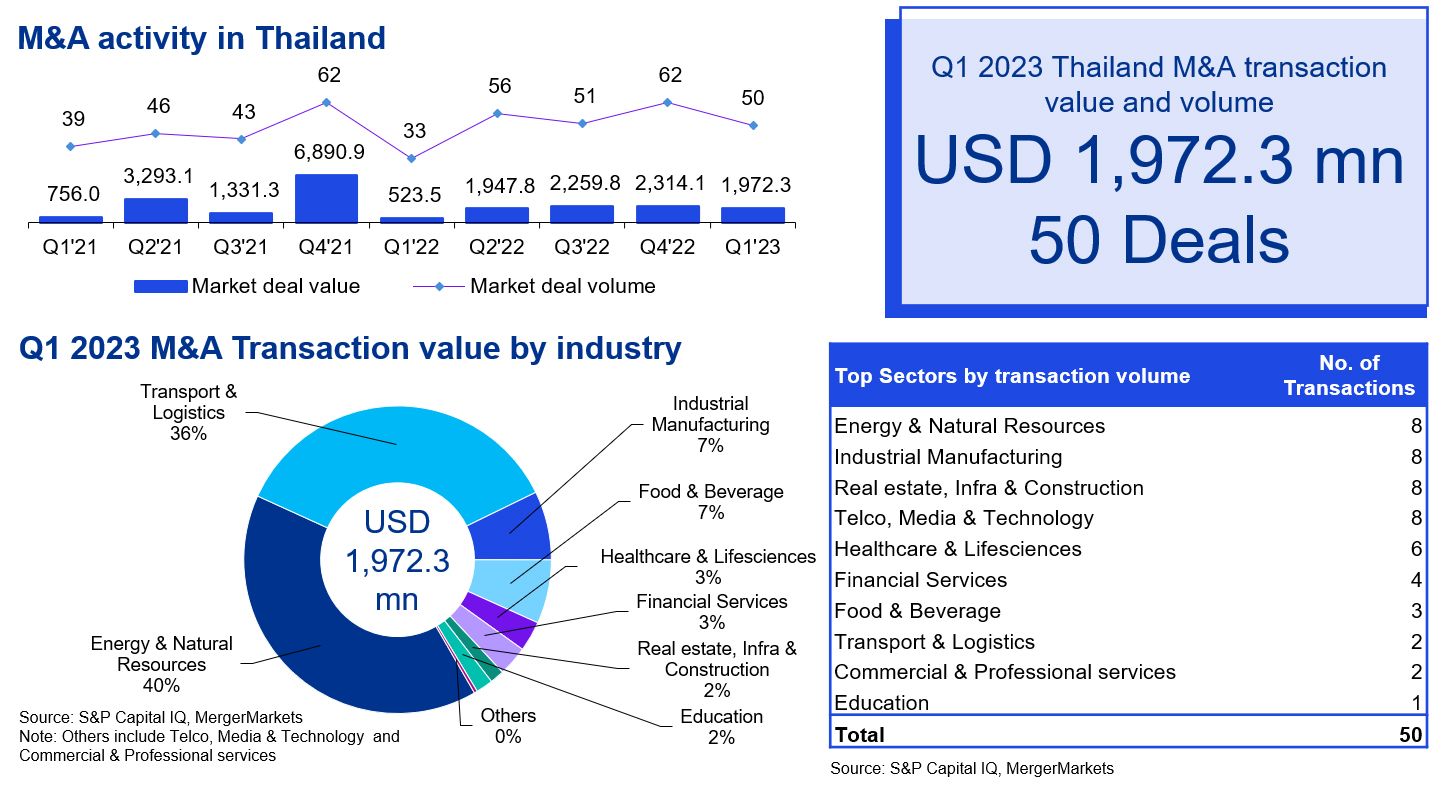

M&A activity during Q1 2023 has seen a significant increase compared to the same period in the previous year, with almost quadruple the value of deals. In total, there were 50 deals worth close to USD 2.0 billion, which is slightly lower than the previous quarter. The Energy & Natural Resources and Transport & Logistics sectors contributed 76% of the total Q1 2023 deal value. Investments in Thai companies accounted for 94% of deal value, with outbound deals representing 6%. The largest deal in the quarter was Bangchak Corporation PCL’s acquisition of Esso (Thailand) PCL. to balance its long-term strategy with energy affordability and sustainability. The next largest transaction was Flash Express’s USD 448 million series F fundraising to fund expansion of its overseas market and build its live-commerce business.

The Bank of Thailand provided reassurance of the country’s limited exposure to global banking issues as Thai banks have solid capital adequacy, liquidity coverage and non-performing loan coverage ratios. Despite reducing this year’s inflation forecast from 2.0-3.0% to 1.7-2.7% due to reduction in fuel and food prices, the central bank increased interest rates by 0.25%, from 1.50% to 1.75%; this has implications on the cost of capital, where we expect a potential narrowing of valuation gaps, which may help to facilitate deals going forward, especially deals during COVID that were paused due to valuation discrepancies.

Thailand's financial services sector is poised for continued transformation, with a particular focus on digital banking where regulators have announced an intention to allow market participants to apply for virtual banking licenses. We expect to see international players with expertise to enter the market in consortia with local companies to form a compelling value proposition in competing for one of the three licenses expected to be awarded.

Data criteria

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million

- All deals included have been announced but may not necessarily have closed

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia