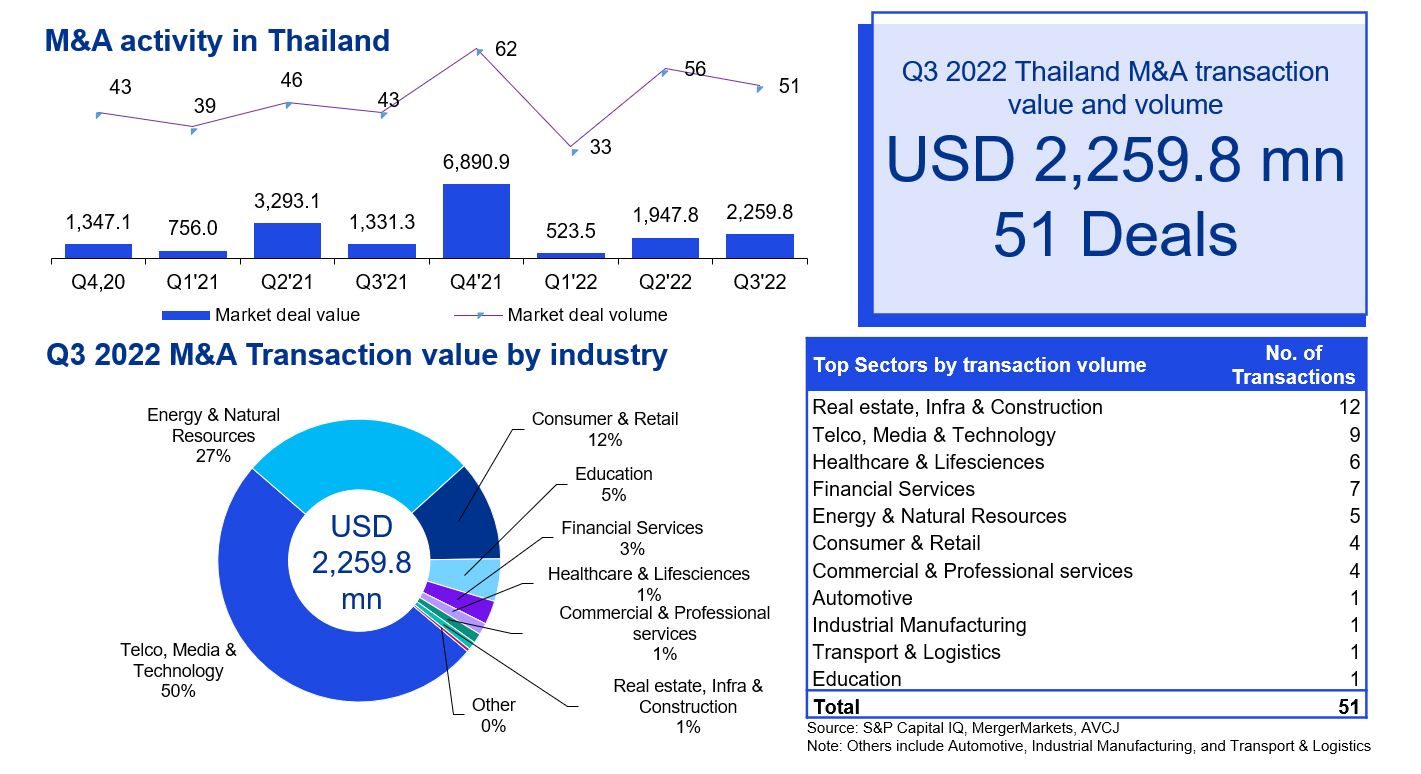

M&A activity in Q3 2022 was at a similar level as the previous quarter, with 51 deals valued at USD 2.3 billion. Investments in Thai companies accounted for most of the deal value in Q3, at 66%, while outbound deals represented 34%.

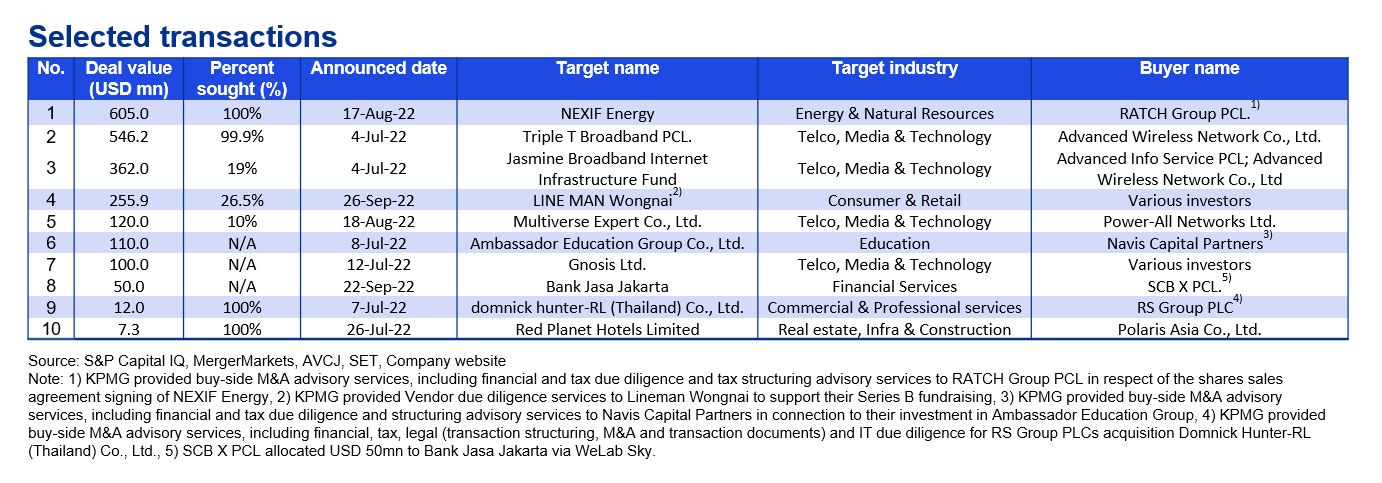

The Telco, Media and Technology, and Energy and Natural Resources sectors contributed 77% of total Q3 2022 deal value. The largest deal in Q3 was RATCH Group’s shares sale agreement signing for USD 605 million of NEXIF’s Asian power plant portfolio to expand its renewables business and accelerate progress towards its goal of a 10-gigawatt portfolio by 2025, a transaction on which KPMG provided financial and tax due diligence, and tax structuring advice. The next largest deal was AIS’s planned USD 546 million buyout of Triple T Broadband PCL. to expand customer reach and improve broadband inclusion in an increasingly competitive telecommunications industry. A notable deal KPMG provided sell-side assistance on was Line Man Wongnai’s USD 256 million Series B fund raising, which saw Thailand’s latest Unicorn valued at USD 1 billion. Other KPMG related deals include Navis Capital’s acquisition of Ambassador Education Group’s school portfolio in Thailand and RS Group PLC’s acquisition of domnick hunter-RL (Thailand) Co., Ltd.

The Bank of Thailand raised interest rates twice this quarter to reach 1%. The Government’s change in monetary policy is targeted to ease inflation, currently above 6%, and to maintain its projected 2022 GDP growth rate of 3.3%.

Economic activity in Q3 was driven by a jump in tourism, as well as improvements in private consumption and private investment. The continued weakening of the Thai baht presents opportunities for exporters to offer more competitively priced Thai goods and services; however, input costs in the economy may also increase. External factors and global economic uncertainty continue to threaten Thailand’s economic outlook.

The higher cost of capital and reduced risk appetite may adversely impact the overall M&A environment. Deals are expected to become more commercial and value oriented going forward, focusing on streamlining operations, expanding offerings, and improving service quality. Themes such as portfolio rationalization, diversification, and platform building may be more relevant toward optimizing the profitability and growth of Thai

Data criteria

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million

- All deals included have been announced but may not necessarily have closed

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia