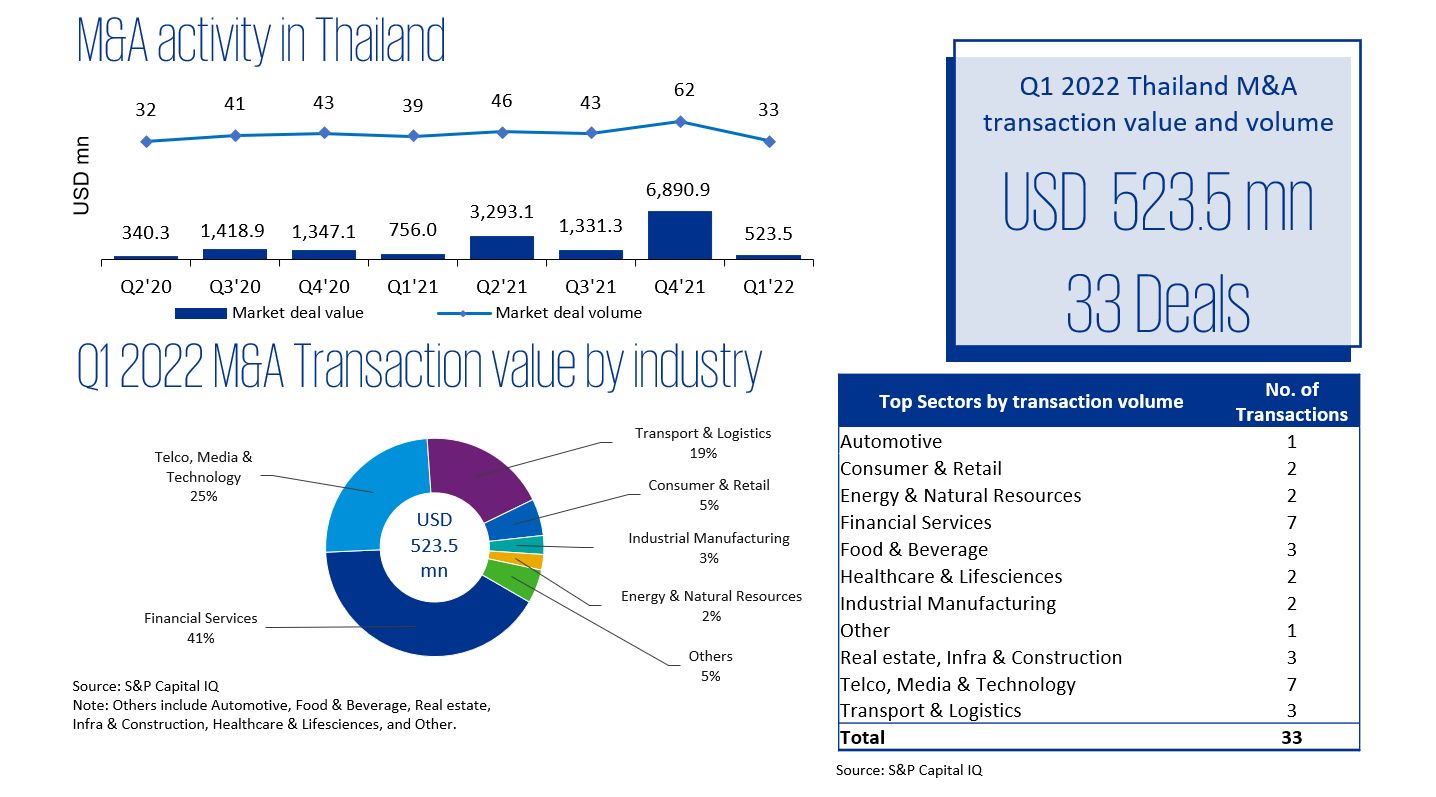

Thailand's economy recovered from the previous quarter’s slowdown owing to increased activities in tourism and exports. Despite the recovery, M&A activities in Thailand saw a contraction in terms of deal value and volume, particularly in comparison to the previous quarter’s above average performance. In the first quarter of 2022, 33 deals were announced with a total deal value of over USD 500 million1).

The decline in investment activities is underpinned by recent geopolitical developments, ongoing supply chain disruptions and the prolonged Omicron outbreak in Thailand. Rising raw material and energy prices in Q1 2022 have also adversely impacted consumer confidence as inflationary pressures emerge both in Thailand and globally.

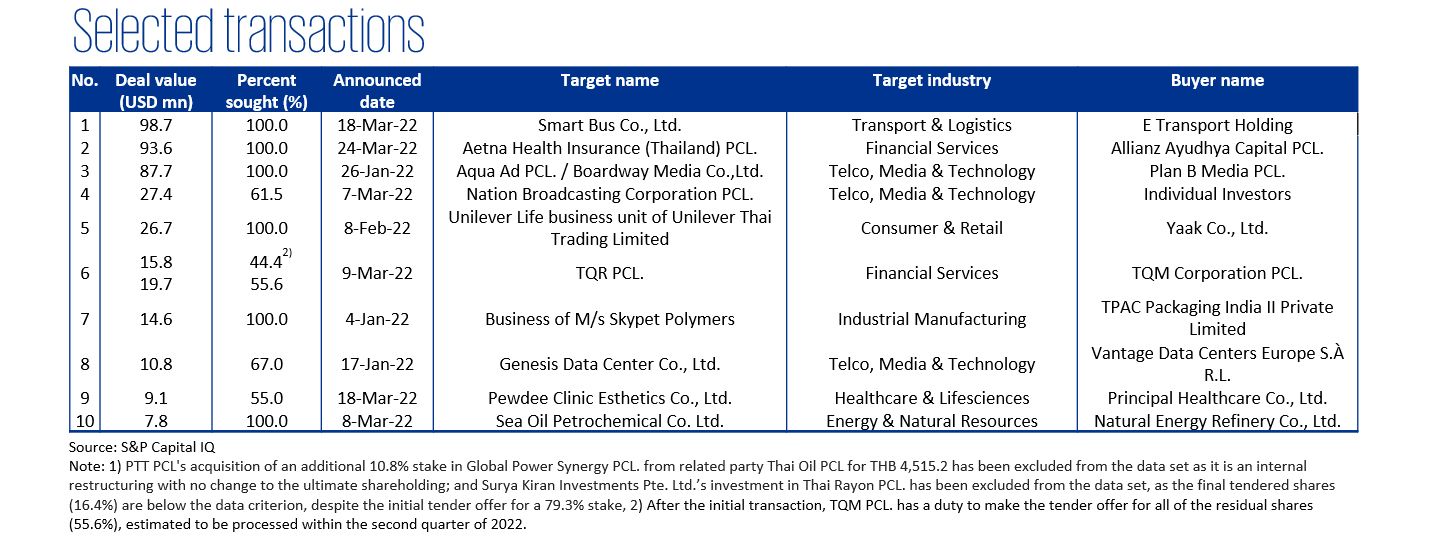

The Financial Service sector accounted for 41% of total deal value, mainly due to Allianz Ayudhya Capital’s planned acquisition of Aetna Health Insurance (Thailand) PCL., allowing the German insurer to further expand its presence in the Thai insurance market. A notable deal was SET-listed Energy Absolute PCL.’s 100% acquisition of Smart Bus Company Limited, a bus operator in Bangkok, via its wholly owned E Transport Holding. This deal is part of EA’s broader expansion strategy to enter the growing electric vehicle industry.

Dealmakers both in Thailand and globally will be keeping a cautious eye on geopolitical tensions and rising inflation, and their consequent impact on supply chains, demand and economic policies.

Data criterion

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million

- All deals included have been announced but may not necessarily have closed

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected

KPMG Deal Advisory

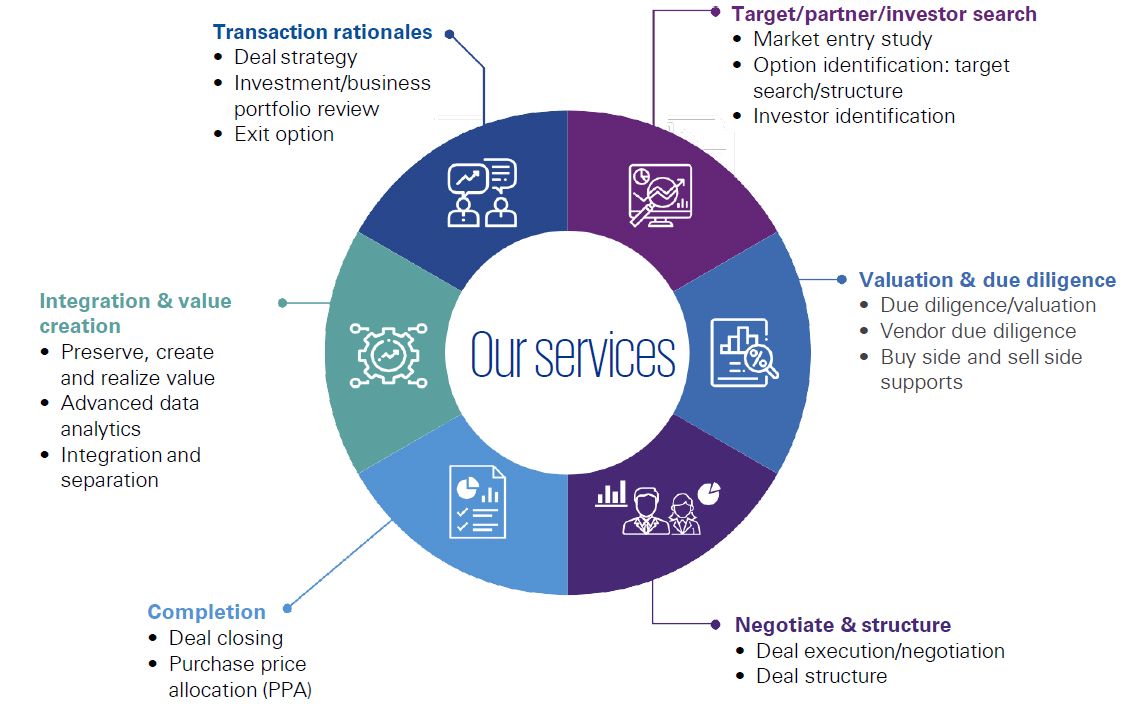

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia