What is Deal Strategy?

Mergers & Acquisitions (M&A) is one of the key strategic levers to grow your business. M&A enables you to accelerate access to new markets, sales and distribution channels, and new capabilities, as well as to optimize infrastructure and operations, and reduce costs. Yet it is critical that any business acquired must fit with, and support, your overall strategic goals in order to achieve sustainable growth.

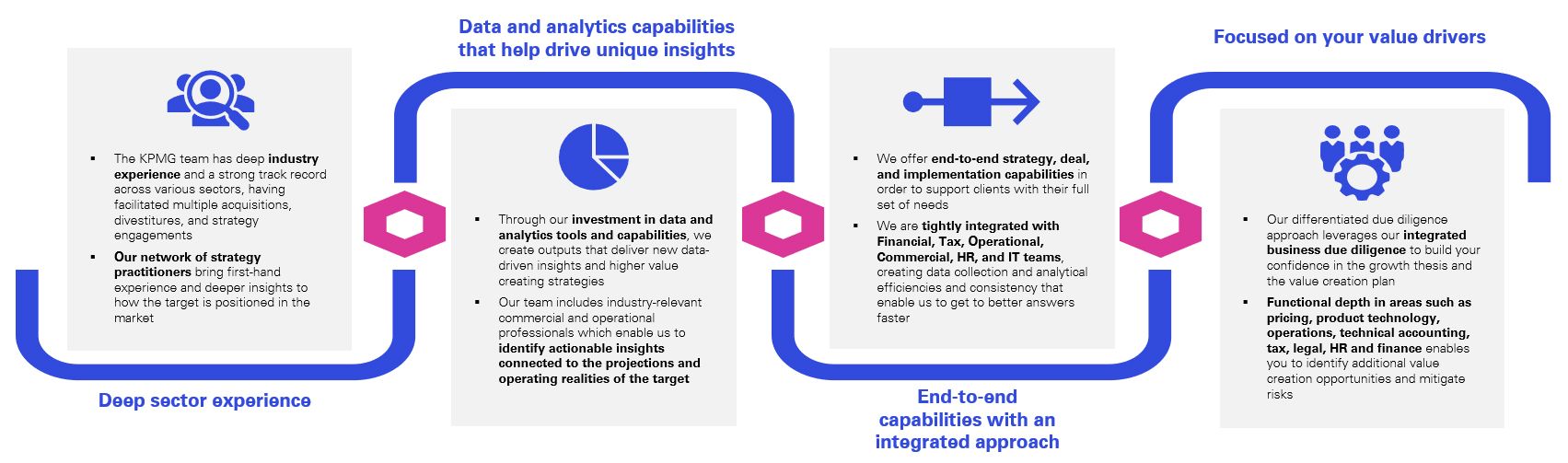

Our deal strategy team provides you with a holistic approach that challenges the conventional thinking and utilizes our industry knowledge and data-driven insights to understand, challenge and realize the strategic fit and value of your investment decisions at different stages of the deal life cycle.

Why is Deal Strategy important?

To achieve the highest value and maximize synergies from M&A, you will need an appropriate strategy aligned to your overall goals and objectives. Our approach combines deep industry knowledge and insights, with analyses of market potential, the competitive environment, and positioning, as well as providing an objective view of the company’s business plan to help answer key strategic questions such as:

- What is the best market entry strategy?

- Should the company build, partner or acquire another company?

- Is the target a strategic fit to the existing business and growth aspiration?

- Does the market in which the target operates have good growth potential?

- Is the target business model viable and sustainable in the long term?

- Should the company carve out non-core or underperforming business units?

When is Deal Strategy relevant?

Our deal strategy services are typically deployed during two stages of M&A process:

- Pre-deal support – We can assist you in searching and screening for possible markets to enter. We combine a strategic analysis of the market with an understanding of your strategy to identify and evaluate potential strategic options for your market entry.

- In-deal support – After you have identified a target, we can provide the next level of analysis to challenge your hypothesis for value creation and strategic fit, and perform diligence to ensure that your deal strategy is robust: Services can range from buy-side commercial due diligence, benchmarking and case studies, to business plan review and value creation assessments.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia