Despite slow economic growth and widespread COVID-19 cases, M&A activities in 2021 soared above 2020 levels in line with the record-breaking year globally for M&A. Thai corporations have been taking advantage of greater access to capital to invest in high growth opportunities in a low growth environment. The pandemic has been a catalyst to invest in enhancing digital capabilities, in line with a post-pandemic world as consumers noticeably grew their reliance on technology.

Positive sentiments of an economic recovery were underpinned by Q4’s surge in inbound tourism, however, this was quickly subdued by the government’s measures to contain the Omicron variant. Continued expansion of the “sandbox” initiative is expected to sustain the lagging tourism sector. COVID-19 continues to pose a threat to 2022’s overall economic outlook as higher household debt, a weakened labor market and supply-side inflationary pressures may dampen consumption.

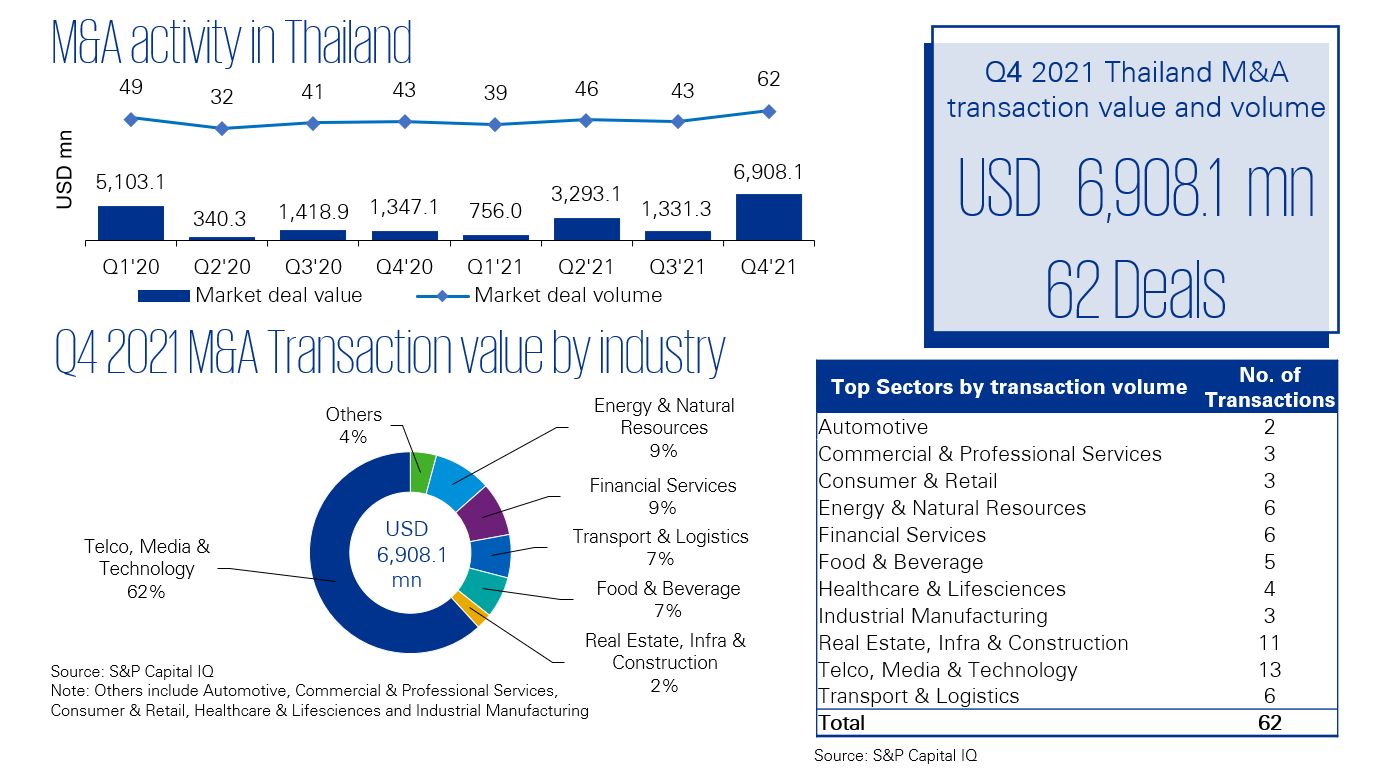

Q4 2021 saw a significant increase in deal volume with 62 deals that amounted to nearly USD 7 billion. The Telco, Media and Technology sector accounted for 62% of total Q4 2021 deal value, mainly due to True Corporation and DTAC’s planned merger to consolidate the Telecom market. A notable deal in the Financial Services sector was SCB’s acquisition of Bitkub, highlighting the proliferation of digital asset investments in Thailand.

Thailand’s strong external and public finances, macroeconomic framework together with rising exports has led the BoT to forecast GDP growth at 3.4% and 4.7% in 2022 and 2023, respectively. This supports the expectation of continued robust M&A activities, with major themes being digital transformation, divestments and diversification, synergy capture, economies of scale and the continued rise of private equity & venture capital.

Data criterion

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million

- All deals included have been announced but may not necessarily have closed

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected

KPMG Deal Advisory

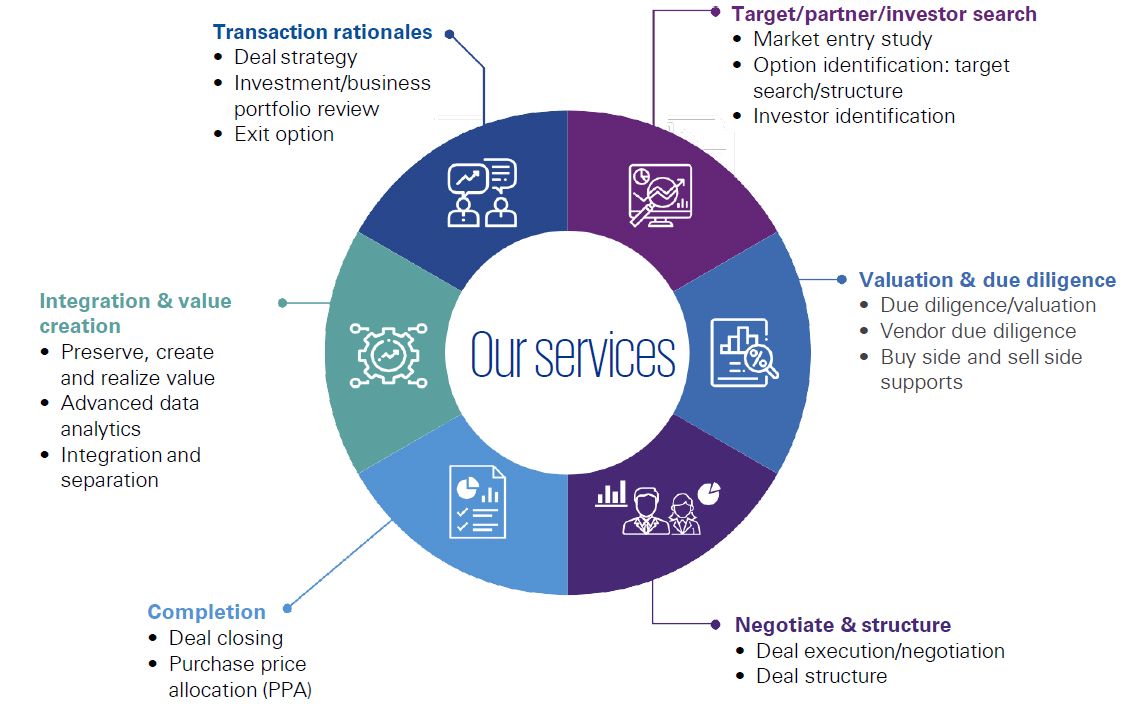

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia