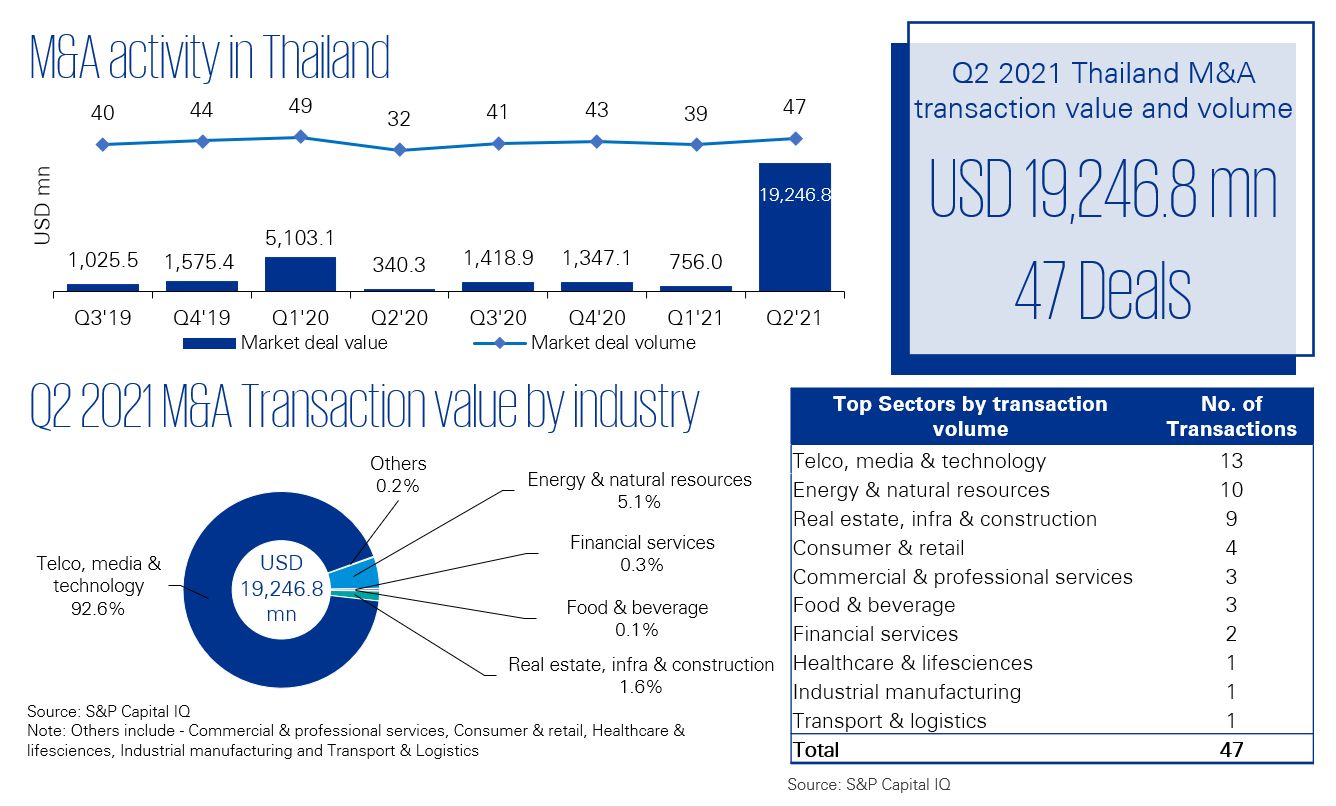

Thailand’s prospects for a near-term economic recovery are challenged by the pandemic’s ongoing third wave. However, the economy is beginning to see a resurgence of exports, showing signs of improvement as major trading partners have managed the pandemic through large vaccination drives, relaxed entry restrictions and economic stimulus - strategies Thailand intends to continue to follow. This, together with acceptance that M&A activities will continue despite the pandemic, increased deal activity in Thailand.

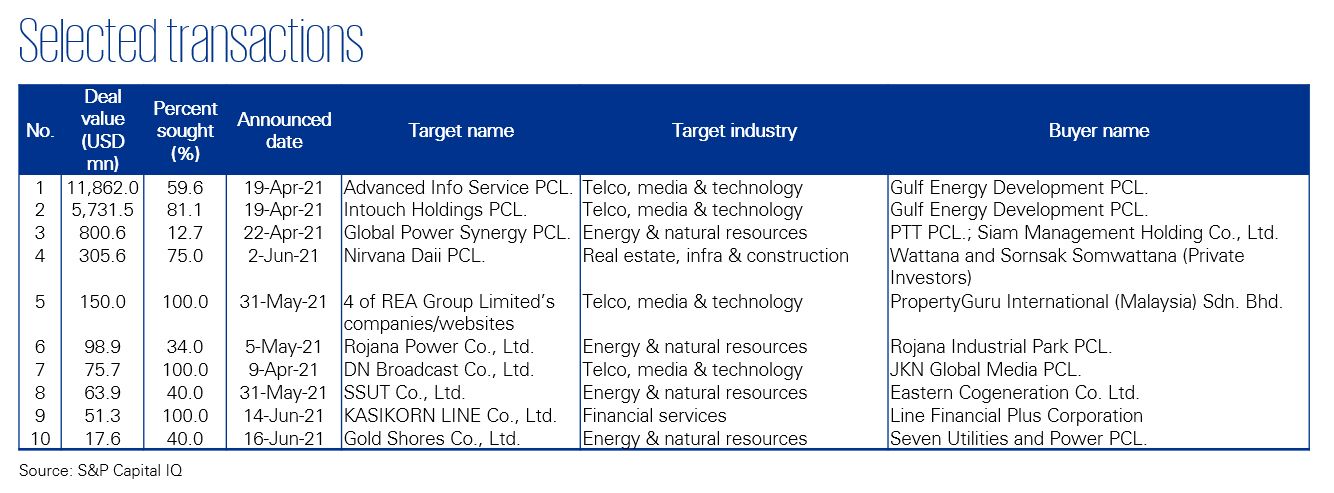

Q2 2021 saw a significant increase in deal volume and especially deal value, driven mainly by Gulf Energy Development PCL’s diversification into telecommunications with majority investments in AIS and Intouch for USD 11.9 billion and USD 5.7 billion, respectively, both subject to acceptance of the tender offers by mid-August. The Telco, Media and Technology sector accounted for 92.6% of total Q2 2021 deal value. Diversification has been a key driver of large deals in Q2, while growing businesses are seeking partnerships and capital to drive expansion.

The BoT left its key interest rate unchanged at a record low. Interest rate inertia paired with the anticipated injection of liquidity into the system shall continue to pave Thailand’s positive M&A trend in the second half of 2021, as large players continue to resume M&A activities and strengthen their market position both domestically and regionally, despite the pandemic.

Data criterion

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million

- All deals included have been announced but may not necessarily have closed

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected

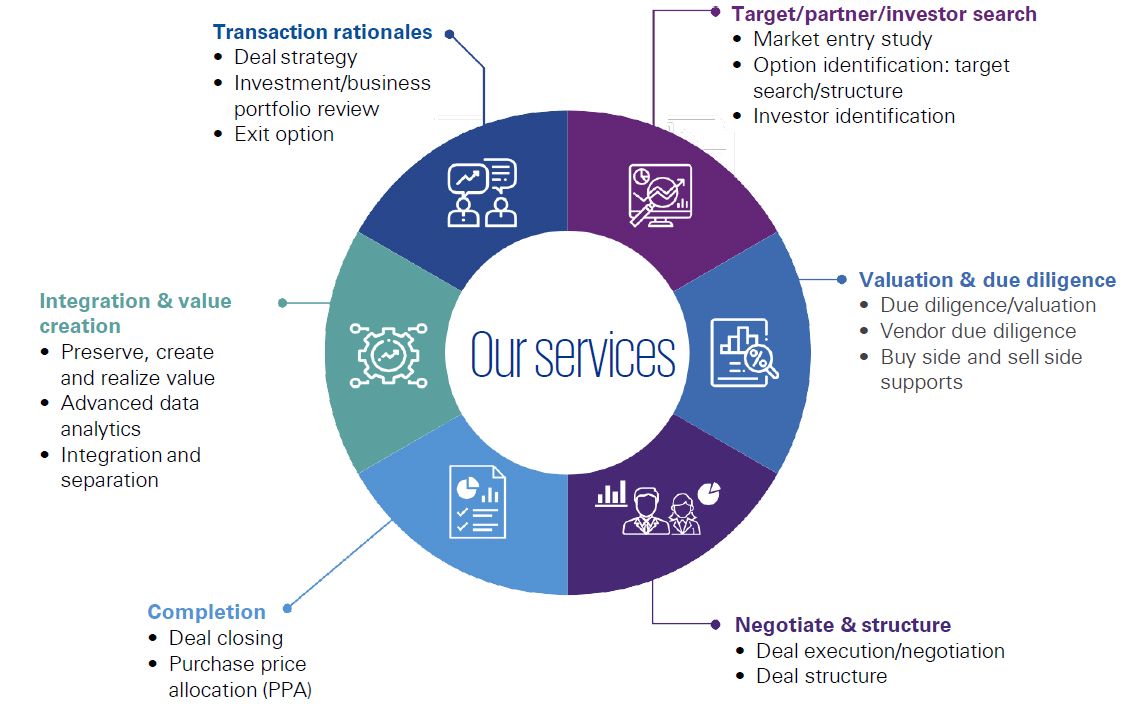

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia