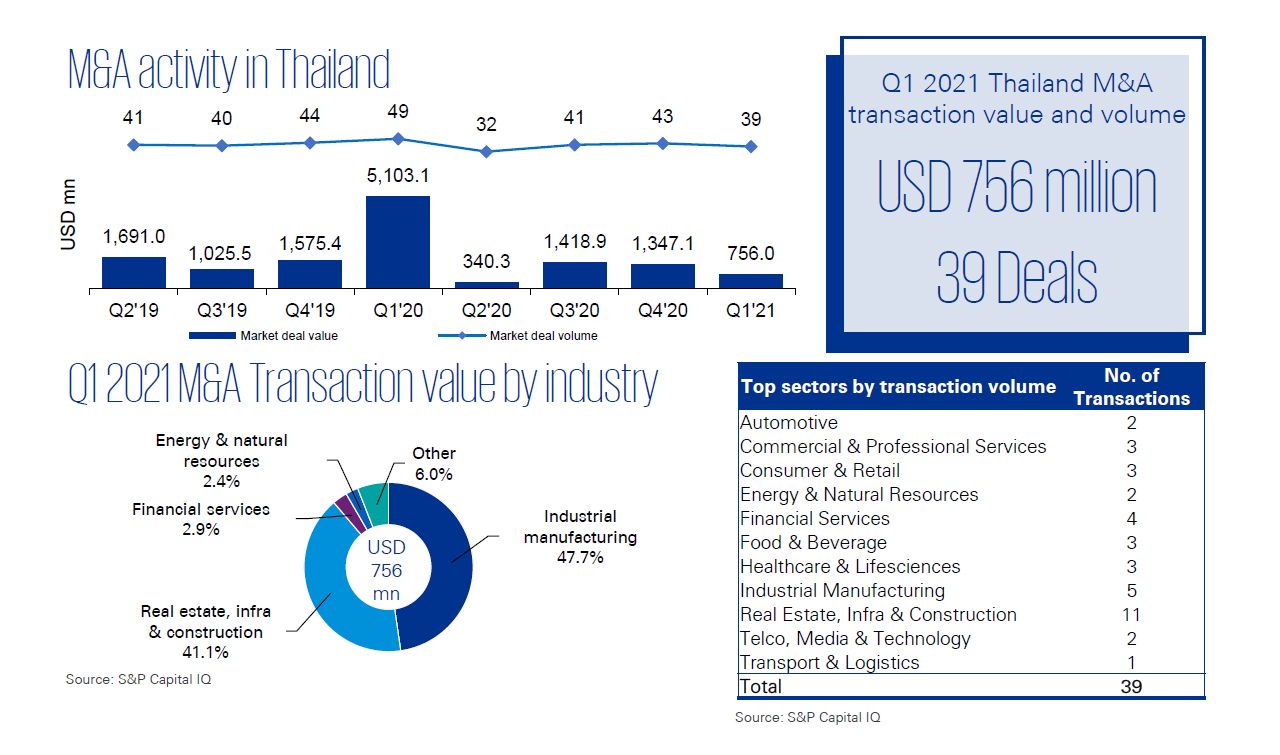

Thailand faced one of the largest economic contractions in over two decades last year. Dampened activity seeped into the first quarter of 2021, where the M&A landscape witnessed a 43.9% decline in deal value compared to Q4 2020 amidst volatile market conditions due to continued uncertainties from COVID-19. Not surprisingly, over 85% of buyers this quarter have been Thai. However, based on current discussions, foreign investors have been active in pursuing deals in Thailand, with many willing to accept back-and-forth quarantine in order to finalize due diligence and execute their deals.

Deal count was moderate, and most deals had a value of less than USD 100 million. The majority of announced transactions in terms of deal value this quarter were in the Industrial Manufacturing and Real estate, Infra & Construction sectors, accounting for 88.8% of total deal value. The largest deal announced was PTT Global Chemical PCL.’s (“PTTGC”) acquisition of an additional 16.2% stake in Vinythai PCL. (“VNT”) to delist VNT from the SET. The second largest transaction was Metro Pacific Investments Corp’s divestment of their entire stake in Don Muang Tollway PCL. for USD 149.3 million.

Data criterion

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million

- All deals included have been announced but may not necessarily have closed

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected

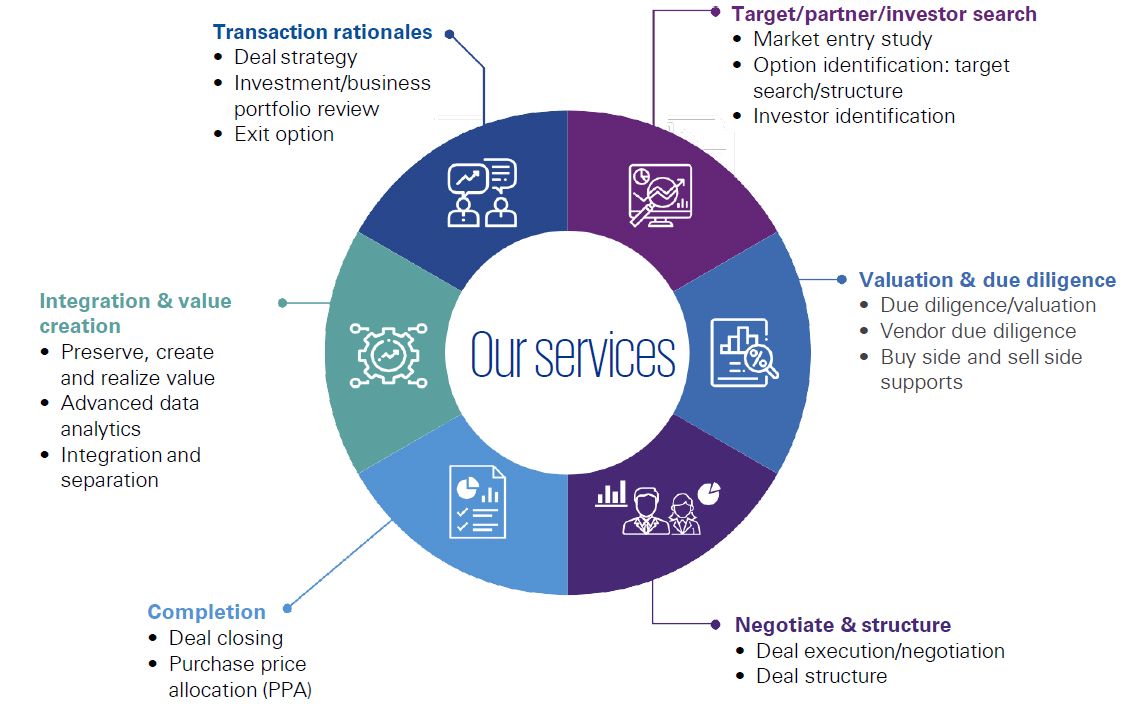

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia