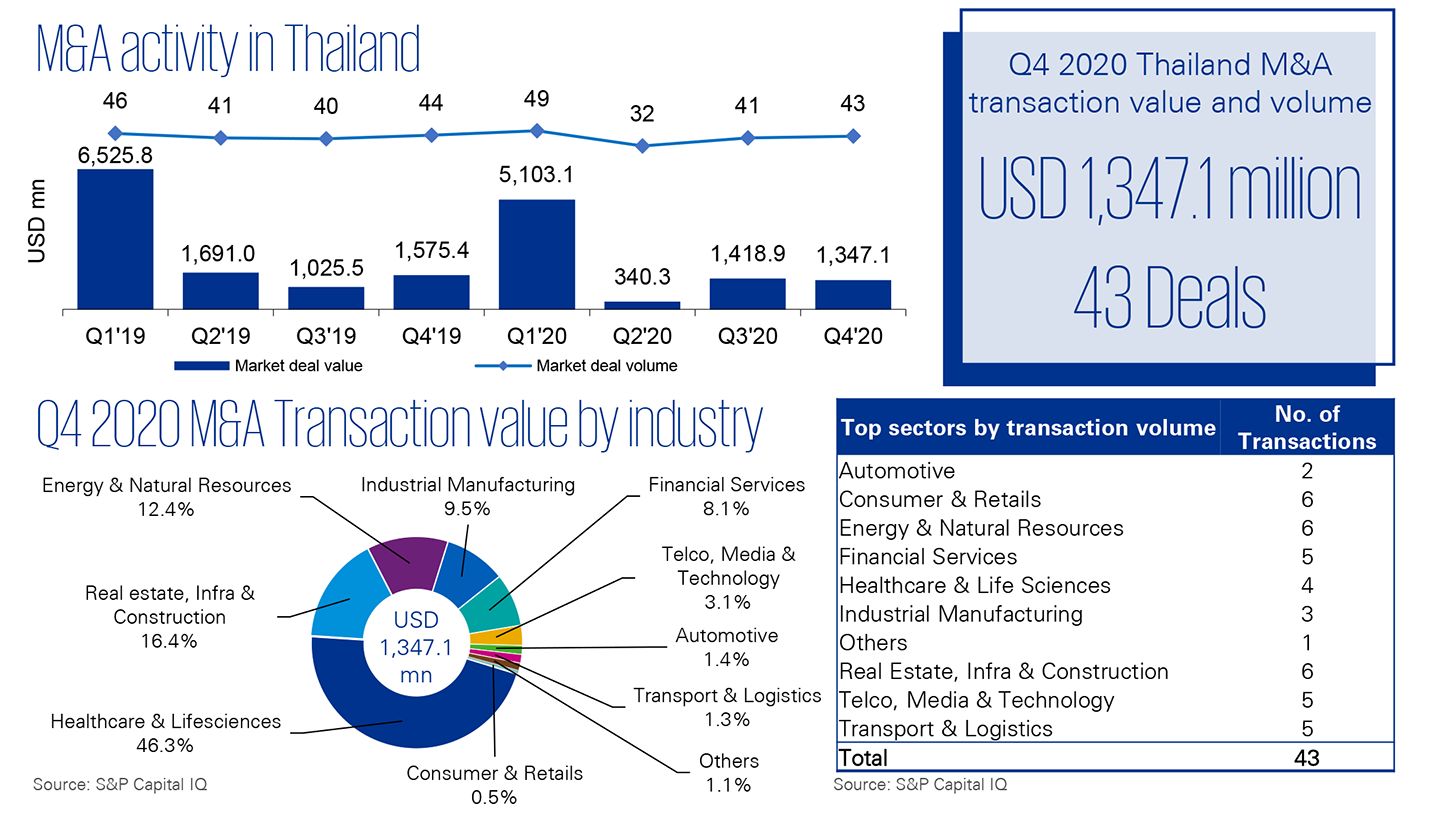

Thailand enjoyed several months with few local cases of COVID-19, allowing for relatively “normal” everyday life to resume. Deal activity once again maintained its pre-pandemic levels this quarter. Border restrictions eased slightly and gave light to increased mobility, which coincided with an uptick of inbound foreign investment. With vaccine distribution in the pipeline, there was optimism at the end of the year that 2021 would see increased consumption, mobility and ultimately an economic recovery, which would positively impact the Thai M&A landscape. However, the recent resurgence of local COVID-19 cases, coupled with the re-introduction of restrictions, poses a threat to the positive outlook and increases uncertainty.

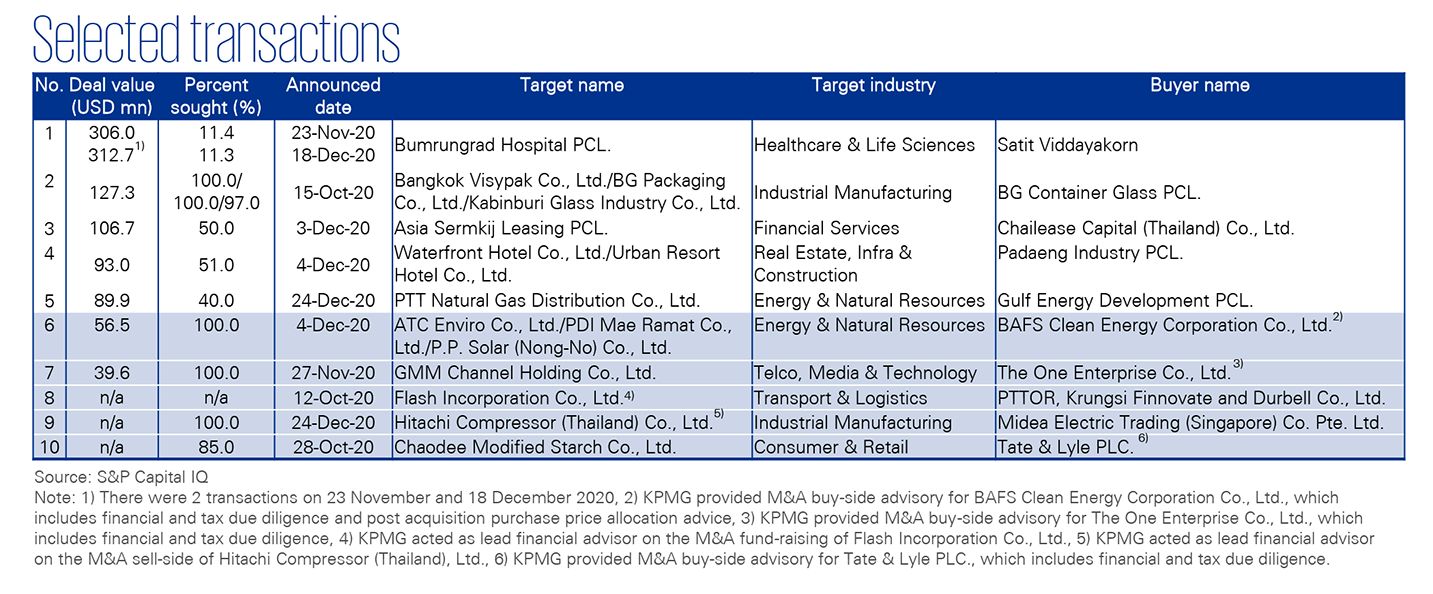

The majority of announced transactions in terms of deal value this quarter were in the Healthcare & Life Sciences, Real Estate, Infra & Construction and Energy & Natural Resources sectors accounting for 75.1% of total deal value. The largest deal announced is BDMS Group’s disposal of a 22.7% stake in Bumrungrad Hospital PCL. (BH) for USD 619 million to Satit Viddayakorn, following an earlier decision not to pursue a take over of BH. This quarter also saw Hitachi Global Life Solutions, Inc. exit the Thai compressor market to Midea Electric Trading (Singapore) Co. Pte. Ltd., a deal in which KPMG acted as lead financial advisor. A remarkable deal in the TMT sector was The One Enterprise’s 100% acquisition of GMM Channel Holding Co., Ltd., a deal where KPMG acted as buy-side financial and tax due diligence advisor. A landmark Transport & Logistics deal was the fund raising of Flash Express, raising fresh capital to expand their network – a deal in which KPMG acted as lead financial advisor.

Data criterion

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals.

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million.

- All deals included have been announced but may not necessarily have closed.

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected.

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia