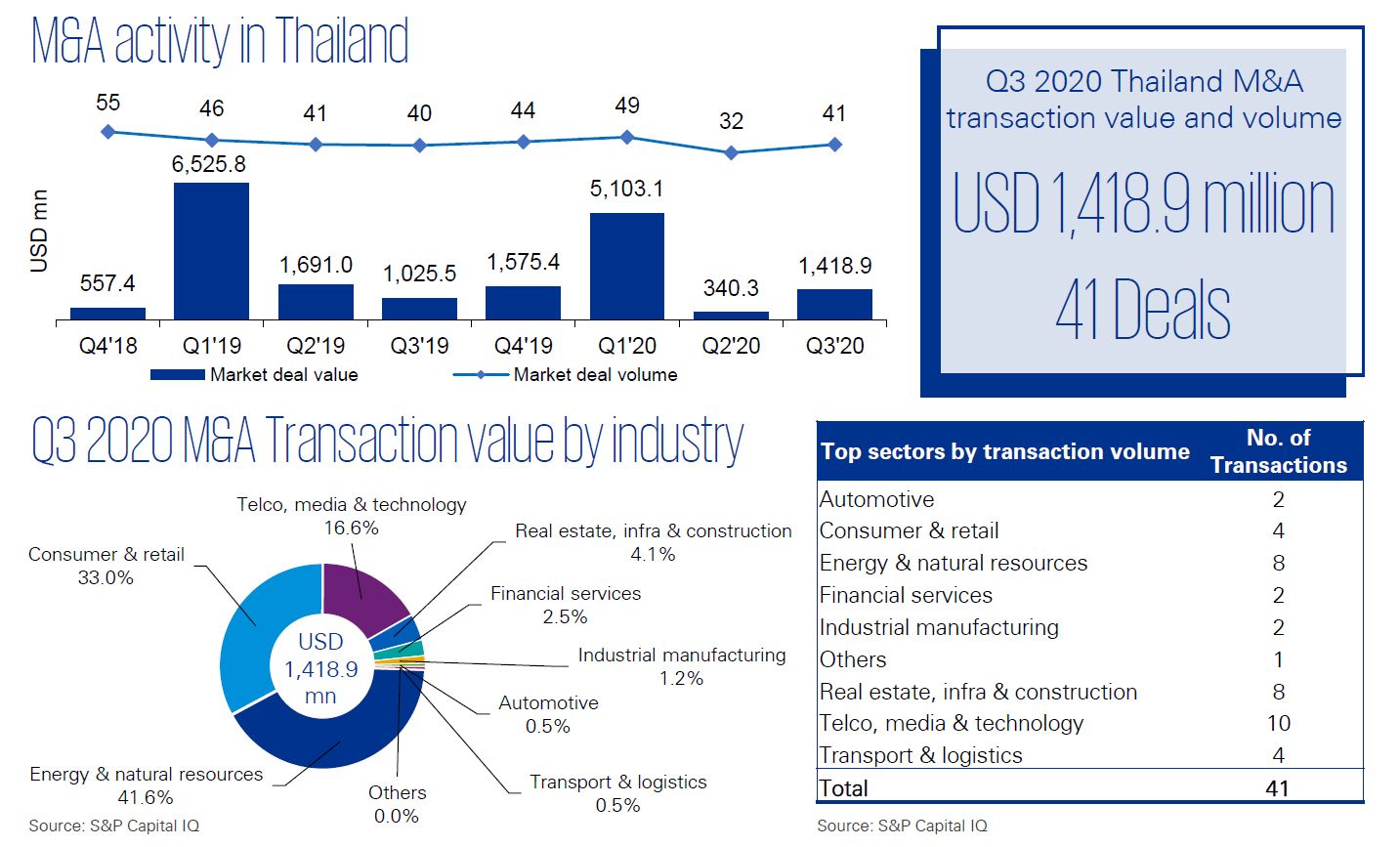

As the economy eases out of COVID-19 restrictions, investor sentiment appears to be recovering as deal activity with respect to the number of deals approaches near pre COVID-19 levels. Not surprisingly the majority of investors in Q3 were local, although foreign investors are cautiously looking to deploy capital by means of cooperating with local partners to execute deals. However, until border restrictions are eased it is unlikely that inbound foreign investment will gain much momentum.

As expressed last quarter, declining valuations are creating opportunities to pursue deals but based on discussions in Q3, the primary obstacle has been navigating through pricing-gaps between buyer and seller. As the wider economic impact of the pandemic continues to be felt, we expect to see more businesses face liquidity challenges, pressuring owners to reduce valuation expectations.

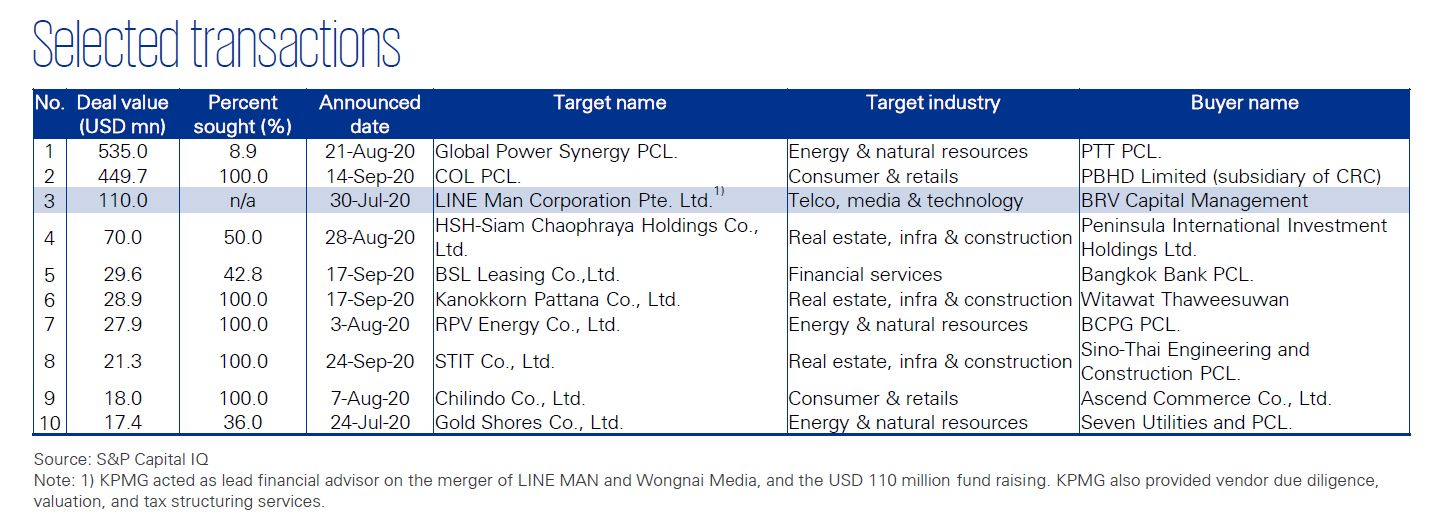

The majority of announced transactions in terms of deal value this quarter were in the Energy & Natural Resources, Consumer & Retail and Telco, Media & Technology (“TMT”) sectors accounting for 91.2% of total deal value. The largest deal announced was PTT PCL’s acquisition of an additional 8.9% stake in Global Power Synergy PCL for USD 535 million as part of a group restructuring. CRC announced its acquisition of COL to strengthen its product ranges and distribution channels. A landmark TMT deal was the merger and fund raising of Thai delivery app LINE MAN and restaurant review platform Wongnai Media, jointly raising USD 110 million of fresh capital – a deal on which KPMG acted as lead financial and tax adviser.

Data criterion

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million

- All deals included have been announced but may not necessarily have closed

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected

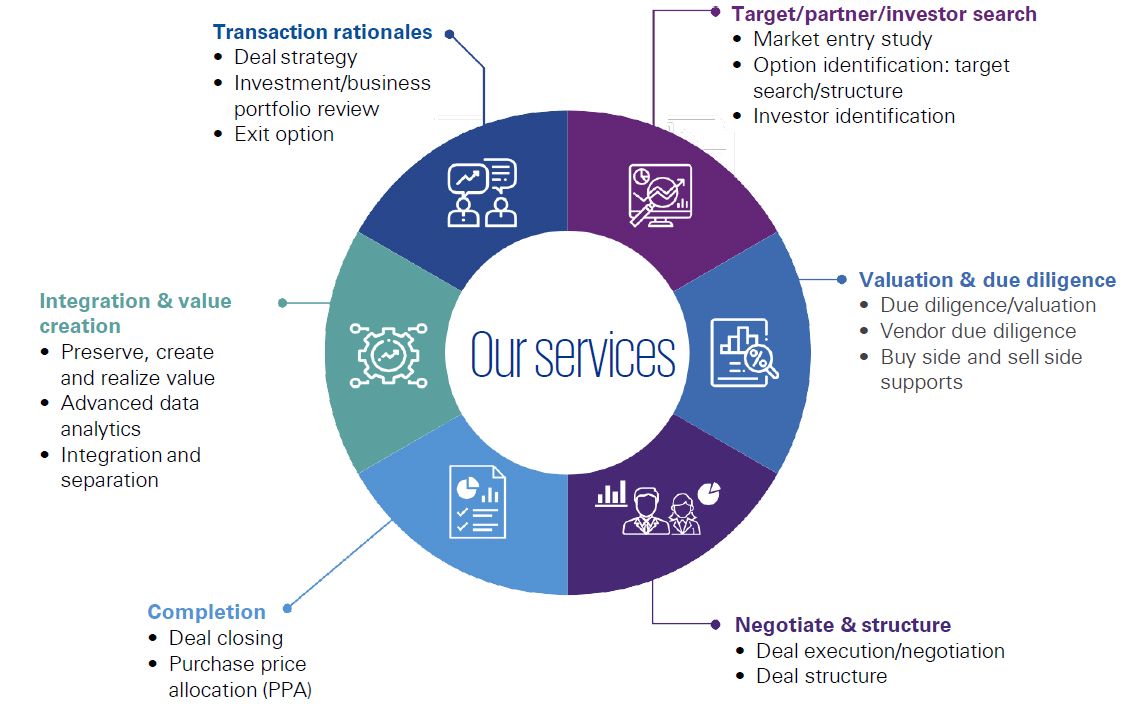

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia