The COVID-19 pandemic and the impact on the global economy have placed unprecedented pressure on businesses around the world, including in Thailand. Due to reduced global demand for trade and mobility restrictions on tourism, the Thai economy has been severely impacted with GDP projected to shrink by 8.1% in 2020[1]. Recovery to pre-COVID-19 levels is expected to take up to two years, subject to containment of further outbreaks and the effectiveness of government support policies.

The Bank of Thailand (BOT) and the Ministry of Finance (MOF) have implemented response packages to support small- and medium-sized enterprises (SMEs), including the debt moratorium program, access to soft loans, and bridge financing for corporate bonds. In addition, the Revenue Department has also released a number of tax relief measures.

Although the breadth and variety of these packages are unprecedented for Thailand, the repayment holiday on both principal and interest will end in October, and with interest charges having continued to accrue, companies will need to engage with their lenders to discuss what further support can be provided as payments become due. At the same time less than 20% of SMEs are eligible for the soft loan package of THB500 billion to support SMEs, and the corporate bond stabilization fund is only available to investment-grade companies that also meet a number of other criteria[2].

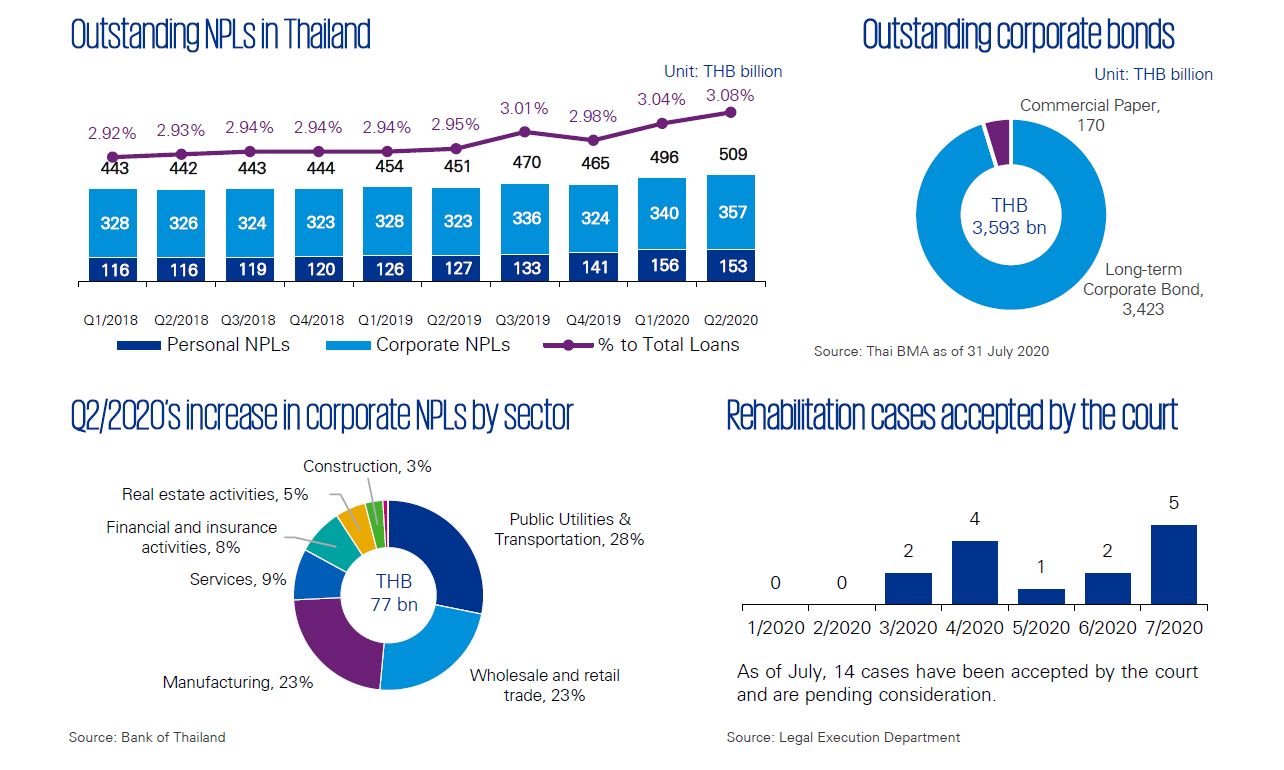

The end of the debt moratorium and eligibility requirements to access other packages mean that many Thai businesses will continue to face acute financial pressure with short-term liquidity, access to finance, and debt repayment. The impact on corporates can be seen in the level of Non-Performing Loans (NPLs) which has increased by approximately THB44 billion from the end of 2019 to Q2/2020, with the percentage of NPLs to total loans increasing to 3.08%. Key sectors in which the impact can already be seen include public utilities and transportation, wholesale and retail trade, and manufacturing.

In order to survive, many businesses in Thailand are turning to the formal court process with 14 filing for rehabilitation under the central bankruptcy court so far this year, including high profile cases such as Thai Airways and Nok Air. The rehabilitation process gives companies protection from immediate actions from creditors. Whilst it is a good (and sometimes necessary) option for some businesses, it should not be seen as the only option, as out-of-court debt restructuring accompanied by a robust turnaround plan can often provide a faster and less costly solution.

Data criterion

- Value data provided in the ‘Outstanding NPLs in Thailand’ chart represent the value of the total outstanding non-performing loans (NPLs) of financial institutions for both corporate and personal consumption. The percentage to total loans represent the total outstanding NPLs to the outstanding loans.

- The pie chart ‘Q2/2020 increase in corporate NPLs by sector’ represents the new and re-entry NPLs which occurred during the period. The number of personal consumption NPLs is excluded.

- The number of rehabilitation cases accepted by the Central Bankruptcy Court only refers to the application that the Court has accepted for consideration. The court may reject the application for rehabilitation.

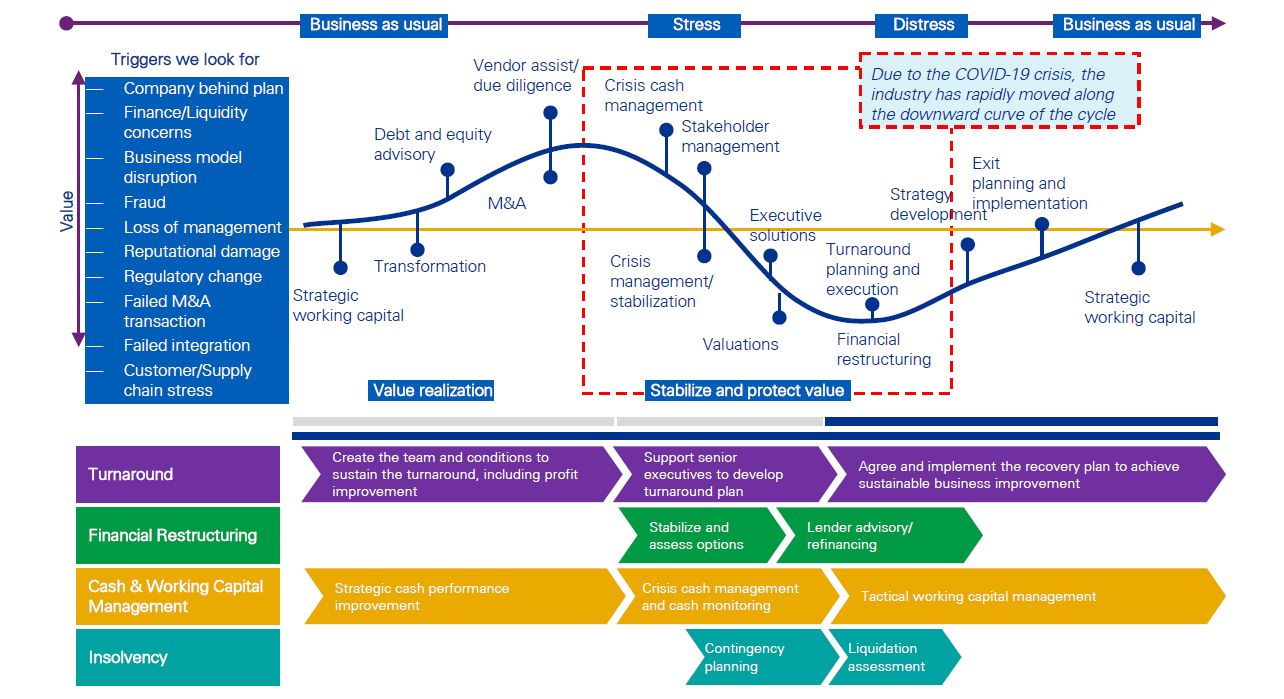

KPMG Deal Advisory

Our solutions address a number of different requirements from businesses and their stakeholders across an organization’s lifecycle. The global impact of COVID-19 has unavoidably pushed several businesses into the Stressed and Distressed part of the cycle. Our experienced approach bring valuable insights and guidance to help you to stabilize, protect value, and then ready the business to emerge.

Sources:

[1] The Bank of Thailand website

[2] BOT Press Release no.20/2020, “Additional measures to assist SMEs affected by COVID-19 and to stabilize corporate bond market”, The Bank of Thailand

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia