As expected, there has been a global trend of declining M&A activities due to uncertainties caused by the COVID-19 pandemic; Thailand’s deal landscape in Q2 2020 has naturally followed suit. Based on discussions with investors, deal flows are likely to increase towards the end of the year. With interest rates at historic lows, companies with solid balance sheets may look to explore distressed opportunities in the next few quarters as more opportunities present themselves. Given that declining valuations are creating opportunities to pursue deals that create long-term value, we expect M&A activities to cautiously move forward.

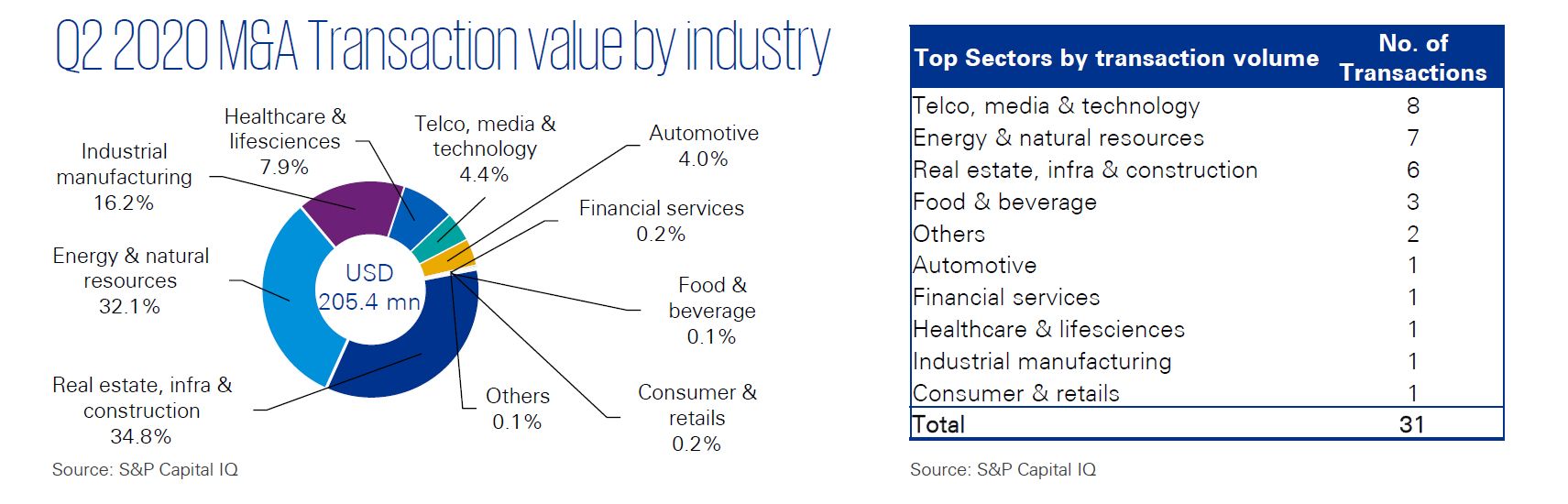

The majority of announced transactions in terms of deal value this quarter were in the Real estate, infra & construction, Energy & natural resources and Industrial manufacturing sectors, accounting for 83.1% of total deal value. The largest deal announced was The Megawatt Co., Ltd.’s acquisition of a 90.0% stake in Siam Solar Generation PCL for USD 36.1 million.

Data criterion

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million

- All deals included have been announced but may not necessarily have closed

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected

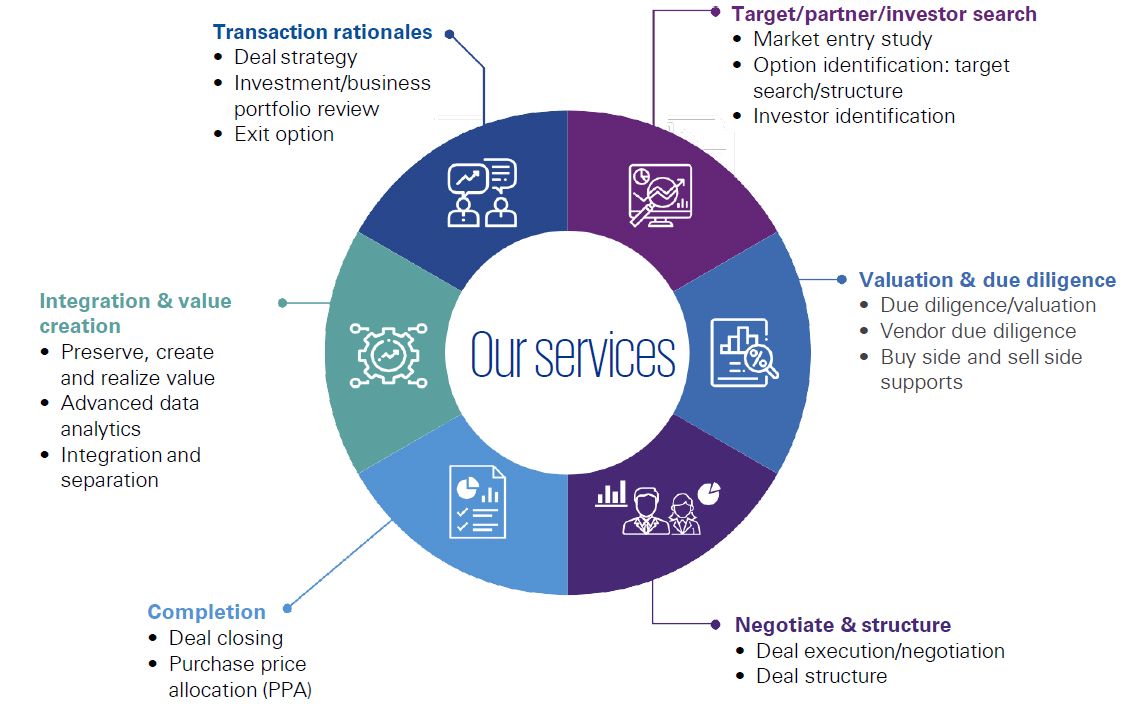

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia