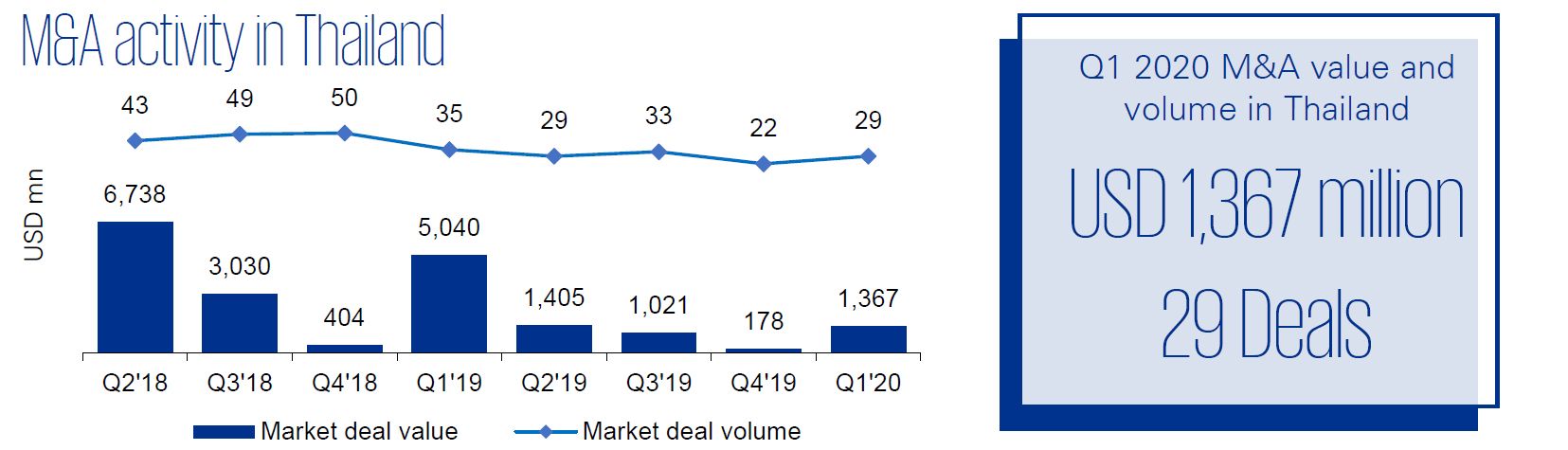

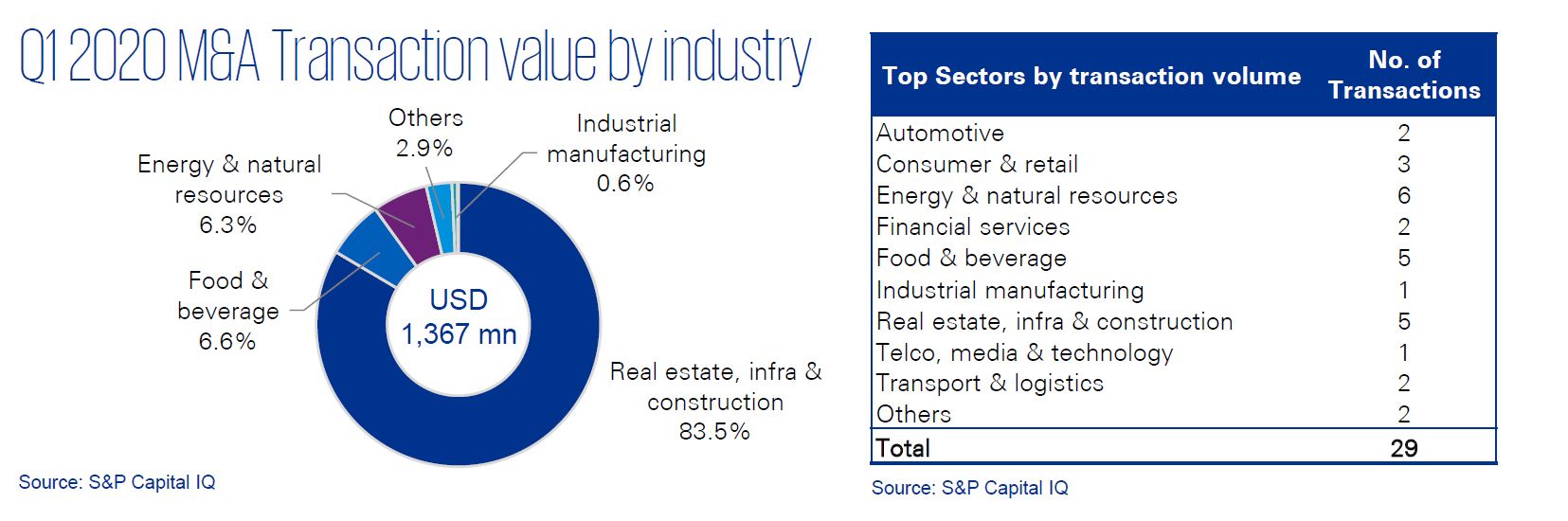

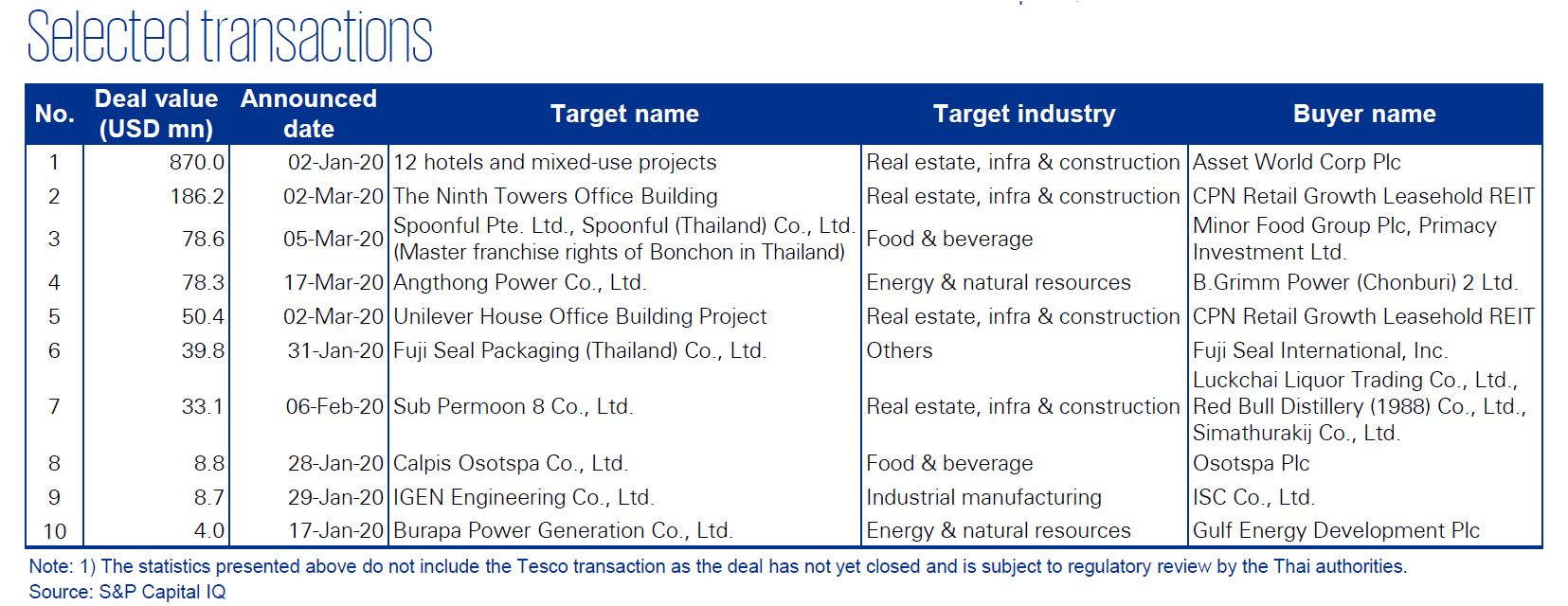

M&A activity was strong at the beginning of 2020 with numerous transactions, including the acquisition of the Ninth Towers office building and Unilever House office building projects (USD 186.2 million and USD 50.4 million) by CPN Retail Growth Leasehold REIT. In Q1 2020, the real estate, infrastructure and construction sector contributed up to 83.5% of the USD 1,367 million M&A transaction value. This is largely driven by Asset World Corp Plc’s acquisition of 12 hotels and mixed-use projects from the family's TCC Group as part of an internal reorganization (USD 870.0 million), the largest deal in Q1 2020.

On March 9, 2020, CP Group won the competitive auction for the acquisition of Tesco’s Asian operations in Thailand and Malaysia for approximately USD 10.6 billion in cash, which will result in one of Thailand’s largest ever acquisitions.1)

The M&A outlook is driven by the economic uncertainty around COVID-19. The general pace of new M&A activities will slow down, and planned transactions put on hold. Deal flow is expected to decelerate, however distressed deal making could see an uptick as opportunistic buyers aim to find value-based targets impacted by the economic downturn. Based on our discussions with various clients, we expect the deal market to rebound end of this year, with possible catch-up effects.

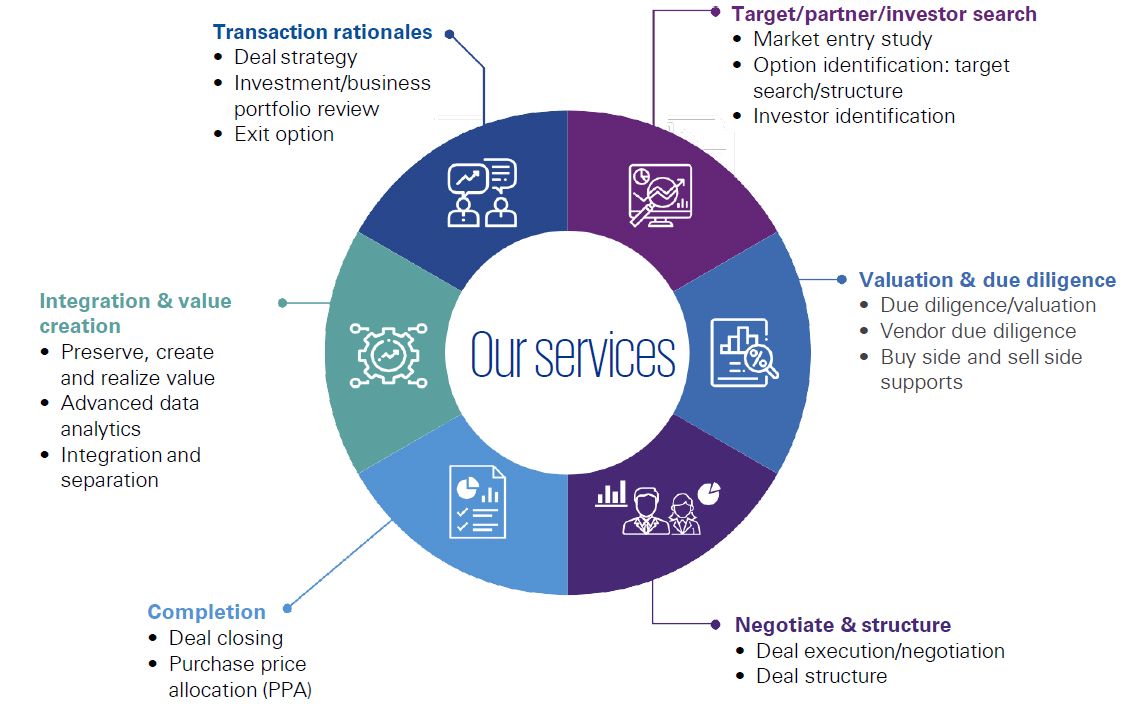

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia