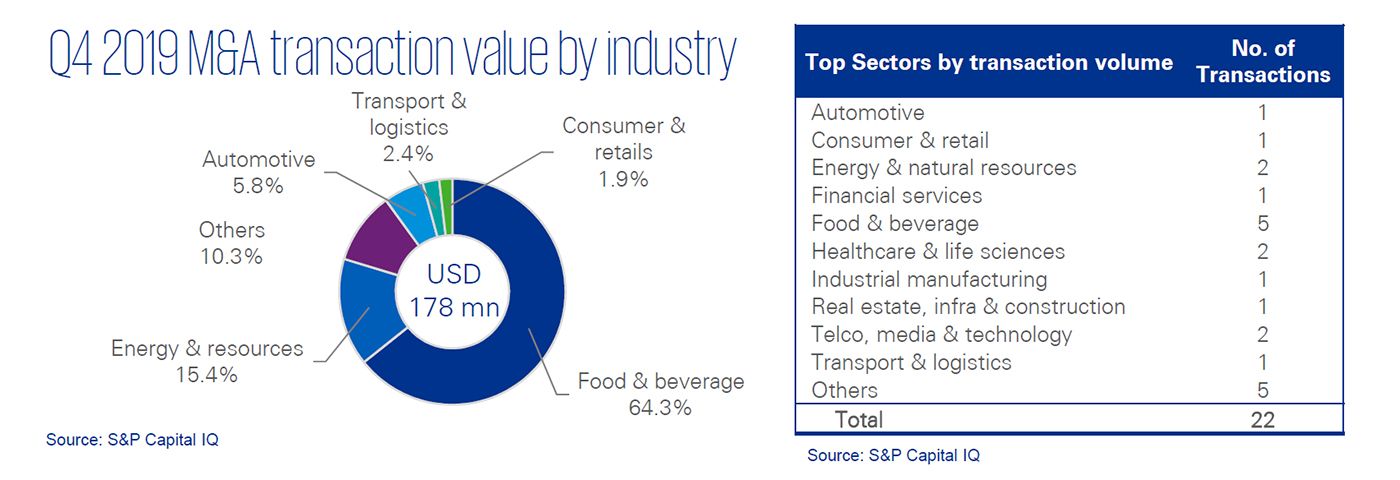

M&A activity in 2019 ended with a number of notable transactions, including TCC’s acquisition of the right to operate Starbucks in Thailand, the acquisition of SCB Life by FWD and the merger of Allianz and Sri Ayudhya Capital (renamed to Allianz Ayudhya Capital PCL). In Q4 2019, the transactions were mainly in the F&B sector. The largest deals were Minor Group acquiring Chicken Time Co., Ltd., the operator of over 40 Bonchon Chicken outlets (USD 66.2 mn) and the acquisition of Santa Fe by Singha Group (USD 44 mn).

M&A activity is expected to remain healthy well into 2020, with a focus on the healthcare industry and consumer sectors. Of particular interest is the announced potential sale of Tesco’s operations in Thailand with nearly 2,000 offline stores as well as an established online platform.

KPMG Deal Advisory

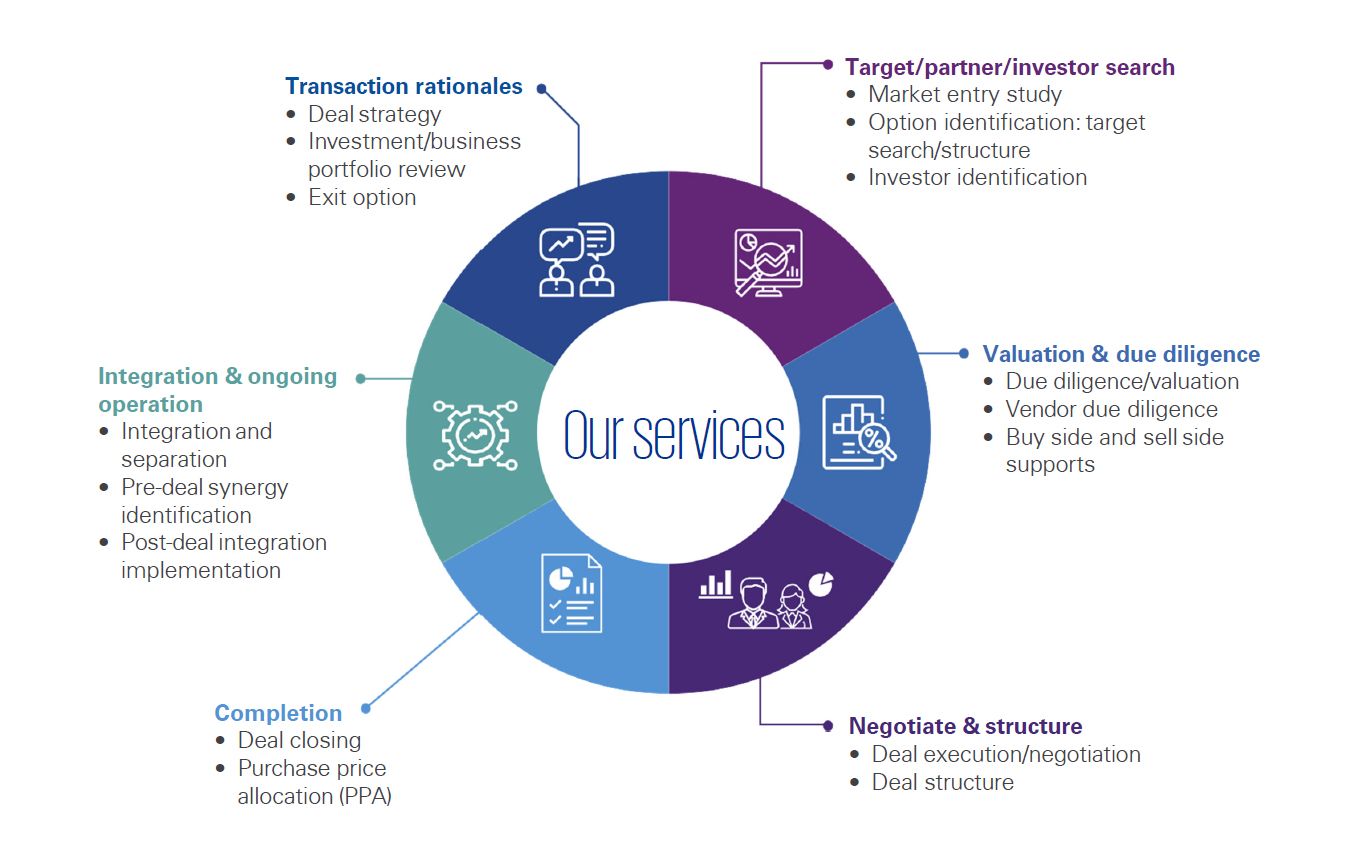

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia