KPMG provides an insightful summary into the dynamics driving Thailand’s Mergers & Acquisitions (M&A) environment in 2023. The article discusses the transformative wave in M&A in the past year which will impact the acceleration of deal activity in 2024.

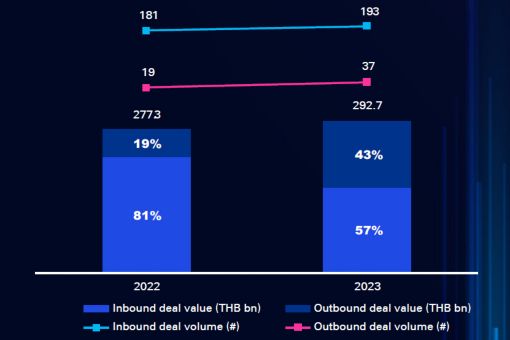

Review of 2023 M&A in Thailand 2023 saw positive momentum in the Thai deal landscape with transaction values increasing by 6% and volume by 15%. In total we saw 230 reported deals amounting to THB 293 billion. This positive trajectory, despite more challenging global conditions, was driven by favorable economic indicators such as reduced unemployment, heightened consumer confidence and the resurgence of the tourism sector, making Thailand an attractive M&A destination. |

||

Within the region, where major markets have experienced a decline in deal activity, Thailand has maintained a stable rate of growth. Looking ahead we expect businesses to continue pursuing external growth strategies, sustaining the positive trend.

M&A activity in Thailand

A closer look at events throughout the year reveals the impact of the domestic political situation on deal flow. An initially uncertain election outcome and unfavorable market conditions in early 2023 dampened deal appetite, and several planned IPOs were delayed. However, the anticipated stability following the formation of the new government improved sentiment for both inbound and outbound investors, despite continued global geopolitical uncertainty. This year, inbound and outbound deal volume experienced changes of +7% and +95% respectively, resulting in an overall deal volume split of 85% inbound to 16% outbound and value split of 57% outbound to 43% inbound.

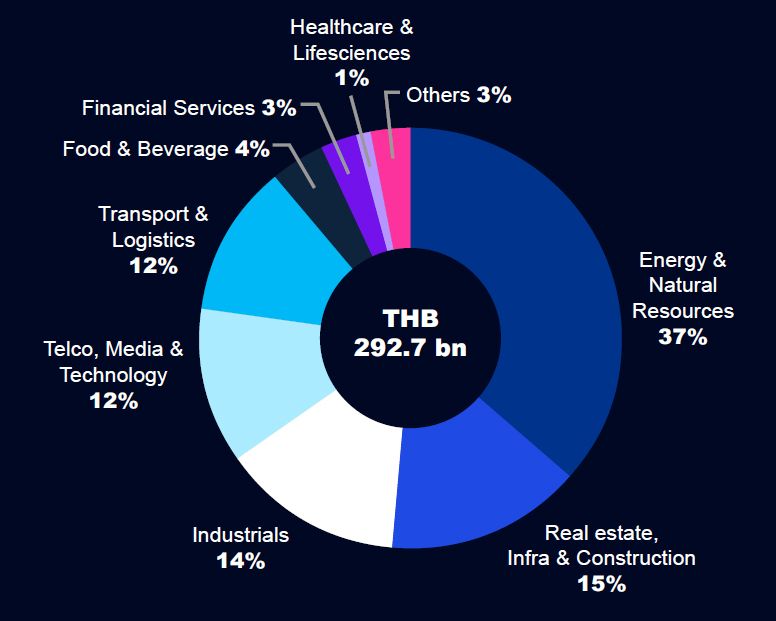

M&A transaction value by industry

The major investment themes in 2023 were in the Energy & Natural Resources, Industrials, Real Estate, Infrastructure & Construction sectors. The Thai government intends to cement the country’s position as a manufacturing and industrial hub through further growth plans, such as the initiative to increase foreign direct investments in the Eastern Economic Corridor (EEC) and new S-curve industries. These strategies boost inbound investment, as global businesses contemplate the development of manufacturing facilities in the region. Thailand is also an attractive alternative for multinational corporations looking to de-risk their supply chains.

The trajectory for M&A in Thailand suggests ongoing transformation. Anticipated rises in partnerships and joint ventures between local businesses and foreign investors underscore the strategic approach to leverage expertise and scalability. We expect to see a continuation of healthy M&A activity in Thailand.

Data criteria:

- Value data provided represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD100 million

- All deals included have been announced but may not necessarily have closed

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected

Source: S&P Capital IQ, MergerMarkets, Stock Exchange of Thailand (SET)

Unveiling the key drivers of 2024 M&A trends in Thailand

In the dynamic Thai M&A environment we have identified three key themes which we believe will drive deal activity in 2024: Value Creation, Distress and ESG.

Although several sectors and many businesses in Thailand are thriving, we will see increasing stress in other areas. The impacts from the COVID-19

pandemic, current economic uncertainties and global disruptions have led to stress and distress across financial markets. With this tightening financial situation, liquidity from banks as well as the bond market has become increasingly limited, and some businesses are facing difficulties repaying and refinancing borrowings. When the doors to traditional refinancing options from banks and the bond market are closed, an opportunity arises for specialized distressed funds or strategic investors to step in and benefit from attractive valuations.

However, despite the prospect of high returns, investors should be aware that such investments do carry higher risks. Investors should take additional care to understand the situation of the business, including underlying operations, existing debt exposures and potential assets that can be used to secure debt or mezzanine financing.

The increasing emphasis on ESG factors is influencing M&A decisions globally, and Thailand is no exception. In 2024, businesses are incorporating sustainability considerations into their M&A strategies, recognizing the importance of responsible business practices. Companies are not only evaluating the financial aspects of a deal but also the potential environmental and social impacts, to align with stakeholder expectations.

The Thai government’s goals to achieve carbon neutrality and net-zero greenhouse gas emissions have spurred a nationwide shift towards ESG business models. This is supported by regulatory measures to promote ESG investing, such as ESG-related disclosure guidelines and the Thailand Sustainability Investment (THSI) list of companies that have passed the ESG criteria of the Stock Exchange of Thailand. This is reflected in the increasing demand we are seeing for ESG due diligence as part of the acquisition process.