For over 30 years, KPMG’s Financial Institutions Performance Survey (FIPS) reports have provided insights into New Zealand’s financial services sector. Each edition presents industry commentary and analysis on the performance of the sector, together with a range of topical articles from industry experts, regulators and our own business leaders.

Banking sector growth in 2024:

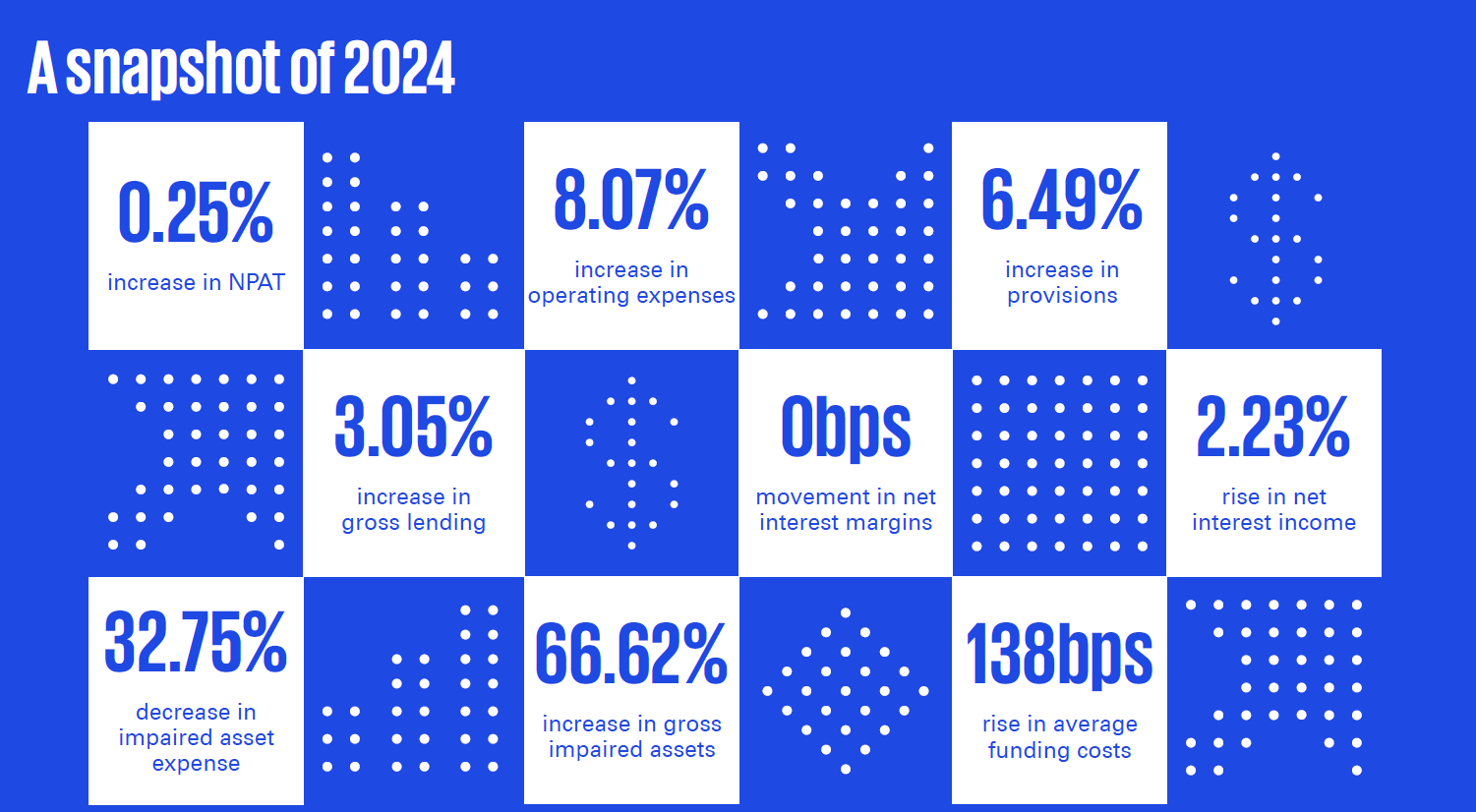

KPMG’s survey of the banking sector results for 2024 reveals that the sector has demonstrated resilience despite ongoing economic challenges, with a net profit after tax (NPAT) of $7.22 billion for 2024 – a slight increase of 0.25% from 2023.

This relatively flat growth comes alongside a 2.23% increase in net interest income to $15.69 billion, fuelled by loan growth of 3.05% while net interest margins remained stable at 2.34%. However, the sector faced headwinds with an 8.07% rise in operating expenses driven by personnel costs, technology costs, and the impact of inflation, and slight relief from a 32.75% decrease in impaired asset expense.

Key figures: