In preparing the XBRL file for financial statements, preparers will need to tag non-financial and financial information within the signed and audited financial statements to relevant matching element labels within the MBRS Taxonomy, which has been created to reflect the latest reporting and disclosure requirements of the MFRS Accounting standards (formerly known as Malaysian Financial Reporting Standards (MFRS), the Malaysian Private Entity Reporting Standards (MPERS) and Companies Act 1965 and 2016.

The onus is on each company’s directors to submit their annual financial statements digitally to Suruhanjaya Syarikat Malaysia (SSM) through the MBRS portal (mPortal). This puts the pressure on companies to invest in engaging qualified talents to convert their signed and audited financial statements into XBRL format accurately, reflecting all requirements by SSM.

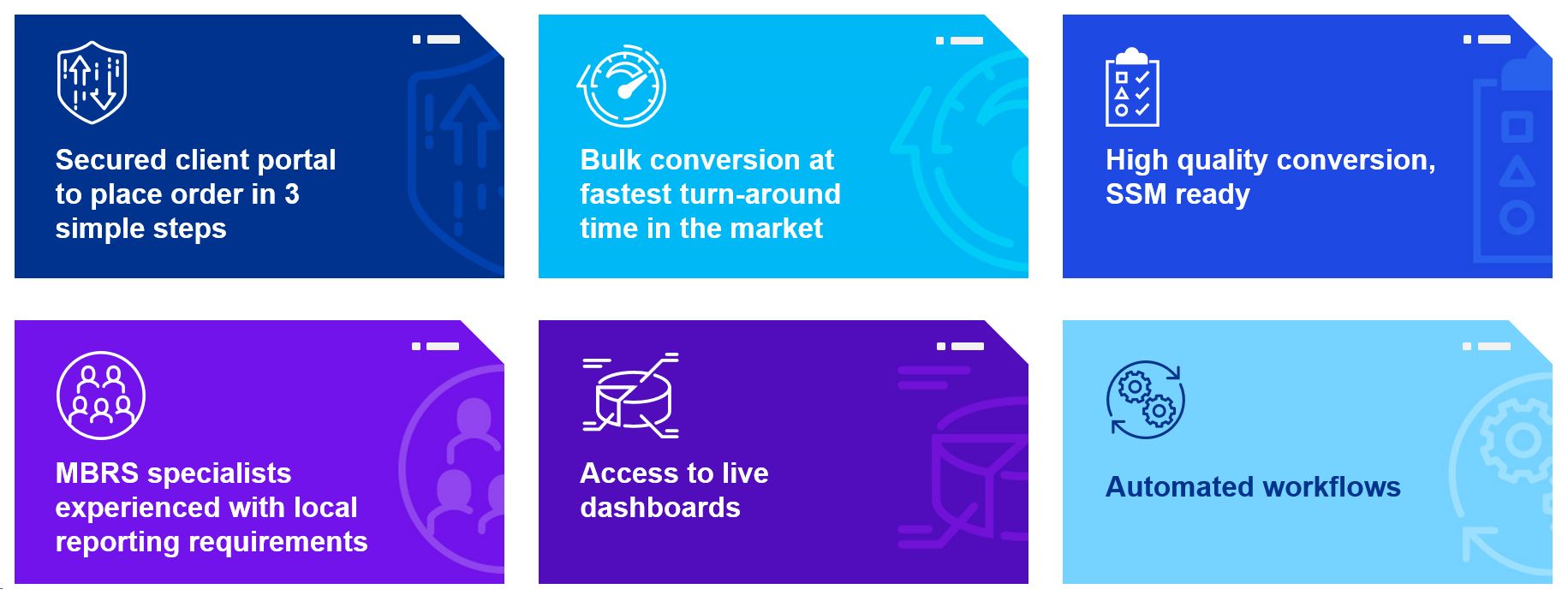

KPMG understands the complexities involved in transitioning to the MBRS requirements, which is why we have developed the KPMG myConversion Powerhouse – an online platform with tech-powered capabilities to provide quick and high accuracy conversion into XBRL files, ready for submission to SSM.

KPMG’s expertise in MBRS

Since 2017, KPMG has been working with SSM as the Master Developer of MBRS Taxonomy, Training and User Reference Guides on Financial Statements. KPMG is also appointed the Master Trainer to train SSM’s Training Service Providers on MBRS for Preparers - Financial Statements Module to conduct nationwide trainings on MBRS for Preparers - Financial Statements Module to the public.

"

"