Preparing for Bank Negara Malaysia’s CRST mandate to enhance the resilience of the financial sector against climate-related risks

Unprecedented changes in our climate now occur much more frequently and with greater intensity. What were once considered normal weather patterns, such as heavy downpours and 1-in-100-year floods, have become significantly more severe, affecting multiple industries including the financial sector, in potentially disruptive ways.

In response to these challenges, Bank Negara Malaysia (BNM) has launched its methodology paper, which outlines the framework for conducting climate risk stress testing (CRST). Participation in the 2024 CRST is mandatory for most financial institutions, with the exception of certain digital banks, where participation remains optional. By subjecting FIs to testing various climate scenarios, the CRST exercise seeks to identify vulnerabilities, enhance risk management practices and foster resilience within the financial sector.

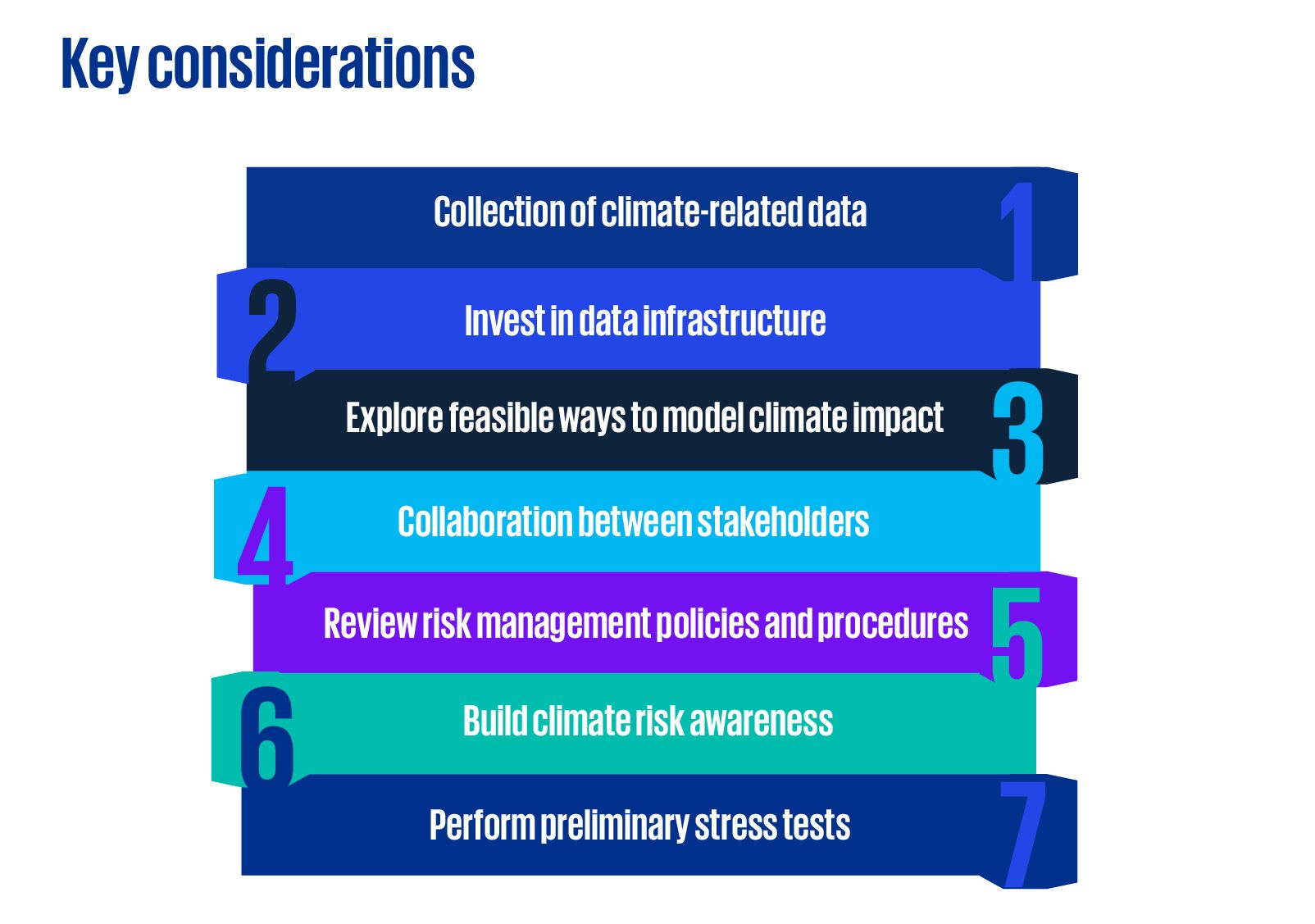

KPMG has prepared this thought leadership to provide financial institutions with practical guidelines to prepare for BNM’s 2024 Climate Risk Stress Testing Exercise. We cover the common challenges and factors that financial institutions should consider when developing their climate risk management framework.