Transfer Pricing Workshop 2025

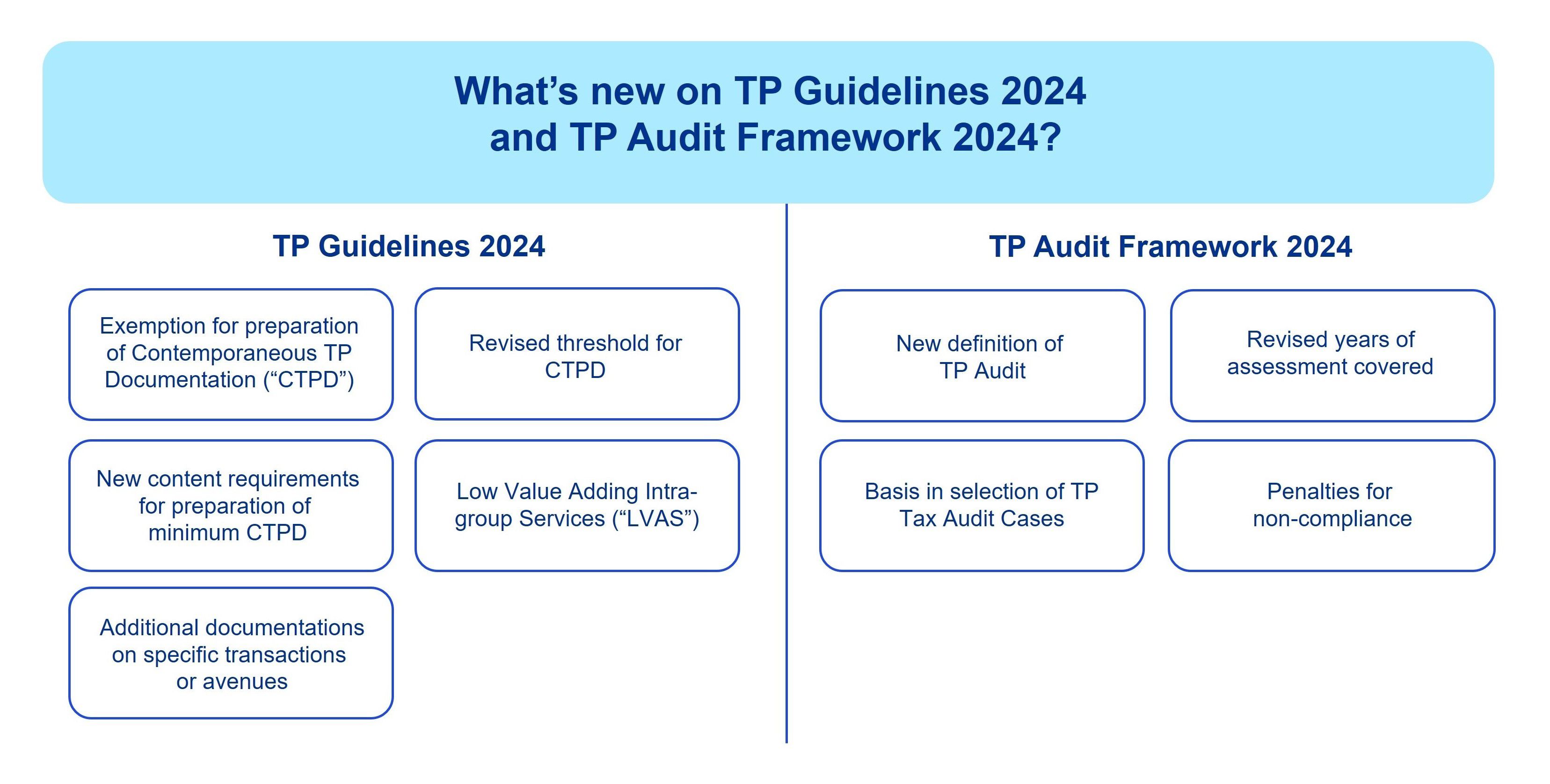

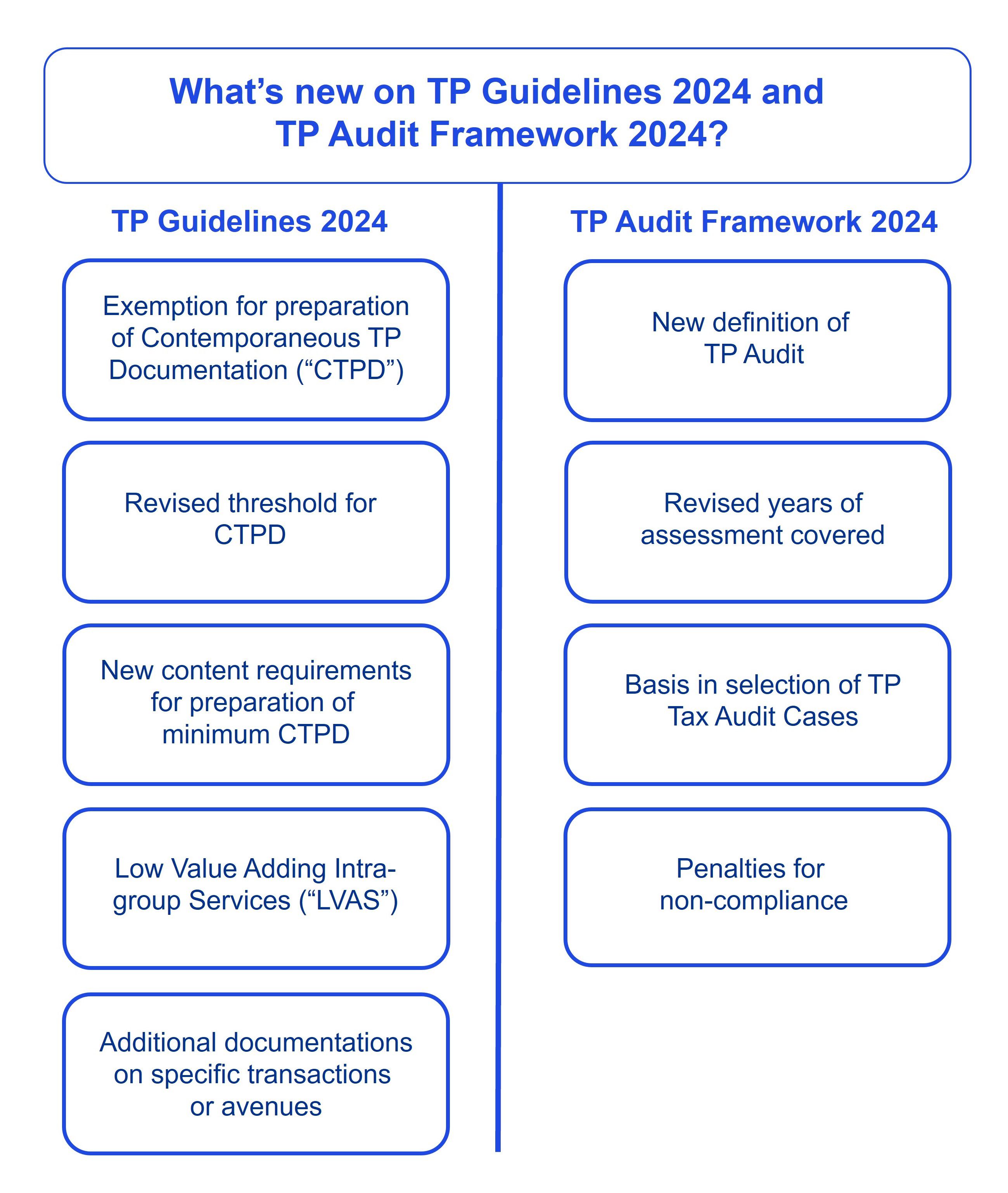

Transfer Pricing (“TP”) in Malaysia continues to face a rapidly evolving regulatory landscape with the issuance of the new TP Guidelines 2024 and TP Audit Framework 2024 by the Inland Revenue Board (“IRB”) on 26 December 2024. These developments clearly signal an escalation in the IRB’s efforts to enforce stricter TP compliance and intensify audit scrutiny.

Join our complimentary workshop for exclusive insights, where our TP specialists will demystify the latest TP lingos and equip you with the knowledge to stay informed about recent updates.

Speakers:

- Chang Mei Seen, Partner – Global Transfer Pricing Services, KPMG in Malaysia

- Suraya Othman, Tax Director – Transfer Pricing, KPMG in Malaysia

- Kishanthini, Tax Manager – Transfer Pricing, KPMG in Malaysia

Who should attend:

- Chief Financial Officers or equivalent

- Finance Managers

- Tax Managers / Advisors

- Accountants and Accounts Executives

- Business Owners

- Accounts / Finance / Tax personnel

TERMS & CONDITIONS

- Registration will remain open until all seats have been filled.

- Registration is on a first come, first served basis and at the sole discretion of KPMG. Limited seats are available at the event venue.

- In the event the seminar is cancelled by KPMG due to unforeseen circumstances, delegates will be informed accordingly.

Date:

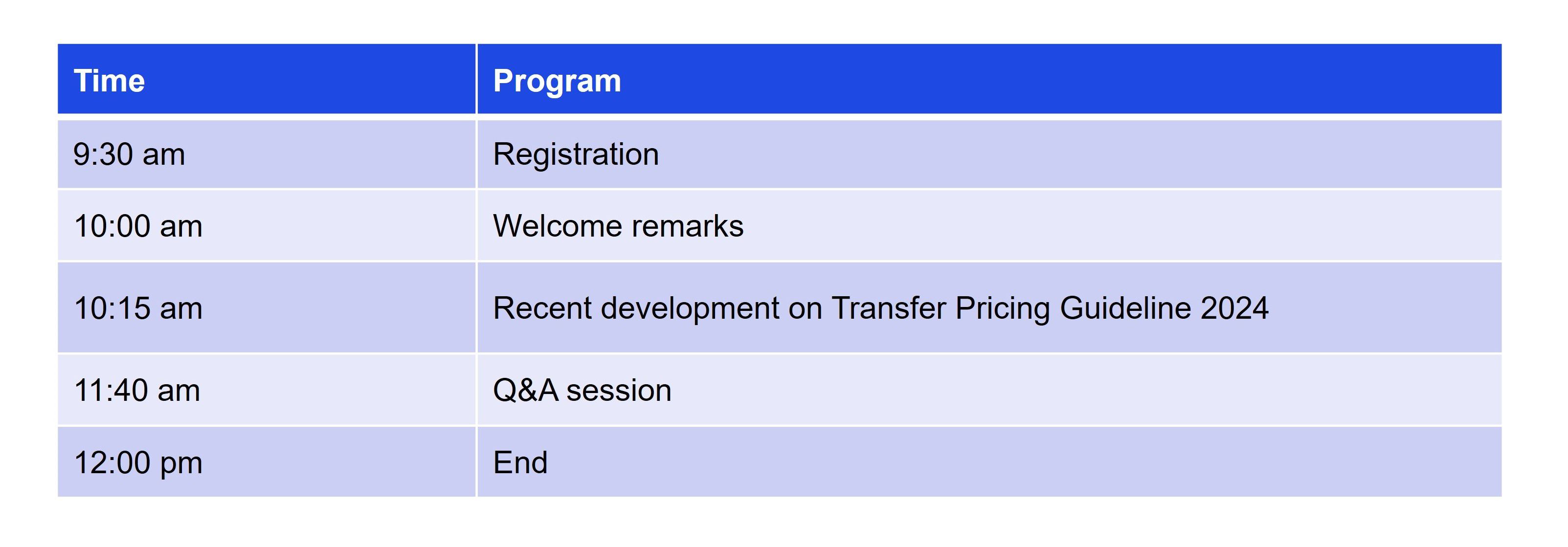

2 July 2025, Wednesday

Time:

10:00am - 12:00pm

Format:

In-person only

Venue:

Level 3, CIMB Leadership Academy, Johor

Participation fee:

Complimentary

For event queries, please email to Amira amiramastura@kpmg.com.my or Azni aznianuar@kpmg.com.my

2 July 2025, Wednesday

Time:

10:00am - 12:00pm

Format:

In-person only

Venue:

Level 3, CIMB Leadership Academy, Johor

Participation fee:

Complimentary

For event queries, please email to Amira amiramastura@kpmg.com.my or Azni aznianuar@kpmg.com.my