Seminar: Stamp Duty – A Peek into the Future

As Malaysia gears up towards the implementation of the phased Stamp Duty Self-Assessment System (“SDSAS”), it is vital for businesses and individuals to stay abreast of the evolving Stamp Duty rules and enforcement initiatives by the Inland Revenue Board of Malaysia (“IRB”).

Join us at this exclusive complimentary seminar as we discuss and take a “peek” into the latest developments and share insights on the SDSAS with Puan Merina Binti Buhari, State Operation Director (Stamp Duty).

During the session, we will:

- Share the mechanism of Stamp Duty

- Highlight common issues and area of focus

- Discuss key considerations moving forward into SDSAS

- Share insights into Stamp Duty tax audit

Who should attend:

- Chief Financial Officers or equivalent

- Finance / Tax Managers

- Legal Officers

- Accountants

- Tax Managers

- Business Owners

- Individual Taxpayers

TERMS & CONDITIONS

- Registration will close once all seats are filled

- Seats are limited and allocated on a first-come, first-served basis, subject to the sole discretion of KPMG.

- In the event the seminar is cancelled by KPMG due to unforeseen circumstances, delegates will be informed accordingly.

Date & Time:

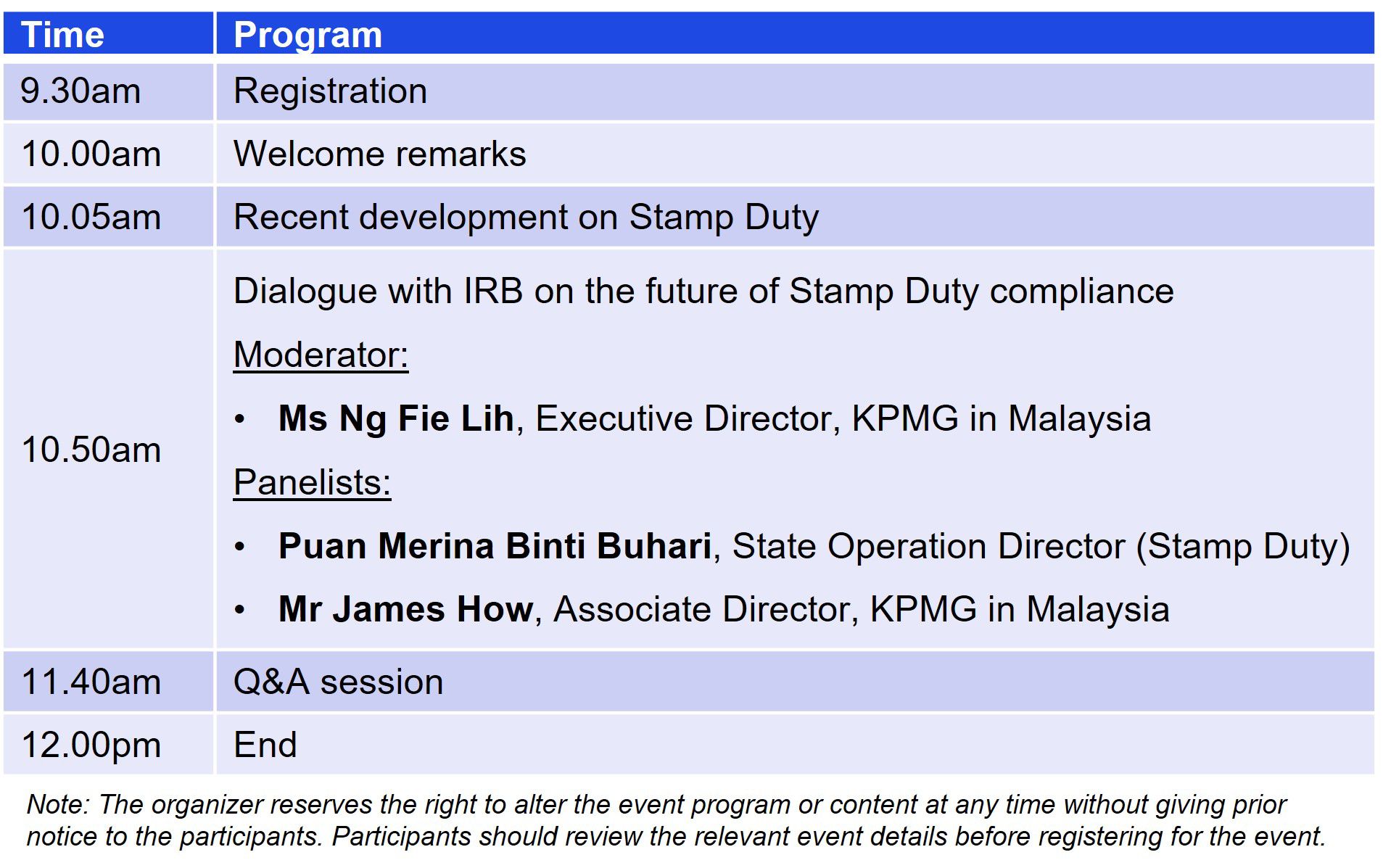

9 April 2025, Wednesday

10:00am – 12:00pm

Format:

In-person only

Venue:

Level 3, CIMB Leadership Academy, Johor

Fee:

Complimentary

For event queries, please email to Rosaline rosalinejuay@kpmg.com.my

or

Safiyah safiyahabdrahim@kpmg.com.my

9 April 2025, Wednesday

10:00am – 12:00pm

Format:

In-person only

Venue:

Level 3, CIMB Leadership Academy, Johor

Fee:

Complimentary

For event queries, please email to Rosaline rosalinejuay@kpmg.com.my

or

Safiyah safiyahabdrahim@kpmg.com.my