Future forward of e-Invoicing

The mandatory implementation of e-invoicing was first introduced in Malaysia for taxpayers with an annual turnover exceeding RM100 million. This initial phase will be followed by the onboarding of taxpayers with annual turnovers ranging from RM25 million to RM100 million, with full implementation extending to all other taxpayers in the near future.

While the government has granted a 6-month interim relaxation period from the respective implementation dates, there are still e-invoicing obligations that must be met, many of which may not yet be fully understood by businesses.

We invite you to attend this forum, hosted by KPMG in Malaysia and HASiL Selangor, where we will discuss implications for your business.

• Board of directors

• Senior management

• Group tax personnel

• Finance managers

CPE:

This event grants 4 CPE hours

TERMS & CONDITIONS

REGISTRATION: Closes on a first come, first served basis and at the sole discretion of the organizer. Limited seats are available. Delegates will receive a confirmation email once their registration has been successfully processed.

CANCELLATION POLICY: In the event the event is cancelled by KPMG due to unforeseen circumstances, delegates will be informed accordingly.

NOTE: The organizer reserves the right to alter the event program or content at any time without giving prior notice to the participants. Participants should review the relevant event details before registering for the event.

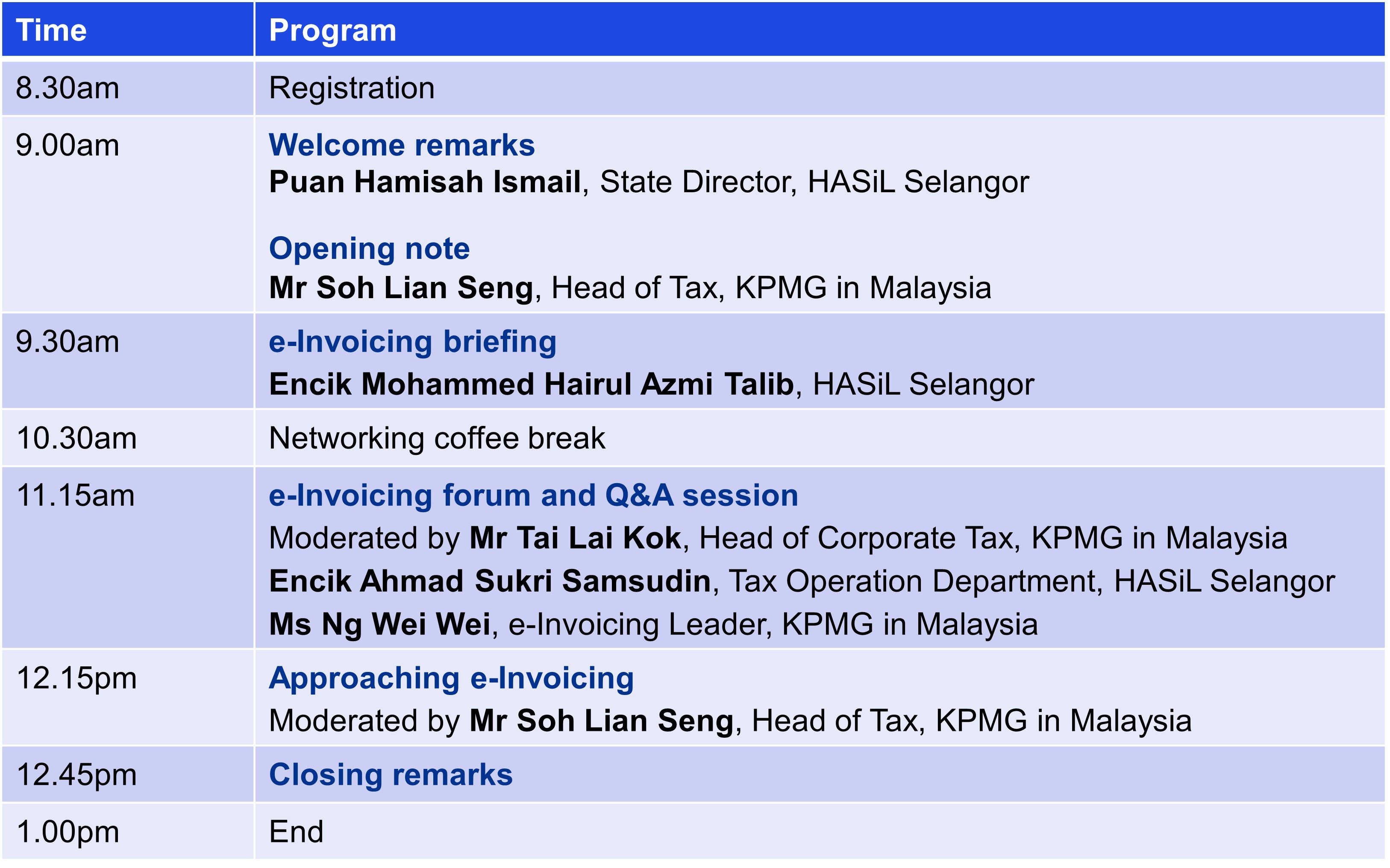

28 November 2024 (Thursday)

8.30am – 1.00pm

Fee:

Complimentary

Venue:

Menara HASiL, Petaling Jaya

For event queries, please email to Patricia mjeow@kpmg.com.my or

Kai Qian kaiqianlim@kpmg.com.my