International Financial Reporting Standards (IFRS) are constantly evolving, providing new ways for businesses to present their financial position and performance. This article explores the newly effective requirements for financial reporting periods beginning on or after 1 January 2023, with earlier application generally permitted.

IAS 8 - Definition of accounting estimates

In terms of IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors, changes in accounting policies are generally applied retrospectively whilst changes in accounting estimates are applied prospectively. However, the International Accounting Standards Board (“the Board”) has noted diversity in practice in making a distinction between estimates and accounting policies and has thus issued an amendment to clarify the definition of estimates.

The amendments now clarify that estimates are monetary amounts in the financial statements that are subject to measurement uncertainty i.e., uncertainty that arises when monetary amounts in financial reports cannot be observed directly and must instead be estimated. The amendments go on to clarify that a company develops an accounting estimate to achieve the objective set out by an accounting policy.

Developing an accounting estimate includes both:

- selecting a measurement technique (estimation or valuation technique) – such as:

- an estimation technique used to measure a loss allowance for expected credit losses on trade debtors when applying IFRS 9 Financial Instruments, or

- a valuation technique (income approach or market approach) when measuring the fair value of investment property under IAS 40, and

- choosing the inputs to be used when applying the chosen measurement technique – e.g., estimating the expected cash flows for measuring the fair value of investment property.

The amendments are effective for periods beginning on or after 1 January 2023, with earlier application permitted, and will apply prospectively to changes in accounting estimates and changes in accounting policies occurring on or after the beginning of the first annual reporting period in which the company applies the amendments.

IAS 1 - Disclosure Initiative: accounting policies

Making information in financial statements more relevant and less cluttered has been one of the key focus areas for the Board. Companies make materiality judgements when deciding what information to disclose and how to present it. However, management are often uncertain about how to apply the concept of materiality to disclosure and find it easier to defer to using the disclosure requirements in IFRS as a checklist. As a result, relevant information is obscured by less relevant information and this retracts from the usefulness of the financial statements.

The Board has thus issued amendments to IAS 1 Presentation of Financial Statements, and the main changes include the following:

- requiring companies to disclose their material accounting policies rather than their significant accounting policies;

- clarifying that accounting policies related to immaterial transactions, other events or conditions are themselves immaterial and as such need not be disclosed; and

- clarifying that not all accounting policies that relate to material transactions, other events or conditions are themselves material to a company’s financial statements.

By way of example, one way to meet the new requirements would be by reference to the consolidation accounting policy. Instead of disclosing the boilerplate wording taken from IFRS 10 Consolidated Financial Statements on the control definition and the consolidation procedures, a group could instead disclose only how it de facto controls a particular investee whilst holding less than a majority of the voting rights (in a situation where this is relevant), and forgo the disclosure of the consolidation procedures since these are identical for all companies applying the standard and thus does not bring any value-add to the users.

The amendments are effective from 1 January 2023 but may be applied earlier.

Deferred tax related to assets and liabilities arising from a single transaction

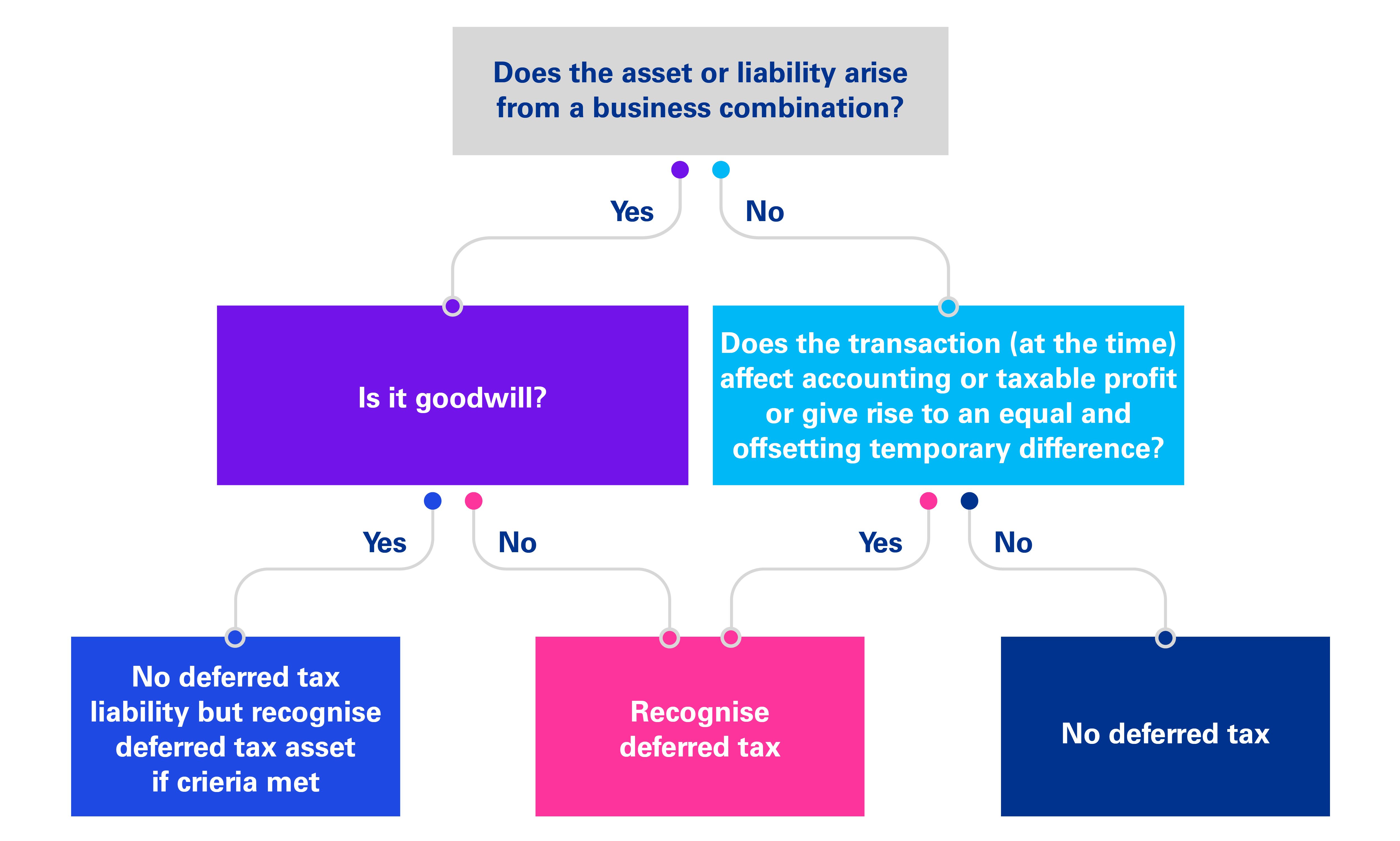

Currently there is diversity in practice when accounting for deferred tax on transactions that involve recognising both an asset and a liability with a single tax treatment related to both.

For example, a company may be entitled to a tax deduction on a cash basis for a lease transaction that involves recognising a right-of-use (ROU) asset and a corresponding lease liability under IFRS 16 Leases. A temporary difference may then arise on initial recognition of the ROU asset and the lease liability. Prior to the amendment, the Initial Recognition Exemption (IRE) of IAS 12 Income Taxes stated that deferred tax is not recognised for certain temporary differences that arise on the initial recognition of assets and liabilities, and applies to:

- a deferred tax liability (but not a deferred tax asset) that arises from the initial recognition of goodwill; and

- a deferred tax asset or liability that:

- arises from the initial recognition of an asset or liability in a transaction that is not a business combination; and

- affects neither accounting profit nor taxable profit at the time of the transaction.

When applying the IRE to the temporary difference arising from, say, leases, a company may currently apply a number of different approaches:

- apply IRE and therefore there is no deferred tax recognised,

- not apply the IRE and asses the ROU asset and lease liability together as integrally linked and recognise deferred tax on a net basis, or

- not apply IRE and recognise deferred tax on the ROU asset and lease liability separately (gross basis).

The amendments now clarify that the IRE does not apply to transactions such as leases and decommissioning obligations. These transactions give rise to equal and offsetting temporary differences, and all companies will need to reflect the future tax impacts of these transactions and recognise deferred tax. Therefore, in conjunction with the IRE definition stated above, IAS 12 further requires that the transaction does not give rise to equal taxable and deductible temporary differences for the IRE to apply. If the transaction does give rise to equal taxable and deductible temporary differences (e.g., leases), the IRE cannot be applied. Essentially, the expectation is that companies now recognise deferred tax on leases on a gross basis when the tax deduction is allocated to the lease liability.

Although the amendments generally apply for annual reporting periods beginning on or after 1 January 2023, the associated deferred tax asset and liabilities for leases and decommissioning liabilities will need to be recognised from the beginning of the earliest comparative period presented, with any cumulative effect recognised as an adjustment to the relevant component of equity at that date.

Amendments to IAS 12 in relation to Global Anti-Base Erosion

To address concerns about uneven profit distribution and the tax challenges of the digitalisation of the economy, various agreements have been reached globally to introduce a global minimum tax rate of 15%. Once changes to local tax laws are enacted or substantively enacted, companies may be subject to the top-up tax.

These GloBE (Global Anti-Base Erosion) rules apply to multinational groups that have consolidated revenues of EUR 750 million or more in at least two out of the last four years, and these groups will be required to calculate their GloBE effective tax rate for each jurisdiction where they operate. If the blended GloBE effective tax rate for all companies in a specific jurisdiction is below the 15% minimum rate, then they will be liable to pay a top-up tax for the difference.

As jurisdictions prepare to amend their local tax laws to introduce the global minimum top-up tax in line with the GloBE model rules, stakeholders are questioning how to account for the changes under IFRS. In particular, they question whether top-up tax is in the scope of IAS 12 and, if so, how to account for its deferred tax impacts.

To address these concerns, the IASB has amended IAS 12 to:

- provide a temporary mandatory exception from deferred tax accounting for top-up tax; and

- require companies to provide new disclosures (qualitative and/or quantitative) to compensate for the potential loss of information resulting from the relief.

- Qualitative information: How the company is affected by Pillar Two taxes and in which jurisdictions the exposure arises – e.g. where the top-up tax is triggered and where it will need to be paid.

- Quantitative information: The proportion of profits that may be subject to Pillar Two income taxes and the average effective tax rate applicable to those profits, or how the average effective tax rate would have changed if Pillar Two legislation had been effective.

This information does not need to reflect all the specific requirements in the legislation – companies can provide an indicative range. Disclosures may include quantitative and qualitative information.

Companies can benefit from the temporary mandatory exception immediately but are required to provide the new disclosures to investors for annual reporting periods beginning on or after 1 January 2023.

Conclusion

Although these amendments are not considered major revisions to the existing standards, the impact of these changes may be significant or otherwise depending on the specific facts and circumstances of each reporting entity. In many cases a disclosure of the impact of the application of these amendments is generally expected in the financial statements.