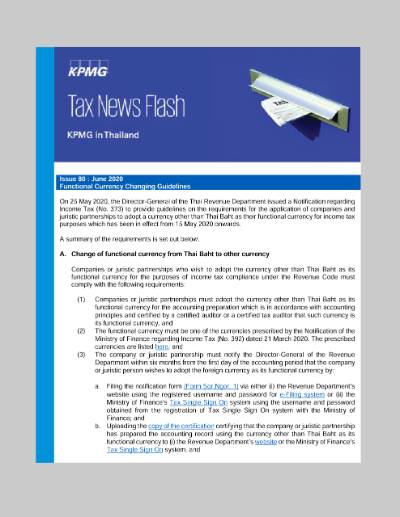

On 25 May 2020, the Director-General of the Thai Revenue Department issued a Notification regarding Income Tax (No. 373) to provide guidelines on the requirements for the application of companies and juristic partnerships to adopt a currency other than Thai Baht as their functional currency for income tax purposes which has been in effect from 15 May 2020 onwards.

A summary of the requirements is set out below.

A. Change of functional currency from Thai Baht to other currency

Companies or juristic partnerships who wish to adopt the currency other than Thai Baht as its functional currency for the purposes of income tax compliance under the Revenue Code must comply with the following requirements:

- Companies or juristic partnerships must adopt the currency other than Thai Baht as its functional currency for the accounting preparation which is in accordance with accounting principles and certified by a certified auditor or a certified tax auditor that such currency is its functional currency, and

- The functional currency must be one of the currencies prescribed by the Notification of the Ministry of Finance regarding Income Tax (No. 392) dated 21 March 2020. The prescribed currencies are listed here, and

- The company or juristic partnership must notify the Director-General of the Revenue Department within six months from the first day of the accounting period that the company or juristic person wishes to adopt the foreign currency as its functional currency by:

a. Filing the notification form (Form Sor.Ngor. 1) via either (i) the Revenue Department’s website using the registered username and password for e-Filing system or (ii) the Ministry of Finance’s Tax Single Sign On system using the username and password obtained from the registration of Tax Single Sign On system with the Ministry of Finance; and

b. Uploading the copy of the certification certifying that the company or juristic partnership has prepared the accounting record using the currency other than Thai Baht as its functional currency to (i) the Revenue Department’s website or the Ministry of Finance’s Tax Single Sign On system, and - The company or juristic partnership must file tax returns directly through either (i) the Revenue Department’s e-Filing system or (ii) the Ministry of Finance’s Tax Single Sign On system.

The company or juristic partnership that meets all requirements listed in (1) to (4) is eligible to use the currency other than Thai Baht as its functional currency from the first day of the accounting period that the Director-General of the Revenue Department is notified. Such currency must be used consistently until the subsequent change (if required) is approved by the Director-General of the Revenue Department.

B. Subsequent change of the functional currency

Companies or juristic partnerships who have notified the adoption of the currency other than Thai Baht as its functional currency to the Director-General of the Revenue Department as specified in A and subsequently wish to change their functional currency must comply with the following requirements:

- The company or juristic partnership must prepare accounting records which are in accordance with accounting principles and certified by a certified auditor or a certified tax auditor that the currency to be changed is its functional currency of the company or juristic partnership, and

- The functional currency must be Thai Baht or one of the currencies prescribed by the Notification of the Ministry of Finance regarding Income Tax (No. 392) dated 21 March 2020. The prescribed currencies are listed here, and

- The company or juristic partnership must notify the Director-General of the Revenue Department within six months from the first day of the accounting period that the company or juristic person is willing to change its functional currency by:

a. Filing the application (Form Sor.Ngor. 2) via either (i) the Revenue Department’s website using the registered username and password for e-Filing system or (ii) the Ministry of Finance’s Tax Single Sign On system; and

b. Uploading the copy of the certification certifying that the company or juristic partnership has prepared the accounting records using the currency other than Thai Baht as its functional currency to (i) the Revenue Department’s website or the Ministry of Finance’s Tax Single Sign On system, andThe company or juristic partnership must file tax returns directly through either (i) the Revenue Department’s e-Filing system by using the registered username and password or (ii) the Ministry of Finance’s Tax Single Sign On system by using the username and password obtained from the registration of Tax Single Sign On system with the Ministry of Finance.

Once the application is approved by the Director-General of the Revenue Department, the company or juristic partnership who meets all the above requirements is eligible to use the new functional currency from the first day of the accounting period.

C. Conversion of the remaining cash, assets or liabilities at the end of accounting period using the rates that are not ascertained by the Bank of Thailand

Companies or juristic partnerships who wish to convert cash, assets or liabilities remaining in the last day of accounting period into the functional currency by using rates that are not ascertained by the Bank of Thailand must comply with the following requirements:

- Obtain an approval from the Director-General of the Revenue Department within the accounting period that the company or juristic partnership wishes to use the rates that are not ascertained by the Bank of Thailand, and

- The rates must be referred to in the international currency exchange system, and

- Once the rates are approved by the Director-General of the Revenue Department, the rates must be used from the accounting period that the approval is granted until the subsequent change (if required) is approved by the Director-General of the Revenue Department; and

- The application must be filed via either (i) the Revenue Department’s website or (ii) the Ministry of Finance’s Tax Single Sign On system;

If the application is not filed or the approval is not granted, companies or juristic partnerships must convert the value of cash, assets or liabilities from other currencies into Thai Baht and subsequently convert the value from Thai Baht into the functional currency.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia