Slovenia – Amendments to Personal Income Tax Act

Slovenia – Amendments to Personal Income Tax Act

With effect from 1 January 2020, amendments to Slovenia’s Personal Income Tax Act have been implemented. The new rules include changes in: tax reliefs and tax brackets for the year 2020; the method of determining the amount of taxable car benefit for electric vehicles; and the taxation of income from independent business activities. Additional changes also apply to tax rates on income from capital (interest, dividends, and capital gains) and rental income.

Amendments to Slovenia’s Personal Income Tax Act have been implemented, and include changes in:

- tax reliefs and tax brackets for the year 2020,

- the method of determining the amount of taxable car benefit for electric vehicles, and

- the taxation of income from independent business activities.1

Additional changes also apply to tax rates on income from capital (interest, dividends, and capital gains) and rental income.

The measures came into effect on 1 January 2020.

WHY THIS MATTERS

These amendments will generally lead to lower personal income tax on employment income, but higher tax on “private” income. As a result, for those assignees subject to Slovenian tax law, employers could experience slightly lower international assignment costs. However, the tax outcome will depend on each taxpayer’s particular set of facts and circumstances.

In cases of assignments to Slovenia where assignees are subject to Slovenian taxation, and for assignees working outside Slovenia but still subject to Slovenian taxation, international assignment cost projections and budgeting should reflect the changes described in this newsletter. Where appropriate, adjustments to gross-up packages and payroll withholdings may need to be made.

Highlights of Amendments

Personal Income Tax (PIT) Calculation

The amendment introduces higher amounts of tax reliefs and new tax brackets for the year 2020. General tax relief for Slovene tax residents shall increase from EUR 3,302.70 to EUR 3,500.00 per annum.

In addition to general tax relief, residents whose annual taxable income (employment, independent business activity, and other income) does not exceed EUR 13,316.83 are entitled to an additional tax base decrease in the amount of EUR 18,700.38 – 1.40427 x annual income.

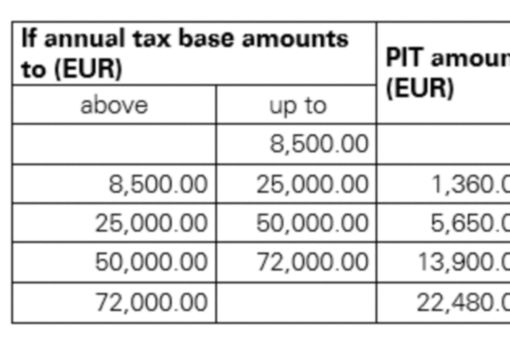

The amendment also includes changes in the tax brackets to be used in tax year 2020:

The tax relief for dependent family members and unemployed adult children (above the age of 18 years) can only be applied if the adult child has the same registered permanent address as the taxpayer claiming tax relief for him or her.

Valuation of Taxable Car Benefit

According to the new amendment, an electric motor vehicle that is provided to an employee by the company, and is used for private purposes, will result in an addition to taxable income. This inclusion is required regardless of the actual use of the vehicle for private purposes and irrespective of the manner in which the employer obtained the vehicle. The amount to be included in the employee's tax base is 0.3% of the purchase value of the vehicle per month if the vehicle value at acquisition, including value added tax (VAT), does not exceed EUR 60,000.

If the acquisition value of the vehicle, including VAT, exceeds EUR 60,000, the employee's tax base shall be determined in the amount of 1.5% of the value that exceeds the EUR 60,000, per every month of use of the vehicle.

Income from Independent Activities

The amendment introduces minimum taxation of income from a business activity for taxpayers who do not have a current tax loss. If an independent taxpayer performing a business activity determines his or her taxable basis as the difference between the actual revenues and expenses, the taxable basis can be decreased by the current year’s and previous years’ tax reliefs. The tax loss can be carried forward up to 63 percent of the taxable basis of income from the business activity. The minimum tax basis, after deduction of any tax reliefs and the tax losses are carried forward, shall amount to at least 37 percent of the taxable basis.

Increased Tax Rates for Private Income (Interest, Dividends, Capital Gains, Rental Income)

The amendment introduces increased tax rates on income from capital and rental income. In addition, the tax base for capital gains is determined differently.

The tax rates on capital gains continue to depend on the holding period of the asset. According to the amendment, the general tax rate is increased from 25 percent to 27.5 percent.

Over time, the tax rate decreases as follows:

- after 5 years of holding the asset, the tax rate is 20% (15% before the amendment);

- after 10 years, the tax rate is 15% (10% before the amendment);

- after 15 years, the tax rate is 10% (5% before the amendment);

- after 20 or more years of holding the asset, the tax rate remains 0%.

The amendment increased the tax rate on rental income from 25 percent to 27.5 percent. The taxable basis for rental income is decreased by the standard costs deduction of 15 percent of the income achieved (formerly 10 percent).

In respect of the tax basis for capital gains, under the amendment the deduction for standard costs is to be determined differently. Previously, the value of capital at the time of acquisition was increased by 1 percent of standard costs and the value of capital at disposition was decreased by 1 percent of standard costs, meaning that standard costs could result in capital loss. Following the amendment, if the difference between the value of an asset at the time of disposition and the value of equity at the time of acquisition is positive, the difference is reduced by standard costs (the sum of 1 percent of the acquisition value and 1 percent of disposal value), limited to the positive difference. Standard costs are not considered when a loss is incurred upon disposition of the property.

The tax rate for dividends and interest is increased to 27.5 percent from 25 percent.

FOOTNOTE

1 For the text of the amendment of the PIT Act as approved by the Parliament (in Slovene), see the unofficially consolidated text.

The information contained in this newsletter was submitted by the KPMG International member firm in Slovenia.

SUBSCRIBE

To subscribe to GMS Flash Alert, fill out the subscription form.

2024 KPMG Slovenija, d.o.o., KPMG poslovno svetovanje, d.o.o. and KPMG računovodske stroitve, d.o.o. are Slovenian limited liability companies and member firms of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee.

For more detail about the structure of the KPMG global organization please visit kpmg.com/governance.

GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.