Rules and procedures on taxation of trust

(Prakas No. 192 MEF.Prk.GDT, dated 12 March 2025)

Prakas no. 192 which is effective from 12 March 2025 outlines the rules and procedures regarding the tax implications of Trust operations in Cambodia, relevant to the Trustor, Trustee, and the beneficiaries including both resident and non-resident taxpayers.

We summarize below the key tax provisions of this Prakas:

| Description | Details |

| Definitions (Art. 3) | We list below some of the key terms used in this Prakas:

|

Tax registration (Art. 5) |

|

Keeping accounting records for the Trustee/Trust Company (Art. 6) |

|

Taxable income of the Trustee/Trust Company (Art. 7) |

|

Taxable income from the Trust (Art. 8) |

Income generated by the Trust shall be subject to tax in accordance with the existing tax rules and regulations in force, including:

The Trustee and/or the Trust Company, as the manager and arranger of the Trust, shall have the obligation to record the transaction in the accounting records of the Trust operation, submit the tax declaration, and pay the tax to the GDT. |

Tax obligations of the Trustee/ Trust Company (Art. 9, & 11) |

In addition to the tax obligations of the Trustee, as mentioned above, the Trustee/Trust Company has an obligation to pay other taxes and/or comply with the existing tax laws and regulations, including the submission and payment of tax to the GDT. |

| Tax exemptions (Art. 10) | Tax exemptions provided under existing tax rules and regulations which apply to any type of tax shall also apply to the Trust property related to that type of tax. |

Any provisions that are contrary to the provisions of this Prakas shall be abrogated.

Our comments

The Cambodian Trust Law, promulgated way back in 2019, lacks the important provisions regarding the tax implications of a Trust operation relevant to the Trustor, Trustee, and the overall income and operations of the Trust. Hence, this Prakas is a positive development in clarifying the tax compliance obligations of the parties involved in a Trust operation.

Given that Trust operations in Cambodia is still at an early stage, it would be reasonable to expect that the tax rules and regulations concerning Trust operations will evolve as taxpayers and regulators gain more familiarity with the Trust operations and their tax consequences. In the meantime, we have identified several points under this Prakas which may need further clarification and are worth consideration:

- It is unclear whether the tax rules and compliance obligations of Trust operations covered by Art. 5 to 11 would also apply to other types of Trust, e.g., Public Trust (i.e., generally provided to the government and/or its instrumentalities for the benefit of Cambodian people), or for Social Trust (i.e., generally used in society for cultural, educational, human, religious, or scientific purpose). It can be observed that generally, transactions and/or income realized by the government and non-profit organizations are exempted from tax. Hence, clarification on the specific rules and criteria for potential tax exemptions on non-commercial Trusts would be welcomed.

- It appears that the Trustee/Trust Company will be responsible for tax compliance obligations for the Trust operations. In cases where there is more than one Trust managed by the Trustee/Trust Company, it is unclear whether there would be a specific identification (e.g., TIN) used for each Trust to clearly attribute the tax declaration/payment for each specific Trust operation. This would also facilitate the conduct of future tax audits on the Trust operations.

- The Prakas also provides scenarios whereby Trustors (who could be resident or non-resident) may provide funds (e.g., cash) to the Trust, which can be used by the Trustee to purchase properties, including real estate properties, in Cambodia under the Trustee’s name. There is a question whether this mechanism would circumvent the legal requirement of land ownership in Cambodia, which prohibits non-residents from acquiring land in Cambodia.

- Article 8(4) of the Prakas clarifies that income distribution from the Trust to a non-resident taxpayer would generally trigger the WHT under existing tax rules and regulations. However, the rules are unclear if the recipient of the income distribution from the Trust is a resident.

Notwithstanding the above, we hope that this new Prakas will serve as a catalyst for more business and economic activities in Cambodia, particularly for M&A and business restructuring transactions, as they will now be able to consider the viability of using a Trust operation in their overall business structure.

Withholding Tax (WHT) relief for domestic airline

(Prakas no. 198 MEF.Prk.GDT, dated 17 March 2025)

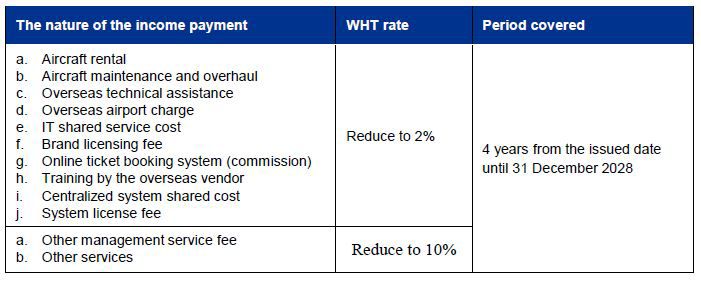

This Prakas covers the WHT reduction on payments made by domestic airline companies to non-resident taxpayers. Below is the summary of the tax relief:

To be eligible for the tax relief, the domestic airline must declare the monthly and annual tax via the E-filing system to the GDT by the due date and maintain proper accounting records and information related to its business activities in accordance with the tax provisions in force.

Our comments

This Prakas further reduces the applicable WHT on specific transactions made by domestic airlines, as earlier provided under Instruction no. 009 on the Reduction of withholding tax and specific tax for airline companies, reinforcing the government’s efforts of revitalizing the tourism and domestic airline industry in Cambodia, as this will further reduce the overall operating cost of domestic airlines in Cambodia.

From the signing date until the end of 2028, domestic airlines can enjoy the above-mentioned WHT relief for the above-mentioned expenses. From an administrative standpoint, taxpayers may further clarify from the GDT as to how to apply these reduced rates in the GDT’s E-filing system.

Supporting documents for interest between related parties

(Instruction no. 14256 GDT, dated 12 May 2025)

Further to the issuance of the new Transfer Pricing (TP) Prakas 574, dated 19 September 2024, the GDT issued this Instruction to clarify the following supporting documents for interest on loans between related parties:

a) Enterprises that have loans with related parties can determine interest rates following their agreement and shall be exempted from complying with the “Arm’s Length Principle”, provided the enterprise maintains the following supporting documents:

1) Loan agreement which clearly states the length and repayment term

2) Business plan or current and forecasted Financial Statements, and the purpose of the loans together with the explanations

3) Resolution of the Board of Directors (for enterprises that are not single-member private limited enterprises).

b) Where an enterprise borrows money from related parties, the interest rate on that loan cannot exceed the market rate limit at the time of borrowing. For the purpose of this Instruction, the market interest rate limit is the average loan interest rate from five major domestic commercial banks, which is issued annually by the GDT.

c) Enterprises that have transactions requiring cash advance from related parties with a term of less than one year, starting from the date of cash receipt until the actual settlement date of the cash advance, shall not be considered as a “loan transaction” and shall be exempt from interest implementation following the “Arm’s Length Principle”.

d) For loan transactions between third parties, the interest shall follow the loan agreement together with clear supporting documentation.

e) Loan transactions between related parties and/or between third parties are not required to be submitted or notified to the GDT.

The Instructions no. 151 GDT, dated 22 January 2014, Instruction no. 11946 GDT, dated 21 August 2018, and Instruction no. 10979 GDT, dated 25 May 2022, are all abrogated.

Our comments

Instruction No. 14256 consolidates all the previous Instructions related to loan transactions. The provisions are consistent with the previous Instruction No. 10979, with some updates clarifying the acceptable interest rates for third-party loans and eliminating the GDT notification requirement for all loans, whether with related or third parties.

A loan transaction between related parties is still exempt from the “arms-length principle”, provided that the taxpayer has maintained the required documents. Otherwise, the “arms-length principle” shall be applied.

Although this Instruction appears to provide some degree of flexibility for related parties to determine the interest rate for related party loans, it is still highly recommended that taxpayers ensure that the interest rate applied is reasonable or rational, considering the factors and circumstances surrounding the loan transaction. In case of doubt, you may consult with your TP advisors for further clarity.

As committed tax advisors to our clients, we welcome any opportunities to discuss the relevance of the above matters to your business.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

relief for domestic airline, Supporting documents for interest between related parties.pdf/jcr:content/renditions/cq5dam.web.400.600.jpeg)