Issuance of a notification letter on incorrect Tax declaration

(Notification No. 9124 GDT, dated 21 March 2025)

Notification no. 9214, which takes effect from the signing date, provides that the General Department of Taxation (GDT) will issue official notification letters to taxpayers for incorrect tax declarations.

Notification no. 9124 also clarifies that if the GDT finds irregularities and inconsistencies between the information and data submitted by the taxpayers and other relevant sources, the GDT will issue an official notification letter to the taxpayer, through physical delivery at the taxpayer’s premises or via electronic means.

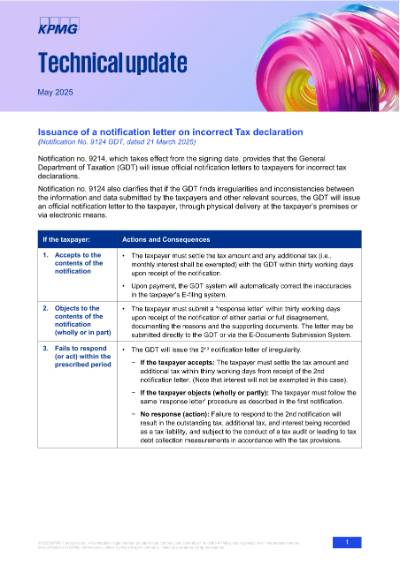

| If the taxpayer: | Actions and Consequences |

| 1. Accepts to the contents of the notification |

|

| 2. Objects to the contents of the notification (wholly or in part) |

|

| 3. Fails to respond (or act) within the prescribed period | • The GDT will issue the 2nd notification letter of irregularity. − If the taxpayer accepts: The taxpayer must settle the tax amount and additional tax within thirty working days from receipt of the 2nd notification letter. (Note that interest will not be exempted in this case). − If the taxpayer objects (wholly or partly): The taxpayer must follow the same ‘response letter’ procedure as described in the first notification. − No response (action): Failure to respond to the 2nd notification will result in the outstanding tax, additional tax, and interest being recorded as a tax liability, and subject to the conduct of a tax audit or leading to tax debt collection measurements in accordance with the tax provisions. |

Our comments

One notable concern regarding the issuance of notification letters to taxpayers is that inconsistencies and/or irregularities may be captured through the GDT’s comparison of the taxpayer’s own data with other taxpayers’ data (i.e., cross-checking), or through other relevant sources. This may pose potential challenges for taxpayers in case of protests, as taxpayers may not be privy or have access to the source of information used by the GDT in their comparison/analysis.

In this case, keeping proper and sufficient documentation would be key in ensuring that taxpayers would be able to support the basis of their tax declarations to the GDT. Having a trusted tax agent/advisor would also be beneficial in ensuring that taxpayers remain up to date with the changes in the tax landscape (and industry practices) and ensuring that tax declarations comply with the tax laws and regulations in force. Furthermore, conducting a self-review (i.e., a tax health check exercise), at least annually, could help minimize these findings and/or prepare taxpayers for the proper approach to be taken in order to promptly correct the errors of the tax declarations and/or in case, they receive this notification from the GDT.

It must be noted that although the notification is effective from the signing date, it remains unclear when will the GDT begin to issue such notification letters to the taxpayers. To ensure receipt of such letter, taxpayers must also ensure to properly update its records (e.g., latest physical address, email address, contact information, etc.) with the GDT.

The conduct of the tax audit program in 2025

(Notification No. 10263 GDT, dated 1 April 2025)

Notification no. 10263 announced that the GDT will conduct an on-site tax audit on 4,827 enterprises in 2025.

In accordance with the Standard Operating Procedures (SOP) on tax audit, each enterprise will be subjected to an on-site tax audit once every 3 years, unless the taxpayer is considered as “high risk”, has inaccurate tax declarations, and/or if the tax audit is upon the request of the taxpayer itself.

Our comments

This notification did not specify the specific sector(s) and/or categories of taxpayers covered by the initial 4,827 count identified by the GDT. Among others, we understand that the GDT is keen on reviewing the tax compliance practice of businesses who are enjoying certain tax reliefs, incentives, and/or privileges to ensure eligibility to said incentives. Meanwhile, taxpayers with unsound tax compliance practices may also be prioritized for said tax audit.

In any case, all taxpayers should be ready to manage GDT tax audits as part of the tax compliance cycle in Cambodia. Needless to say, it is imperative that taxpayers comply with all tax laws and regulations, including, but not limited to, accurate and timely filing/payment of the tax declarations as well as keeping proper accounting records and all required supporting documents for all transactions.

As committed tax advisors to our clients, we welcome any opportunities to discuss the relevance of the above matters to your business.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia