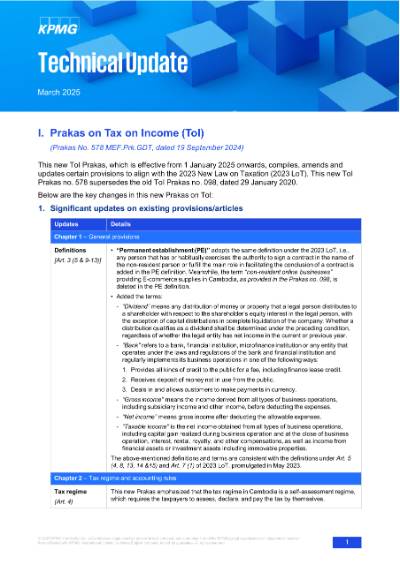

I. Prakas on Tax on Income (ToI)

(Prakas No. 578 MEF.Prk.GDT, dated 19 September 2024)

This new ToI Prakas, which is effective from 1 January 2025 onwards, compiles, amends and updates certain provisions to align with the 2023 New Law on Taxation (2023 LoT).

This new ToI Prakas no. 578 supersedes the old ToI Prakas no. 098, dated 29 January 2020. Below are the key changes in this new Prakas on ToI:

1. Significant updates on existing provisions/articles

| Updates | Details |

| Chapter 1 – General provisions | |

Definitions [Art. 3 (5 & 9-13)] |

• “Permanent establishment (PE)” adopts the same definition under the 2023 LoT, i.e., any person that has or habitually exercises the authority to sign a contract in the name of the non-resident person or fulfill the main role in facilitating the conclusion of a contract is added in the PE definition. Meanwhile, the term “non-resident online businesses” providing E-commerce supplies in Cambodia, as provided in the Prakas no. 098, is deleted in the PE definition. • Added the terms: - “Dividend” means any distribution of money or property that a legal person distributes to a shareholder with respect to the shareholder’s equity interest in the legal person, with the exception of capital distributions in complete liquidation of the company. Whether a distribution qualifies as a dividend shall be determined under the preceding condition, regardless of whether the legal entity has net income in the current or previous year. - “Bank” refers to a bank, financial institution, microfinance institution or any entity that operates under the laws and regulations of the bank and financial institution and regularly implements its business operations in one of the following ways: 1. Provides all kinds of credit to the public for a fee, including finance lease credit. 2. Receives deposit of money not in use from the public. 3. Deals in and allows customers to make payments in currency. - “Gross income” means the income derived from all types of business operations, including subsidiary income and other income, before deducting the expenses. - “Net income” means gross income after deducting the allowable expenses. - “Taxable income” is the net income obtained from all types of business operations, including capital gain realized during business operation and at the close of business operation, interest, rental, royalty, and other compensations, as well as income from financial assets or investment assets including immovable properties. The above-mentioned definitions and terms are consistent with the definitions under Art. 5 (4, 8, 13, 14 &15) and Art. 7 (1) of 2023 LoT, promulgated in May 2023. |

| Chapter 2 – Tax regime and accounting rules | |

| Tax regime (Art. 4) | This new Prakas emphasized that the tax regime in Cambodia is a self-assessment regime, which requires the taxpayers to assess, declare, and pay the tax by themselves. |

| Updates | Details |

Chapter 3 – General rules on the taxable income Part 1 – Tax year and taxable income |

|

| Tax year (Art. 7) | Art. 7 (1) clarifies the requirement for a change of tax years. • Transition periods: - For existing taxpayers, the implementation shall commence from 1 January of the year requested until the date before the start of the new tax year. Meanwhile, for new taxpayers, the implementation shall commence from the operation date until the date before the start of the new tax year. - Deductible depreciation expense shall be prorated based on the number of days during the transition period over 365 days. - The loss carried forward for transition periods is considered as 1 year. • Renewal periods: The new tax year is 12 months after the end of the transition period. • This Article also enumerates the required documents to request for changes of tax year. Meanwhile, Art. 7 (2) states that for a physical person, sole proprietorship and partnership, ToI shall be calculated from total income realized within any calendar year. |

| Source of income (Art. 8) | Art. 8 added the below provision regarding the 14% WHT consideration on the “deemed dividend” transaction previously introduced under Prakas no. 372, dated 5 April 2019. • The conversion, partly or wholly, of Retained Earnings (RE) to the capital of an enterprise, i.e., supported by a Board of Director (BoD) resolution of the enterprise and clear evidence of the changes in the capital with recognition from competent authorities shall not be considered as the distribution of a dividend and not subject to WHT. Where the enterprise withdraws the capital to distribute to shareholders, this withdrawal shall be considered as a dividend distribution for the proportion of capital derived from retained earnings. • In case of transfer, partly or wholly, of shares in capital or equity of an enterprise which has RE, the RE relating to the shares transferred, irrespective if converted or not converted to capital or equity, shall be considered as dividend distributions. • In case of cessation of business operation, the RE is considered as wholly distributed to the shareholders. Art. 8 also clarifies that the subsidiary expenses associated with the management and technical services paid to the suppliers of these services shall be considered as part of the management and technical services. Lastly, Art. 8 adopted the same provision under the 2023 LoT that the income from business activities of a non-resident taxpayer through a PE in Cambodia, as well as the income from the supply of the same goods or services which are similar to business activities of non-resident taxpayer’s PE in Cambodia, shall be considered as Cambodiansourced income. |

Chapter 3 – General rules on the taxable income Part 4 – General rules on expenses |

|

| Appropriation of own goods or services for business uses [Art. 24 (6)] | The provision below under Art. 28 (6) of the old ToI Prakas no. 098 was slightly modified: • Appropriation of goods or services for business use shall not be treated as sales but must have proper verifiable evidence and cannot record as expenses. As noted, the wording “cannot record as expenses” has been deleted under this new ToI Prakas no. 578. |

Chapter 3 – General rules on the taxable income Part 5 – Deductible and non-deductible expenses |

|

| Charitable contribution (Art. 31) | Art. 31 added a definition for charitable contribution. For the purpose of ToI, “charitable contribution” refers to a contribution in cash or in kind to a not-for-profit activity as follows: a. Any organization organized and operated exclusively for religious, charitable, scientific, literary, or educational purposes, where no part of the property or income is used for private benefit. b. Any association whose income is not used for the private benefit of any shareholder or physical person. The above-mentioned definitions and terms are consistent with the definitions under the Art. 16 of 2023 LoT, promulgated in May 2023. |

| Updates | Details |

Chapter 3 – General rules on the taxable income Part 6 – General rules on depreciation |

|

| Research and development (R&D) expenses [Art. 33 (3)(a)] | Art. 35 (3)(a) of Prakas no. 098 provides that R&D expenses can be deducted fully from the result of the period in which they arise. This specific sentence was deleted in the new ToI Prakas no. 578. |

Chapter 3 – General rules on the taxable income Part 8 – Withholding tax |

|

| General rules of WHT [Art 43 (1)] | Art. 43 (1) added the provision below on the timing of WHT, which aligns with Instruction no. 12350, dated 20 April 2023: • For the purpose of WHT, the taxpayers shall record accrued expenses monthly, following the result of economic activities that have occurred and are related to the expenses figure, regardless of whether the expenses have been paid. |

Chapter 3 – General rules on the taxable income Part 9 – Calculation of tax on income |

|

| Threshold of income subject to annual tax [Art. 49 (4)] | Reiterates the provision that taxable income realized by physical persons, soleproprietorships, and members of a partnership is subject to ToI based on the progressive rate. This is consistent with Art. 4 of the Sub-Decree no. 48, dated 11 March 2024, which provides the threshold of taxable income in Cambodia. |

| Minimum tax (MT) (Art. 51) | Art. 51 added the provision on MT emphasizing that Qualified Investment Projects (QIPs) that have an independent audit report will be exempted from MT. This is consistent with Art. 24 of 2023 LoT, promulgated in May 2023. |

| Exemption from advanced tax on dividend distributions (ATDD) [Art. 52 (2)] | Prakas no. 578 added the items below as exempt from ATDD: a. Income from insurance or reinsurance activities on properties or other risks in Cambodia as per Art. 21(1) of the 2023 LoT. b. QIPs within the income tax holiday (ITH) period, including RE accumulated during the ITH period existing before the year 2020. Paragraph (b) is the same provision as per Instruction no. 30408 GDT, dated 14 December 2022 on the implementation of ATDD. |

Chapter 3 – General rules on the taxable income Part 10 – Accounting records |

|

| Obstructing the implementation of provisions on taxation [Art. 59 (4)] | Art. 59 (4) adopts the same criteria regarding acts considered as obstruction on the implementation of the tax regulation as per Art. 225(4) to (13) of the 2023 LoT, promulgated in May 2023. |

2. Newly added Chapter

Chapter 4 – Tax on Income for Foreign Branches

| Provisions | Remarks |

| Definitions (Art. 61) | Foreign branch refers to a fixed place of business in Cambodia of foreign company, whose other assets belong to Head Office (HO) overseas. |

| Taxable income (Art. 62) | Foreign company branch is subject to tax on income for Cambodian source income only. The taxable income for the foreign company branch is the income from the business activities in Cambodia less allowable expenses. |

| ToI computation (Art. 63) | The ToI payable shall be calculated by multiplying the taxable income by the applicable tax rate. |

| ATDD (Art. 64) | If in any current tax year, the Branch transfers Cambodian sources income overseas, the income: a. Shall not be subject to ATDD, if the income transferred is from the income after paying ToI. b. Shall be subject to ATDD, if the income transferred is from income not yet subjected ToI. |

| WHT (Art. 65) | Besides the WHT on payment to resident physical persons, the foreign company branch shall withhold and pay a 14% WHT on the following payments to non-residents: • When transferring the income after paying taxes as per Art. 63 & 64 to the HO overseas; or • The payment of Cambodian source of income to non-resident except for reinsurance on assets and risks in Cambodia. |

Our comments

Generally, the provisions under this new ToI Prakas No. 578 are consistent with the changes under the 2023 LoT. Many elements in this new ToI Prakas mirror the provisions of the previous Prakas no. 098, with a few updates/revisions to take into account observations on the recent tax issues noted during the actual implementation of the tax laws and regulation.

We cite below our insights into the significant changes under this new Prakas:

• The update on tax regimes, emphasizing the self-declaration system, reinforces the importance of the taxpayer’s responsibility in the tax compliance cycle in Cambodia. Additionally, the more explicit guidelines for changes in the tax year provide essential procedural clarity, particularly for local subsidiaries owned by non-resident enterprises applying for a different tax year.

• The nuanced treatment of dividend distributions, particularly “deemed dividend” transactions, is a highly contested issue. With the updated provision, taxpayers would hope for a clearer and more consistent implementation of these rules, especially on the tax implications during business cessation.

• The added definitions give clarity on the tax implications of certain transactions. For instance, banks are subject to different tax rules, and are eligible for certain tax reliefs. With the added definition of “banks”, it becomes clearer as to what types of activities are considered as banking activities, eligible for such relief/incentives.

• The new LoT further clarifies the transactions considered as Cambodian-sourced, subject to the applicable tax in Cambodia. With the expanded definition of the term “management and technical services”, taxpayers should revisit their transactions with their non-resident management and technical consultants, as local transactions attributable to these transactions may also trigger WHT.

• The removal of the language disallowing the recording of expenses for appropriated goods/services for business use would give taxpayers more flexibility, while the changes concerning R&D expenses simplify asset recognition but may impact businesses that heavily invest in R&D.

• There is also a full Chapter dedicated to clarifying the taxation of foreign branches. This provides clearer rules on the tax impact of branch operations in Cambodia covering their corporate income, and repatriation of dividends, profits, etc. back to it HO. This would underscore the importance of tax planning for foreign entities doing business in Cambodia.

Overall, Prakas no. 578 introduces a more structured and updated framework for the taxation of income in Cambodia. While it simplifies and clarifies several provisions, it also places some significant changes which might impact the taxpayer’s tax position. Taxpayers, particularly those with complex structures or foreign operations, will need to assess the impact of these changes carefully and should keep themselves updated on the changes to remain compliant.

Lastly, we wish to note that for the purpose of completing the 2024 ToI declaration (i.e., due for E-filing/payment on 31 March 2025), the previous provisions under the old ToI Prakas no. 098 shall remain in force.

II. Standard Operating Procedures (SOPs) released by the GDT

Recently, the GDT released several SOPs summarized below:

| No. | Topic | Key notes |

| 1 | Tax on Means of Transportation | These SOPs outline the rules and procedures for the declaration and payment of the taxes. These include the provisions on purpose, definition, tax rate/payable for each type of transaction, and the transactions exempt from tax. |

| 2 | Tax on Property Rental | |

| 3 | Real Property Tax | |

| 4 | Stamp Tax | |

| 5 | Tax on Unused Land |

Our comments

These new SOPs provide clearer guidance on the roles and responsibilities of both the tax officers and the taxpayers to ensure proper declaration and payment of the applicable taxes. Impacted taxpayers should seek further advice and guidance from their tax advisors on how these new SOPs will impact their specific transactions to ensure proper compliance and mitigate any tax risks.

As a committed tax advisor to our clients, we welcome the opportunity to discuss the relevance of the above matters to your business.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia