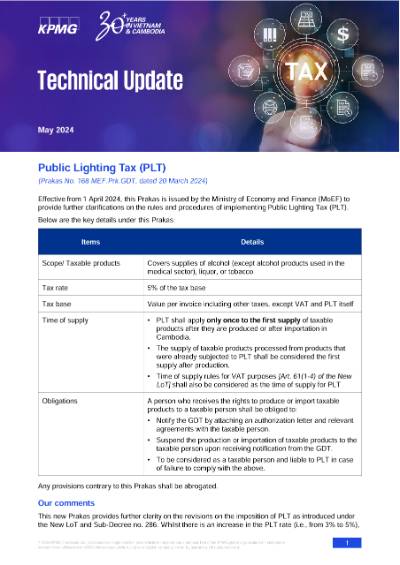

Public Lighting Tax (PLT)

(Prakas No. 168 MEF.Prk.GDT, dated 20 March 2024)

Effective from 1 April 2024, this Prakas is issued by the Ministry of Economy and Finance (MoEF) to provide further clarifications on the rules and procedures of implementing Public Lighting Tax (PLT).

Below are the key details under this Prakas:

| Items | Details |

| Scope/ Taxable products | Covers supplies of alcohol (except alcohol products used in the medical sector), liquor, or tobacco |

| Tax rate | 5% of the tax base |

| Tax base | Value per invoice including other taxes, except VAT and PLT itself |

| Time of supply | • PLT shall apply only once to the first supply of taxable products after they are produced or after importation in Cambodia. • The supply of taxable products processed from products that were already subjected to PLT shall be considered the first supply after production. • Time of supply rules for VAT purposes [Art. 61(1-4) of the New LoT] shall also be considered as the time of supply for PLT |

| Obligations | A person who receives the rights to produce or import taxable products to a taxable person shall be obliged to: • Notify the GDT by attaching an authorization letter and relevant agreements with the taxable person. • Suspend the production or importation of taxable products to the taxable person upon receiving notification from the GDT. • To be considered as a taxable person and liable to PLT in case of failure to comply with the above. |

Any provisions contrary to this Prakas shall be abrogated.

Our comments

This new Prakas provides further clarity on the revisions on the imposition of PLT as introduced under the New LoT and Sub-Decree no. 286. Whilst there is an increase in the PLT rate (i.e., from 3% to 5%), PLT shall only be imposed one time, i.e., on the first supply within the supply chain (previously 3% PLT was imposed on all stages of the supply chain).

Impacted taxpayers should also take note of the proper time of supply rules applicable for PLT to ensure proper compliance and avoid penalties.

(New) Value-Added Tax (VAT) Sub-Decree

(Sub-Decree No. 49 SD.Prk, dated 11 March 2024)

Effective from 11 March 2024, this new Sub-decree on VAT shall cover the rules and procedures on the implementation and collection of VAT on supply of taxable goods/services in Cambodia, including the updates on the VAT rules and regulation previously covered under VAT Sub-Decree no 114, dated 24 December 1999.

This new VAT Sub-Decree also reflects the changes introduced under the 2023 New Law on Taxation (LoT), including the rules on VAT on E-commerce under VAT Sub-Decree no. 64, dated 8 April 2021.

Below are the key updates of the new VAT Sub-Decree:

| Updates | Details |

| Scope (Art. 2) | The new VAT Sub-Decree no. 49 also covers E-commerce services supplied in Cambodia in the definition of taxable supplies. Therefore, any person who provides taxable supplies in Cambodia, including E-commerce supplies, shall be in-scope with this new VAT Sub-Decree. Previously, it was noted that the rules governing E-commerce services supplied in Cambodia are separately covered by VAT Sub-Decree no. 65, as the old VAT Sub-Decree no. 114 does not cover E-commerce supplies |

| Extended period for input VAT claim (Art. 12) | Previously, input tax credits were allowed on taxable purchase of goods/services and importation within the same month. However, the new VAT Sub-Decree has extended this period, allowing input tax credits to be claimed within the same month or 60 days after the supply or importation. |

| VAT refund for Qualified Investment Projects (QIP) (Art. 20) | Previously, all registered QIPs (i.e., whether export-oriented or not) were able to request a refund on the excess input credit every month. Under the new VAT Sub-Decree, it appears that only export-oriented taxable persons shall be allowed to claim a refund every month. Other taxable persons, including none exportoriented QIPs, can only request a refund every 3 months. |

| VAT reverse charge on imported services [Art.23(3)] | The new VAT Sub-Decree expanded the scope of the VAT “reverse charge” declaration to cover services supplied in Cambodia by a non-resident person who does not have a permanent establishment (PE) in Cambodia. |

| Transfer of a business as a going concern (Art. 35) | Under the old VAT Sub-Decree, the transfer of business (as a going concern) would not be subject to VAT, subject to compliance with certain conditions. The new VAT Sub-Decree has eased the conditions and deleted the requirement that the outgoing business (i.e., transferor) must wind-up its operations and deregister with the GDT and other relevant government ministries. |

| VAT on E-commerce Activities (entire Chapter 11) | An entire Chapter 11 (i.e., Arts 36 to 41) was included to provide rules on VAT on E-commerce activities in Cambodia, which is essentially based on the rules provided under VAT Sub-Decree no. 65 and the relevant Prakas on VAT on E-commerce. |

Any regulations contrary to this Sub-decree shall be abrogated.

Our comments

Since the implementation of the old VAT Sub-Decree no. 114 in 1999, business models and terms of trade have evolved, and with the advent of globalization, companies have found new ways of doing business in a country without the need to establish a local presence in said country.

The new VAT Sub-decree will replace the existing VAT Sub-Decree 114, bringing significant revisions and updates to ensure consistency in the implementation of the VAT rules, in light of the recent changes introduced under the New LoT and new rules and regulations, with the aim to expand the tax base and minimize tax leakage in the collection of VAT for supply of taxable goods and services in Cambodia.

One notable change is the requirement to apply VAT “reverse charge” on imported services introduced under Art. 23(3) of the new VAT Sub-Decree. The VAT “reverse charge” mechanism was introduced earlier under VAT Sub-Decree no. 65 which covered E-commerce services supplied in Cambodia. Under Art. 23(3), it appears that the VAT “reverse charge” obligation may not be limited to E-commerce supplies only but apply to a wider scope of services (i.e., E-commerce related or not) provided by nonresident suppliers. It is noteworthy to highlight that the “reverse charge” mechanism under the VAT regime applied in other jurisdictions covers all transactions considered as “imported services”, regardless of whether the services are E-commerce related or not. This new provision requires further clarification from the GDT.

A major positive development introduced under the new VAT Sub-Decree is the extended period to claim input VAT credits (i.e., extended up to 60 days from the time of supply or importation). This would mitigate issues on disallowed input VAT claimed by taxpayers due to late issuance or receipt of proper VAT invoices. Considering the foregoing, it would be reasonable to expect that the online VAT Declaration system of the GDT will be updated to account for these new rules.

Threshold of Monthly Taxable Salary and Annual Taxable Income

(Sub-decree No. 48 SD.Prk, dated 11 March 2024)

This Sub-decree is issued by the Royal Government of Cambodia (RGC) to determine the threshold of monthly taxable salary of resident employees subject to ToS and the threshold of annual taxable income realized by sole proprietorship and distributions to each member of a partnership subject to annual tax, which shall be effective from 11 March 2024.

The threshold of monthly taxable salary of resident employees subject to ToS are as follows:

For resident employees, the tax relief for the spouse and for each dependent child amounting to KHR150,000 per person per month shall be deducted from the gross salary of the employee to arrive at the taxable salary base. In cases where both spouses are employed, the tax relief shall be applied to only one spouse.

The threshold of annual income subject to annual tax (i.e., for a sole proprietorship and income distributed to each member of a partnership that is not considered a legal person) are as follows:

Our comments

Most of the contents of this Sub-decree, including the threshold of monthly taxable salary and annual taxable income determined in this Sub-decree, remain unchanged if compared to the prevailing tax law and regulations concerning tax on salary. Nevertheless, it should be noted that unlike the former Subdecree No. 196 dated September 2022, the annual income threshold does not apply to physical persons, which appears to provide temporary relief for individuals who are earning income aside from income from employment activities. On the other hand, this may pose a question about the government's previous intention to implement a personal income tax (PIT) regime in Cambodia.

Everyone must remain vigilant for any further developments in this area.

Patent Tax

(Sub-decree No. 47 SD.Prk, dated 11 March 2024)

This Sub-decree is issued by the RGC to determine the patent tax rates which shall be applied for a taxable person conducting business in the Kingdom of Cambodia.

Effective from 11 March 2024, the patent tax payable shall be determined as below:

Taxpayers who started their business operations within the last 6 months of the calendar year shall only pay half of the patent tax above.

Our comments

It is noted that the rates of patent tax determined in this Sub-decree remain the same as the prevailing tax law and regulations. All taxpayers must ensure timely renewal and payment of their annual patent tax obligation.

As committed tax advisors to our clients, we welcome any opportunities to discuss the relevance of the above matters to your business.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia