Close-up 3:A new top-line strategy for financial institutions

A new top-line strategy for financial institutions

In the overseas financial industry, attention is being drawn to how several notable players have been strengthening their fee-based businesses. These financial institutions are placing priority on “contributing to the corporate value of customers.”

Similarly, as Japanese financial institutions rethink their transaction fee-based business it will become necessary for them to shift away from traditional investments made on one’s own behalf and toward business opportunities undertaken in tandem with customers. We see the setting up of profit-sharing joint ventures, CVC utilization and synergy development, and the turning of financial know-how into useful services as entry points for financial institutions. Let’s consider this trend with some helpful examples from overseas.

BtoB fee-based business potential

Rapid progress in the practical application of digital technology has led some to deem today the age of the startup. One reason for the proliferation of startups is that a rich environment - data structuring and cloud environments supporting everything from information gathering to service deployment - makes viable even companies with only a handful of staff. At the same time, however, such circumstances are taxed by the need to solve certain social issues.Factors such as the difficulty associated with working for a large corporation, the aging population and shrinking workforce, the segmentation of consumer preferences and needs, and the decline in individual disposable income due to increased social burdens are only compounding society’s demand for “higher-level service from smaller organizations” as well as “the need to cope with the risk of accelerating service obsoletion.”

So, what do entrepreneurs look for in this age of the startup? These would be the ability to easily enter or withdraw from a business and the availability of opportunities to monetize. In the U.S. it is now common for individuals to work regular weekday hours while dedicating evenings and weekends to side businesses that respond to certain local, market or industry needs - and it is the financial institutions that are supporting this style of work.When a company is created, costs associated with the back and middle office can be quite hefty, but financial institutions are playing a role in creating an environment in which services can be enjoyed via metered billing and with zero initial cost.

And the situation in Japan? Well, if you want to launch a startup, you’ll have to devise your own accounting and finance and internal control systems. And find your own personnel. And do this all ahead of time in the name of self-responsibility. If, for example, you want to start a caregiving service or a business providing support services to foreigners, you’ll have to spend some of your time on accounting tasks, hiring others will lead directly to increased costs ... and then there’s always the risk of fraud. Surprisingly, you may find yourself in a situation in which nobody wants to help you.

But management and performance challenges aren’t just for startups. They can be found within a growing number of industries - including top retailers, major hospitals, regional financial institutions, regional logistics companies, and caregiving services. A unique characteristic of Japan’s business environment is that a variety of costs not necessarily associated with the main area of business continue to increase - a contradiction of sorts, given that we live in an age of IT. From the perspective of a Japanese financial institution, however, the various corporate duties that compel businesses to bear costs unrelated to their main business activities constitute a “blue ocean” opportunity for BtoB business fees.

Following are two examples of overseas financial institutions that are practicing the approach of establishing and capitalizing on fee-based business in BtoB markets - a strategy that has been gaining attention in recent years.

Overseas Benchmark #1: DBS and the utilization of CVC

Although the Development Bank of Singapore (DBS) has been turning heads recently for its entry into retail banking in other Southeast Asian markets, for a while now it has been supporting industry through the use of fintech, collaborating with startups and demonstrating a remarkable ability to form cooperative relationships with client companies, making it one of the top financial institutions in Asia.

Last October, DBS announced a collaboration with Agrocorp International, a global agricultural trading company, and Distributed Ledger Technology, a blockchain startup, to develop and provide a blockchain trading platform to 4,500 large scale Agrocorp farmers in Australia. Under this platform, DLT - also a DBS investee - uses blockchain technology to deploy a real-time logistics monitoring system while DBS itself also manages a blockchain-based trade finance service, enabling the real-time actualization of both logistics and finance via DBS’ API. Such an innovative platform, which has the potential to combine “finance + CVC + industry” with “synergy development,” is surely unique.

Remarkably, although the purpose of the project was to reduce costs while improving customer convenience, DBS, a financial institution, made the decision to invest both time and money to develop and provide new services for the client. As a result of that decision, DBS has established an exclusive position for itself: it can capture settlement fees paid by participating merchants of client companies and at the same time capitalize on a variety of opportunities to provide working capital.

Overseas Benchmark #2: NT and its practice of finance BPO

Northern Trust (NT) is a major U.S. bank that has carved out a reputation for being a top player in the U.S. fee-based business segment. For many years, its main business involved securities settlement and the associated supply of working capital, collateral financing, custodianship and cash management solutions (CMS). Because the company has built its business on the principle of focusing on “client assets” and “client operations,” it has developed services related to advanced risk management, anti-money laundering (AML) know-how, and compliance to regional financial institutions and businesses through joint ventures and the acquisition of business process outsourcing (BPO) companies.

Users range from SMEs with just a few employees to large companies, with client companies finding themselves freed from burdensome middle office and risk-management tasks, accounting operations and so forth, enabling them to realize lower-cost operations. NT’s fee-based business is remarkably strong, and now accounts for over seventy percent of its topline revenue.

Moving beyond joint investment with the client to offer new profit model know-how

The common thread connecting the two companies profiled above is the philosophy behind their respective business models. DBS is a government financial institution, so it has strong incentives for undertaking investment and business development from the perspective of industrial development. In the case of NT, there is an expectation for it to engage in certain peripheral business activities that accompany trust banking, and it is written into its corporate DNA to ensure convenience and safety for customers when engaging in these activities.

The most accessible avenue for putting this philosophy into practice is the inorganic strategy of working with multiple partners to invest jointly with and share profits among customers - that is, a “profit-sharing joint venture.” This approach is also referred to as corporate venture capital (CVC) for its consideration of business development synergies based on the know-how of third parties not located within the investing bank.

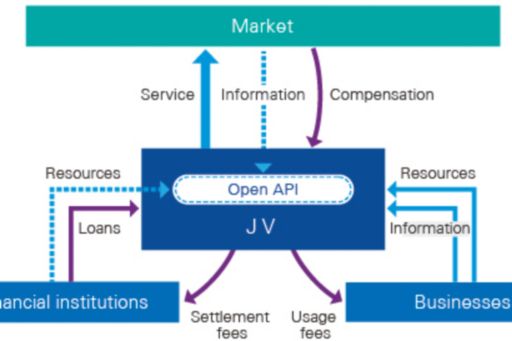

Using the JV: new competitive platform

When a bank utilizes its open API, it can handle all investment processes - from development to execution - gaining a competitive edge because it can present the operation as a completely new service.

But what about Japanese banks? What percentage of recent Japanese bank investment and expenditure has been spent on customer support? Most likely, more than ninety percent is being spent on labor costs, maintenance costs and system renewals - at a time when overseas benchmark financial institutions are already guiding half of their annual investment and expenses toward collaborative business development with customers.

What matters most when considering new business opportunities with client companies? Simply stated, it’s placing the absolute maximum emphasis on client value creation. To achieve this, it’s necessary to negotiate in advance with clients and other collaborators and to agree on a vision for the future that reflects the requirements of each party. Also crucial to success are developing a business plan with a high level of feasibility and having a deep understanding of the target business and market. Cooperation between business experts and collaborators for the sake of ensuring proper management and fulfilling common goals - both when building the business and during execution - is also essential. Forming an effective team requires conditions that facilitate collaboration between partners from different corporate cultures and business areas.

Contributing to new value creation focused on social issues

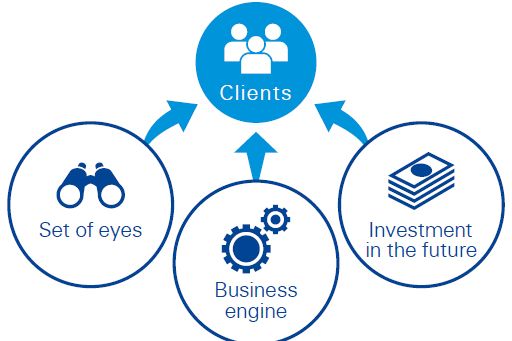

Here, I lay out the three elements that are absolutely necessary for creating virtuous cycles for new, BtoB fee-based businesses based on collaboration between domestic financial institutions, their customers and third parties. The first is a “set of eyes” able to clearly define business needs; the second is an “engine” providing essential infrastructure for building up business; and the third is “investment in the future” that will make it possible to nurture the newly born business.

The starting point is for a trusted set of “eyes” to identify factors that will help expand client and collaborator markets as well as business needs that will help them enhance managerial efficiency. Next, the “engine” to drive the infrastructure that will lighten the operational load must be provided and practical support roles implemented. Finally, it will become possible to effect continuous “investment in the future” using profits gained, and this investment will help to establish both a cycle and a sustainable model for profit growth.

If Japanese financial institutions can harness these three functional elements and introduce new profit models, then the real benefit will be the resulting effect on Japan’s longstanding social issues.

Returning to a topic I touched upon earlier, when it comes to alleviating the labor shortage being experienced by domestic businesses - a shortage brought about by an aging population and shrinking workforce - financial institutions, as business support platforms, should be able to provide treasury management services as well as services that lighten the load of accounting and finance departments. In both areas, financial institutions should be in a position to demonstrate supportive measures for resolving human resources shortages at relatively low cost with conventional financial operations.

Another role financial institutions in Japan are being asked to play is that of helping to address the longstanding issue of revitalizing regional economies, which have suffered under the combined influences of population decline and urban migration. The key to regional revitalization is the promotion of local economies and the jobs that will follow. To make this a reality, developing services and experiences that are unique to each region is essential - a challenge that will be difficult to achieve solely through local wisdom and human resources. More precisely, the creation of new projects through outsourcing, partnership with essential third parties, and effective use of coworking opportunities will be indispensable to the provision of low-cost, high-quality services and experiences. In this respect as well, financial institutions should be in the position to act as regional collaboration hubs playing a leading role in the establishment of new value creation cycles - cycles that are firmly rooted in each region and realized by means of harnessing the three functional elements mentioned above.

By investing alongside one’s clients and creating business opportunities that provide new value together, Japanese financial institutions can reestablish their worth in the domestic market while building new profit models. Bearing this in mind, it seems clear that the way forward for domestic financial institutions is development of their BtoB fee-based business.

Author

Takehiko Matsuura

Takehiko Matsuura offers advisory services ranging from corporate strategy planning to merger integration support for financial services companies. Prior to working at KPMG, Mr. Matsuura worked at an accounting advisory firm and domestic think tank, where he led teams offering services ranging from strategy formulation to PMI, in such business areas as leasing, bank and nonbank M&A, JV strategy, overseas expansion and integration, and CVC establishment and operations. He also worked in business development at a major domestic long-term credit bank. He graduated from Hitotsubashi University’s Faculty of Law.

© 2024 KPMG AZSA LLC, a limited liability audit corporation incorporated under the Japanese Certified Public Accountants Law and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. © 2024 KPMG Tax Corporation, a tax corporation incorporated under the Japanese CPTA Law and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.