Close-up 2: What comes after the panic over plastics?

What comes after the panic over plastics?

We analyze the changing environment around plastics brought about by greater environmental awareness - looking at the issue from the perspective of new government regulations, ESG investment trends and the actions of players in various industries, including materials manufacturing, consumer goods, retail and distribution and material recycling.

In addition, through comparative analysis of trends in Europe, the United States, China and Japan, we examine the directionality of market changes and the impact to be had on Japanese chemicals manufacturers.

Direction of EU-led regulatory and investment trends

Buffeted by a wave of public opinion - in particular among millennials and in the European Union - the marine debris issue has spawned a trend toward reduced use of plastic that in turn has led to stricter government regulations and the expansion of ESG investment. In terms of regulation, import restrictions have been introduced in China and other Asian countries that had traditionally accepted large volumes of plastic waste, while other countries have implemented “reduce and recycle” regulations. In addition, the shift toward globally expanding ESG (environmental, social and corporate governance) investment by institutional investors is expected to have a significant impact on the evaluation of plastic products and the manufacturers that produce them. In response to these trends, global consumer goods brands are beginning to move away from plastics.

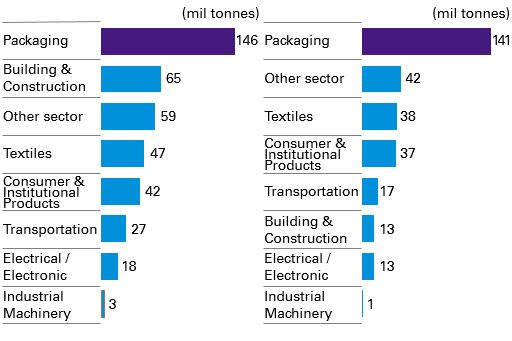

The result is that instead of focusing on more voluminous sources of plastic waste - i.e. packaging - attention is drawn to more familiar sources as early targets - such as plastic straws and bags - even though these items only account for a small percentage of total plastic waste produced. In any case, at least 127 countries are engaged in some form of policymaking seeking to reduce the use of plastic bags, and the greater movement to reduce plastic waste is gaining ground.

The details of these regulations indicate that discussions are progressing in the direction of strengthening efforts to recycle more effectively, in addition to simply promoting reduced use of specific materials. The EU is in the vanguard with targets for recycling recovery rates and inclusion rates for recycled materials. Since day one of the Trump administration, however, U.S. environmental policy has continued to regress, leaving the country completely out of touch with the mainstream. In addition to regulations on the acceptance of imported plastic waste, China is strengthening efforts to reduce the use of such materials, but there are concerns about their effectiveness. Japan enacted the Law for Promotion of Sorted Collection and Recycling of Containers and Packaging in 1995, and since then discussions have taken place at the G20 summit in Osaka and in anticipation of the 2020 Tokyo Olympics; but compared to the EU, its efforts have been lagging. Leadership in the fight to reduce the use of plastic and promote environmental regulations is firmly in the hands of the EU.

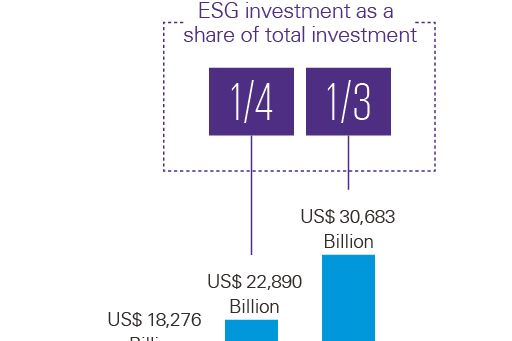

Meanwhile, the scale of ESG investment continues to expand worldwide. At the time of a GSIA survey in 2016, ESG investment was already worth 2,500 trillion yen, accounting for about one-quarter of total global investment; the latest survey, conducted in 2018, shows that in only two years this amount had increased by 34 percent to reach 3,400 trillion yen. Given such growth, ESG investment - which now accounts for as much as one-third of all global investment - is expected to continue along the same trajectory well into the future.

Global ESG investment

Source: “2018 Global Sustainable Investment Review”, GSIA

In Japan, the total amount of ESG investment is still small relative to the EU and U.S. but the average annual growth rate exceeds 300 percent and continues to rise.

In terms of ESG investment, the oil industry is already subject to negative screening. Under the influence of the marine debris problem and public opinion, plastics - which are derived from petroleum - are now recognized as probable targets for similar negative screening by ESG investors. The drive toward ESG investment by institutional investors is becoming such that not only are chemical and petroleum-producing companies no longer able to ignore their influence, but the same now holds true for all companies who simply use these chemicals and petroleum products for consumer goods, distribution, retail and so forth.

Industry change associated with trends for global consumer brands

Consumer goods manufacturers singled out by ESG institutional investors are pursuing efforts to reduce the use of virgin materials and improve recycling efforts ahead of pending regulations in various countries, setting high targets for the period between 2025 and 2030.

Global food and beverage major Nestle has set itself the goal of using only recycled or biodegradable containers by 2025 in addition to introducing PET bottles comprised of 35% recycled PET plastic (50% in the U.S. and Europe). The company has partnered with Veolia, a French transnational working toward the commercialization of chemical recycling; and has tied up with PureCycle Technologies, a U.S.-based recycling tech venture, to introduce standard-level production of recyclable materials in the food manufacturing industry. Other efforts by Nestle include plans to open a research institute dedicated to paper packaging and biodegradable plastics.

Adidas, a leading sports apparel company, has declared that by 2024 it will stop using virgin polyester, which currently accounts for fifty percent of the inputs used for its consumer products. Additionally, it intends to release a running shoe made from a single material in 2021.

Looking at the efforts of many other global consumer brands, the direction of industry change can be aggregated into the following four trends: 1) reduced use of petroleum-derived virgin materials; 2) adoption of biodegradable containers and recyclable materials; 3) promotion of investment in recycling technology and creation of recycling chains (both led by consumer goods manufacturers); and 4) creation of monomaterial products manufactured using only a single material to facilitate easily recyclable finished products.

Issues related to industry change

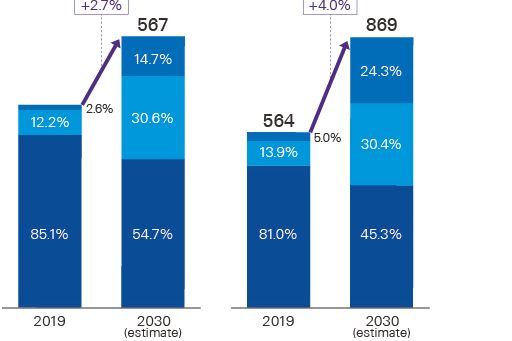

Here, I’d like to introduce data that refutes certain calculations that have been made based on some degree of assumption (please refer to the graph labeled “Global Market Outlook by Plastic Type”).

Global Market Outlook by Plastic Type

*“Bioplastic” is a generic term for biodegradable plastics and plant-derived plastics / Source: KPMG Research

Production:

By 2030, recycled plastics and bioplastics are expected to account for 45% of global plastic production and the production of petroleum-derived plastics could begin to decline.

Market scale:

Because recycled plastic and bioplastic are more expensive than petroleum-derived plastic, their value-based market share will be higher than their volume-based market share, with the former expected to account for 55% percent of the value-based market by 2030.

So far, we’ve reviewed the difficult business conditions surrounding the production and use of plastics, but in reality, the plastics market is expected to continue growing. The packaging sector - now also a target of sustainable manufacturing efforts - has few alternatives (such as paper) to turn to for sustainable packaging; this being the case, expectations are that the switch from virgin materials to bio-based materials and recyclable materials will continue to progress within the plastic industry.

However, the switch to bio-based and recyclable materials presents its own issues. Compared to virgin materials, bio-based and recyclable materials are characterized by lower quality, reduced functionality and higher costs. High-functionality plastics - such as the multilayer films used in food packaging - require many kinds of materials to be mixed together during the manufacturing process, making them difficult to recycle in accordance with mainstream material recycling efforts. Generally speaking, any field that requires highly functional materials faces a harsh reality: it is difficult to satisfy functionality requirements using only the currently available options for recyclable materials and bio-based plastics.

Meanwhile, easy-to-recycle monomaterials have yet to demonstrate a level of technical achievement that would allow them to satisfy industry requirements for quality and functionality.

Notwithstanding the existence of polyethylene terephthalate (PET), often referred to as “the star of recyclable materials,” huge barriers continue to impede the development of recyclable materials that can help business achieve industry targets.

How to overcome these challenges - Recommendations for Japanese chemicals manufacturers

The commercialization of chemical recycling is being looked at as a promising means by which to overcome some of these challenges. Chemical makers to date have made limited effort to use recyclable materials because doing so would reduce demand for virgin materials and because, as far as chemical recycling is concerned, it was not cost-effective. The end result has been a constraining effect on research and development and commercialization.

Contemporary recycling value chains are being led by consumer goods companies, who are endeavoring to build material and chemical recycling chains alongside recycling majors and technology ventures. Already, consolidation among major recycling businesses is progressing globally, and many advances are being made by tech ventures, which view changing business conditions through the lens of opportunity.

Under the current circumstances, some chemicals manufacturers may be looking at the opportunity to sell bioplastics, but the main goal is to build recycling value chains; and the role that the industry can play in building these value chains is great. In particular, they are expected to contribute to the construction of chemical recycling chains as solutions to future challenges. Through collaboration with consumer goods manufacturers and recycling companies, chemical manufacturers are expected to play a role in making way for mass production based on the technologies provided by technology ventures, and for commercialization of their own accumulated technologies which are still in the research and development phase.

Further expectations for the creation of recycling value chains include not only participation by individual companies in in initiatives led by major consumer goods manufacturers, but also collaborative efforts alongside major global chemical companies that allow Japanese companies to play a leading role in the construction of recycling frameworks worldwide. Substantial hurdles remain to be overcome, such as de facto bargaining, rulemaking and efforts to promote global cooperation (especially the paradigm-setting efforts of the EU), but the time to take big steps toward the fulfillment of these roles and expectations is right now.

Author

Kaoru Mano

Kaoru Mano assumed his current position in 2014, coming from a background in strategy consulting. Focusing mainly on the chemical and materials industries, Mr. Mano offers expertise in the restructuring of business portfolios, formulation of new business strategies, and provision of business execution support. He also has a wealth of experience supporting Japanese companies’ expansion into overseas markets by both organic and inorganic means. He values a consulting style that promotes clients’ organizational change by utilizing a combination of business strategy and M&As, and he does so with close attention to overall organizational alignment. He studied at the National Defense Academy, majoring in Mathematical Physics in the School of Science and Engineering, and also completed research at the Japan Advanced Institute of Science and Technology’s School of Knowledge Science.

© 2024 KPMG AZSA LLC, a limited liability audit corporation incorporated under the Japanese Certified Public Accountants Law and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. © 2024 KPMG Tax Corporation, a tax corporation incorporated under the Japanese CPTA Law and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.