In our latest CEO Outlook survey, most global CEOs named geopolitics and political uncertainty the top threats to organizational growth.

For several decades, businesses reacted to geopolitical changes instead of actively anticipating them. As geopolitical turbulence grows and alliances shift, leaders need to anticipate and respond proactively, rather than reactively, to geopolitical events.

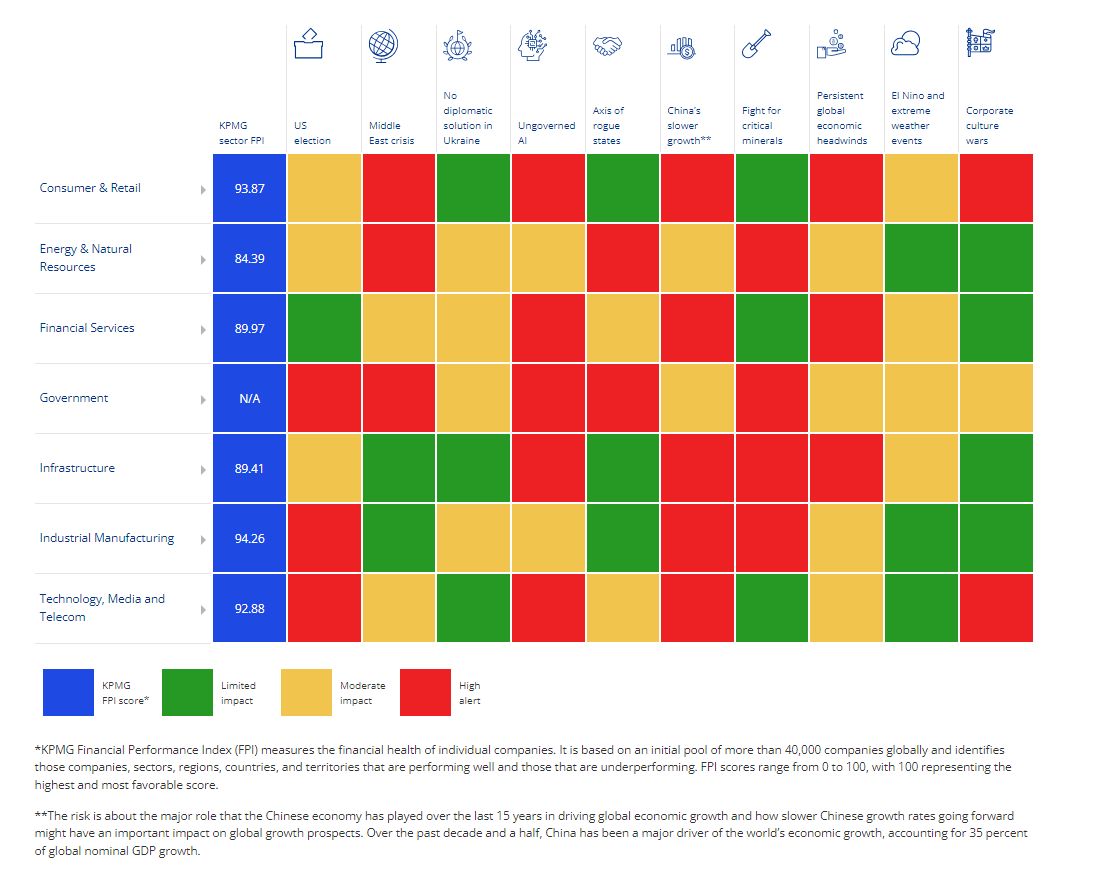

Eurasia Group releases a report each year forecasting potential geopolitical risks that may play out over the upcoming year. Our report assesses the relationship between these potential risks and broader geopolitical trends and their potential impact on global business.

Top risks

In our report analysis, we have identified three critical trends for businesses, which we call 'bottom lines':

|

KPMG |

US |

Middle |

No |

Ungoverned AI |

Axis of |

China’s |

Fight for critical minerals |

Persistent global economic headwinds |

El Nino and extreme weather events |

Corporate culture |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Energy & Natural Resources |

84.39 | ||||||||||

| Financial Services | 89.97 | ||||||||||

| Government | N/A | ||||||||||

| Infrastructure | 89.41 | ||||||||||

| Industrial Manufacturing | 94.26 | ||||||||||

| Technology, Media and Telecom |

92.88 | ||||||||||

| Consumer & Retail | 93.87 |

| KPMG FPI score* |

Limited impact |

Moderate impact |

High alert |

*KPMG Financial Performance Index (FPI) measures the financial health of individual companies. It is based on an initial pool of more than 40,000 companies globally and identifies those companies, sectors, regions, countries, and territories that are performing well and those that are underperforming. FPI scores range from 0 to 100, with 100 representing the highest and most favorable score.

**The risk is about the major role that the Chinese economy has played over the last 15 years in driving global economic growth and how slower Chinese growth rates going forward might have an important impact on global growth prospects. Over the past decade and a half, China has been a major driver of the world’s economic growth, accounting for 35 percent of global nominal GDP growth.

What can business leaders do?

The world has become a much more geopolitically complex place, and these complexities are only expected to grow. Business leaders need to focus on building strategies and frameworks that take their geopolitical response from reactive to proactive, including developing holistic geopolitical risk management approaches.

There are five steps business leaders can start to take today:

- Use dynamic risk assessment to prioritize and quantify risk

Geopolitical risks rarely exist in isolation. It is crucial for companies to consider the interconnectedness of risks within their operations, supply chains and broader ecosystem. - Visualize your supply chain exposure

Supply chains are now influenced by a trade policy that forces businesses toward

new trading partners at a time when cyber and geopolitical exposure are increasing. Mitigating these risks requires a multifaceted approach. - Integrate trusted AI into your business

Companies need to harness the power of AI and accelerate thoughtful adoption while recognizing the potential risks. AI strategies should be firmly rooted in ethical conduct and responsible practices. - Drive sustainable innovation to prevent disruptive regulation

In today’s increasingly disruptive world of climate disasters, political conflict and societal inequalities, rapid ESG progress is crucial to achieving a more sustainable future. Leaders can use the power of ESG to transform their businesses. - Develop a comprehensive public engagement strategy

Business leaders are increasingly pressured to take public positions on social and political issues such as polarizing conflicts, gender issues and net zero targets. Companies need a framework to decide when and how to communicate publicly on social and political issues.

Connect with us

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia