Goods and Services Tax (GST) is one the most important tax reforms of modern India, and is scheduled come into effect from 1 July 2017. The reform is expected to have a far-reaching impact on all businesses, including trading, manufacturing and services. GST is set to change the landscape of tax compliance significantly, and will require customised technology to help ensure timely, complete and accurate reporting of transactions.

Business and finance heads require a robust solution that would function on multiple devices and provide reports that can be customised to their respective organisations.

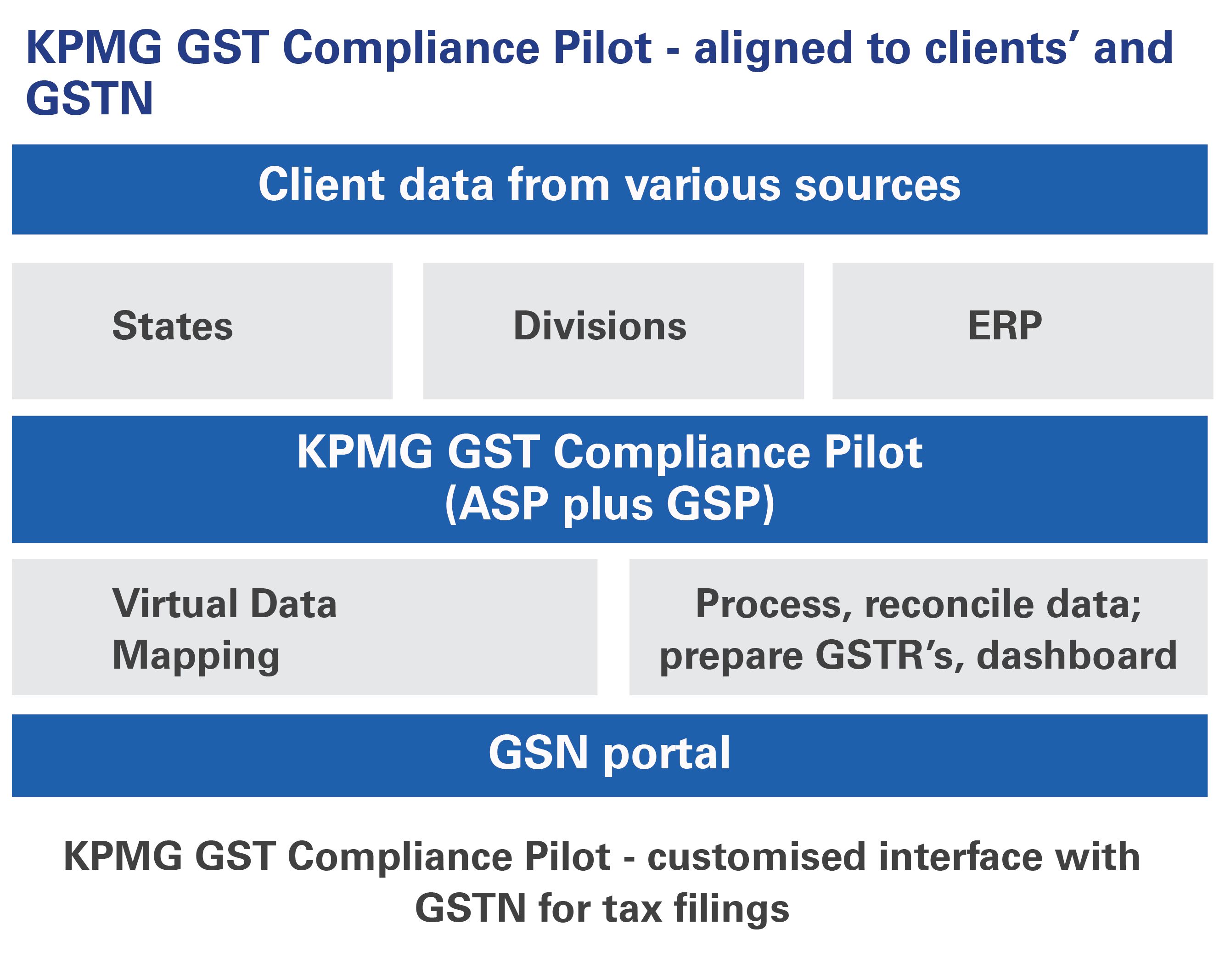

The KPMG GST Compliance Pilot delivers advanced data analytics, which provides various business insights through its dashboard and highlights abnormal trends. Our solution has top notch and robustly tested security features to help safeguard valuable data.

GST compliance – The new normal

Key aspects of compliances in the GST regime

- Transaction reporting of purchase and sales data, at invoice and HSN

- Multiple filings every month, every state

- Credits available, based on matching of purchase data with sales data filed by vendors in the GSTN portal

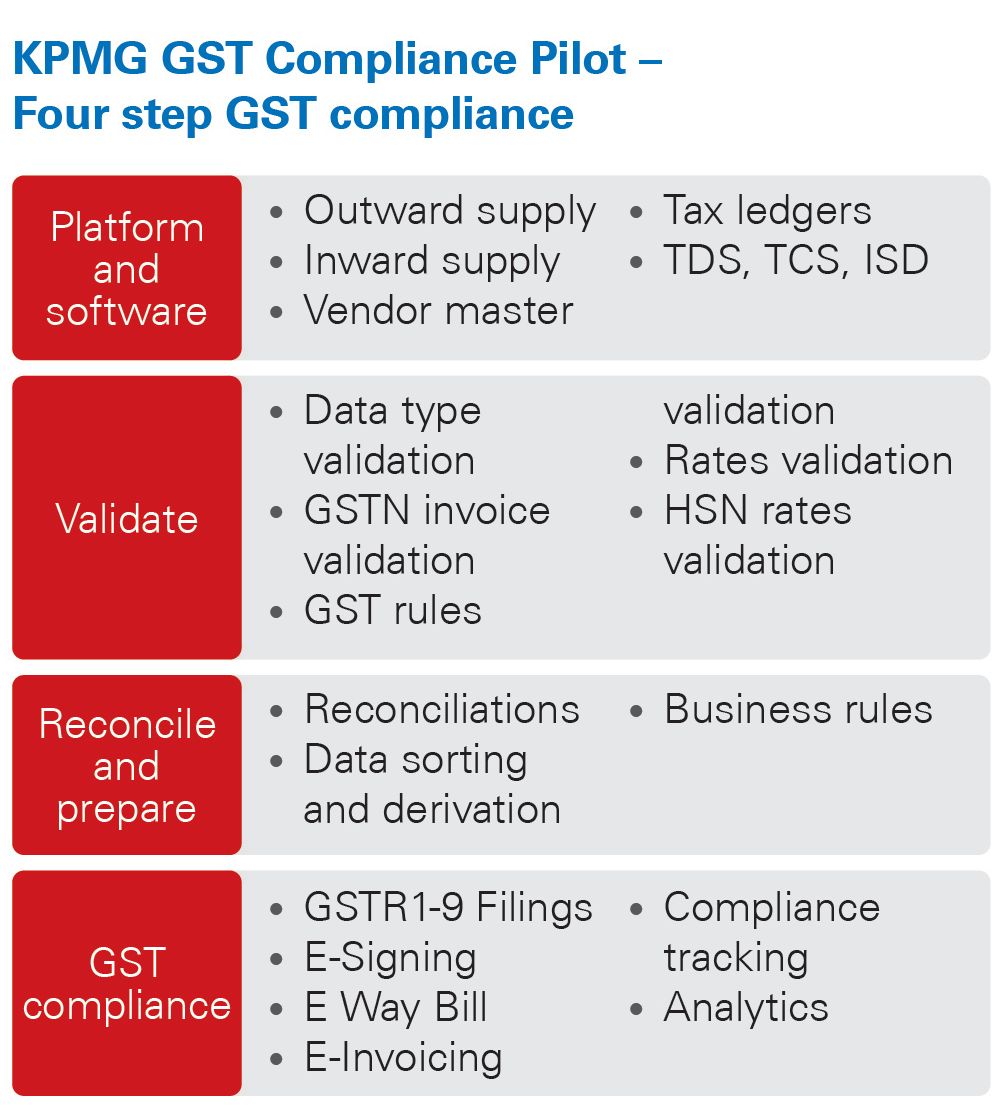

- Need for robust technology and strong tax technical team to: Evaluate tax positions and provide pragmatic business advice

— Increase input credits and improve working capital efficiency

— File returns on a timely basis with accurate and complete reporting of transactions

— Create seamless GSTN interface for large data volumes

— Be flexible and capable of change management – to deal with uncertainties surrounding evolving laws

— Will help in generating e-invoices and e-way bill, in near real time, without any manual intervention

— Assist in meeting your requirements for the e-invoicing system and in integrating the same with the GST return filing system, especially in light of the new return filing system that is proposed to be introduced from April 2020.