Introduction

Banks are currently required to follow the Master Direction - Classification, Valuation and Operation of Investment Portfolio of Commercial Banks (Directions), 2021 (2021 regulations) for the classification and valuation of their investment portfolio. The 2021 regulations are largely based on a framework introduced in October 2000. It is based on the then prevailing global standards and best practices.

With significant developments in the global standards on classification, measurement and valuation of investments (i.e. the International Financial Reporting Standards (IFRS)), the linkages with the capital adequacy framework as well as progress in the domestic financial markets, there was a need to review and update the 2021 regulations.

Accordingly, on 12 September 2023, the Reserve Bank of India (RBI) issued revised regulatory guidelines on investment classification and valuation- the Master Directions – Classification, Valuation and Operations of Investment Portfolio of Commercial Banks (Directions), 2023 (2023 guidelines).

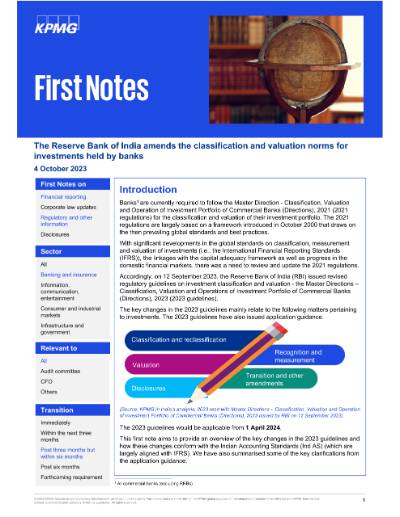

The key changes in the 2023 guidelines mainly relate to the matters mentioned below. The 2023 guidelines have also issued application guidance for ease of implementation.

The 2023 guidelines would be applicable from 1 April 2024.

Classification of investments

The investment portfolio would be categorised into three categories – Held to Maturity (HTM), Available for Sale (AFS) and Fair Value through Profit and Loss (FVTPL). Held for Trading (HFT) would be a separate investment subcategory within FVTPL, aligned with the specifications of ‘Trading Book’ as per the Basel III framework. The 2023 guidelines have done away with the maximum period within which investments in the HFT category need to be sold.

The 2023 guidelines have also revised the classification for investments in subsidiaries, associates and joint ventures.

Initial recognition

All investments should be measured at fair value on initial recognition. Unless facts and circumstances suggest that the fair value is materially different from the acquisition cost, it must be presumed that in most cases, the acquisition cost is the fair value. As per the 2021 regulations, investments are initially recognised at acquisition cost.

Subsequent measurement

The 2023 guidelines state that:

- The securities held under HTM should be carried at cost and not be Marked to Market (MTM) after initial recognition

- The securities held under AFS should be fair valued at least on a quarterly basis, if not more frequently

- Securities that are classified under the HFT sub-category within FVTPL should be fair valued on a daily basis, whereas other securities in FVTPL need to be fair valued at least on a quarterly basis, if not more frequently

- Investments in subsidiaries, associates and joint ventures should be held at acquisition cost.

Investments in HTM

Currently, the 2021 regulations place a ceiling on investments in HTM as a percentage to total investments. There is also a ceiling on Statutory Liquidity Ratio (SLR) securities that can be held in HTM. These ceilings have been dispensed with. However, the controls for sales out of HTM have been tightened to ensure that the basic principles for classification of securities as HTM are not invalidated. Accordingly, any sale from HTM needs to be made in accordance with the bank’s board approved policy, and the details need to be disclosed in the notes to accounts.

Reclassification between categories

After transitioning to the revised regulatory framework, banks should not reclassify investments between categories (i.e., HTM, AFS and FVTPL ) without the approval of the Board of Directors and RBI. At the time of transition, banks would be allowed a one-time option to re-classify their investments and adjust the gains/losses arising on such reclassification.

Valuation

To increase the consistency and comparability in fair value measurements and related disclosures, the 2023 guidelines have prescribed that the investment portfolio be bifurcated into three fair value hierarchies- Level 1, Level 2 and Level 3. Disclosures pertaining to fair valuation has also been prescribed.

Investment reserve account

The need to maintain an investment Reserve Account (IRA) would be dispensed with. The balance in IRA, if any, as on 31 March 2024, should be transferred to the revenue/general reserve, provided the bank meets the minimum regulatory requirements of Investment Fluctuation Reserve (IFR). If the bank does not meet the minimum IFR requirements, the balances in IRA should get transferred to IFR. The need to maintain IFR continues.

Enhanced disclosures

The 2023 guidelines have prescribed robust disclosures which would be required to be made in the financial statements for the year ending 31 March 2025. The disclosures pertaining to fair value hierarchy would be required to be made in the financial statements for the year ending 31 March 2026 and onwards.

In this issue of the First Notes, we have provided an overview of the key changes in the 2023 guidelines and how these changes conform with the Indian Accounting Standards (Ind AS) (which are largely aligned with IFRS). We have also summarised some of the key clarifications from the application guidance.

To access the text of the RBI announcement, please click here

You can reach us for feedback and questions at aaupdate@kpmg.com.