Introduction

In May 2021, the Securities Exchange Board of India (SEBI) introduced Business Responsibility and Sustainability Reporting (BRSR) which requires top 1,000 listed entities (by market capitalisation) to file BRSR as part of the Annual Report with SEBI from FY 2022-23 onwards. BRSR consists of disclosures which require these listed entities to report on their performance against the nine principles as per ‘National Guidelines on Responsible Business Conduct’ (NGBRCs).

Given the growing importance of ESG disclosures for investors and other stakeholders, there was a need for entities to obtain assurance on the ESG disclosures. In February 2023, SEBI issued a consultation paper proposing a regulatory framework for enhancing the ESG disclosures which consisted of applicability of BRSR Core, disclosures for value chain and specifications on assurance, including a glide path.

Subsequently, on 29 March 2023, SEBI approved these proposals with respect to BRSR Core, value chain disclosures, and assurance thereof in a phased manner.

New development

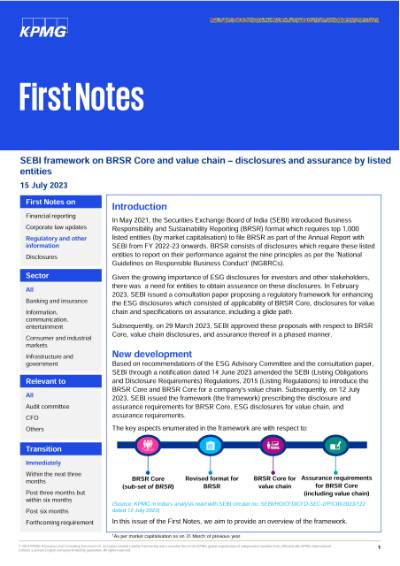

Based on recommendations of the ESG Advisory Committee and the consultation paper, SEBI through a notification dated 14 June 2023 amended the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (Listing Regulations) to introduce the BRSR Core and BRSR Core for company’s value chain. Subsequently, on 12 July 2023, SEBI issued a framework (the framework) prescribing the disclosure and assurance requirements for BRSR core, ESG disclosures for value chain and assurance requirements.

The key aspects in the framework are with respect to:

- BRSR Core

- Revised format for BRSR

- Assurance requirements for BRSR Core and value chain

In this issue of the First Notes, we aim to provide an overview of the framework.

To access the text of the amendment to the Listing Regulations, please click here.

To access the text of the framework issued by SEBI, please click here.

You can reach us for feedback and questions at aaupdate@kpmg.com.