The impact of the restriction on reliefs

In the past, a “do nothing” approach may have been the default option as no IHT may have been paid on death on agricultural and business assets, and such assets are inherited with a tax-free value uplift for the heirs.

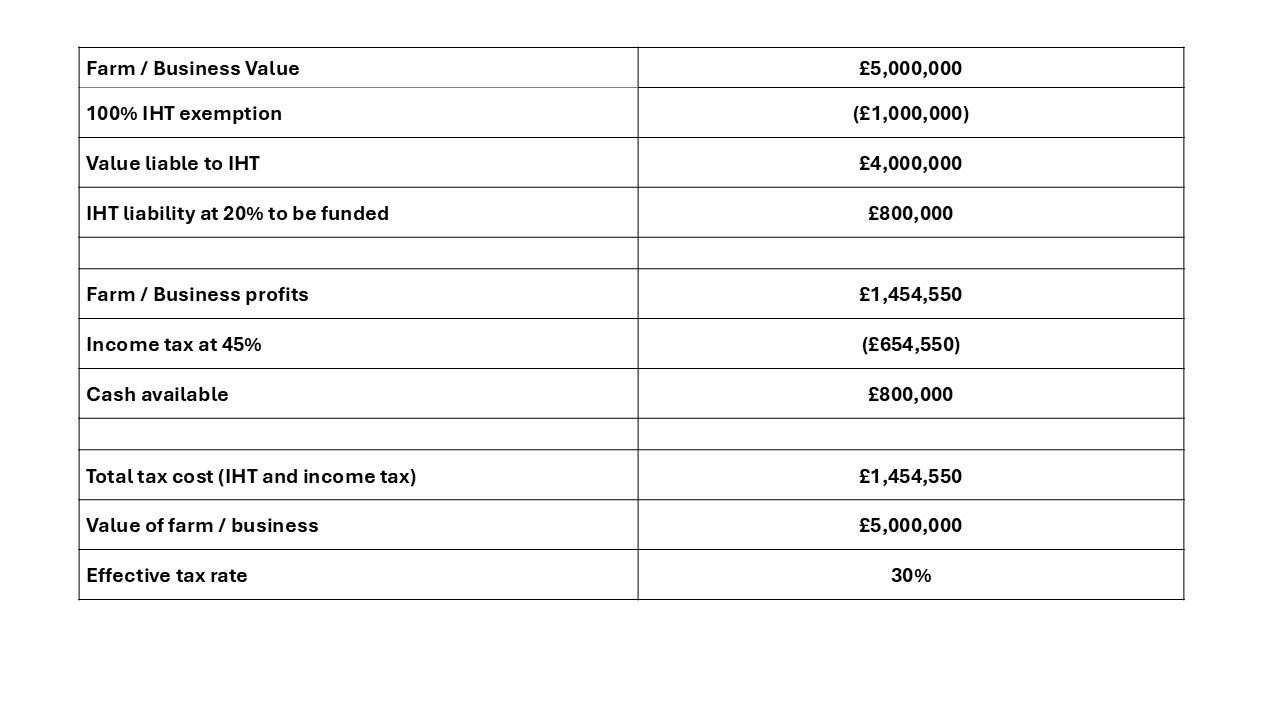

However, from 6 April 2026, the government will introduce a £1 million cap on the assets eligible for IHT relief. For any value above the £1 million cap, an effective IHT tax rate of 20% will apply. This is half of the standard 40% IHT rate which applies to assets which do not qualify for any IHT exemptions.

The impact of the restriction on reliefs is that, for the first time, farmers and business owners may be exposed to and have to fund an IHT liability. In order to pay an IHT bill assets may have to be sold or an IHT payment fund will have to be set aside. Where inherited assets are not sold by the beneficiaries, other tax costs may arise which means that the overall tax rate may be significantly in excess of the 20% headline rate. This is likely to have a significant impact on the business, especially from a cash flow perspective. The table below provides a simplified illustration of the potential impact: