Irish consumers are preparing for a more challenging Christmas this year, reflecting ongoing economic uncertainties.

The latest KPMG Next Gen Retail Survey reveals that 77 percent of Irish shoppers expect Christmas shopping to be significantly more expensive this year, compared to 72 percent in 2024.

While two in five (40 percent) plan to spend less compared to last Christmas, this marks an increase in cautious spending habits.

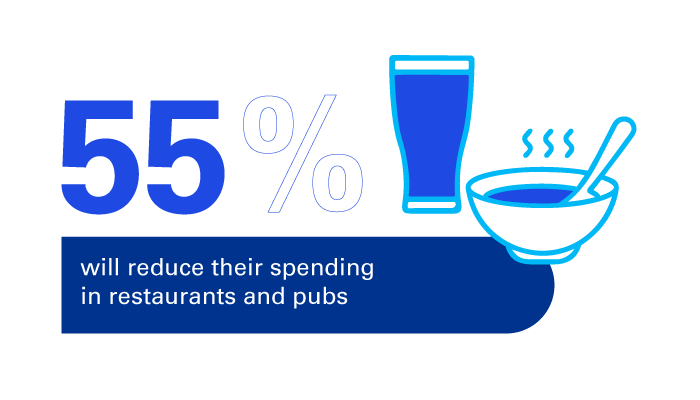

Price is still the primary factor influencing consumers when choosing where to shop, with 56 percent ranking it as a crucial consideration. Quality follows as the second most important driver, with 17 percent prioritising it when selecting a retailer.

Additionally, individuals aged 35 to 54 are particularly inclined to rank finding the best price in their shopping decisions.