The next five years – the trends that matter

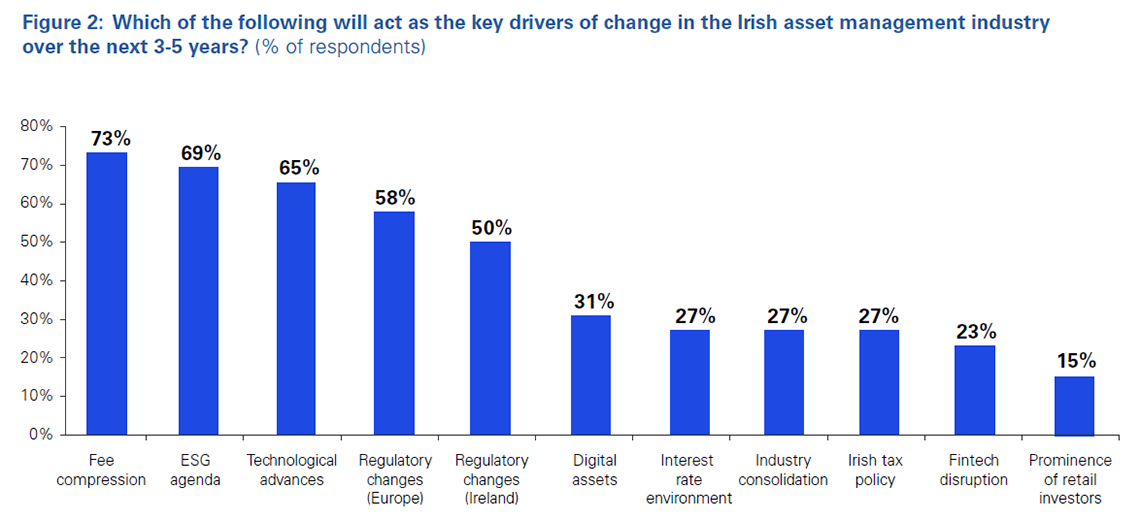

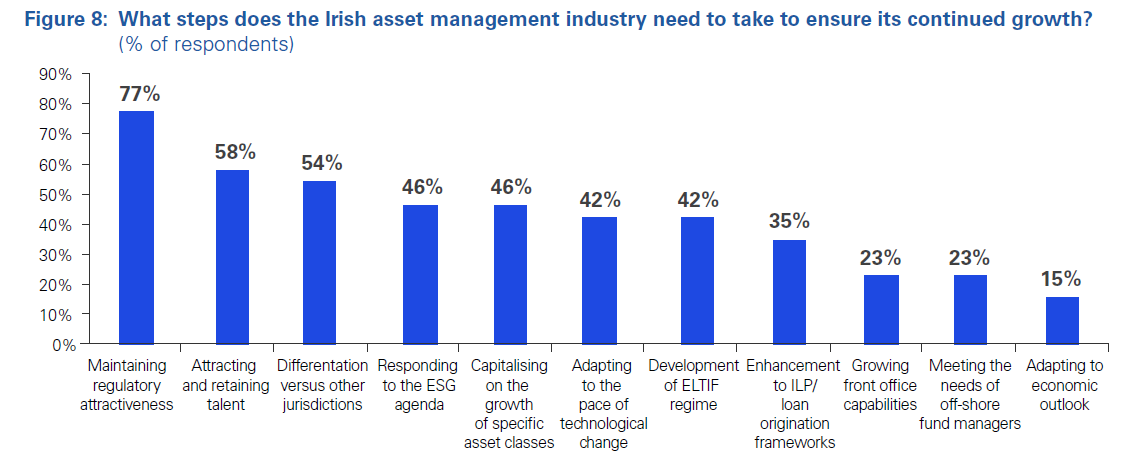

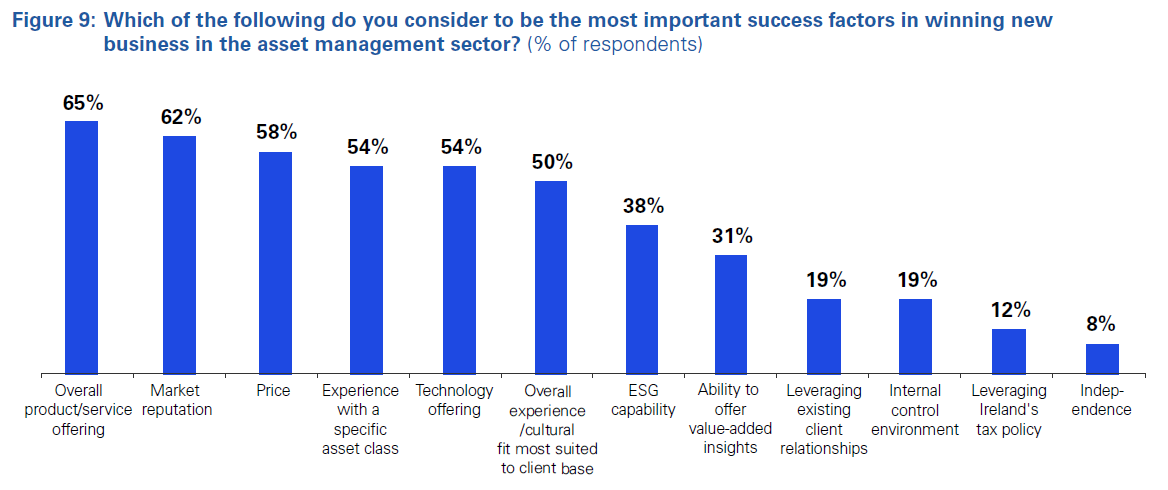

As always, the industry is evolving rapidly in response to an array of technological, commercial, and regulatory trends. To drill into these pressures and forecast the industry’s response, KPMG has performed extensive research via surveys and conversations with leading sector players. The following themes emerge clearly:

Substance: in the post-Brexit shakeup, the rise of third party mancos continues unabated as costs and regulatory pressure make it less viable to run self-managed funds, particularly for smaller managers. The substance requirements of these third party mancos continues to increase as regulators aim to avoid “letterbox entities” of a small number of local employees.

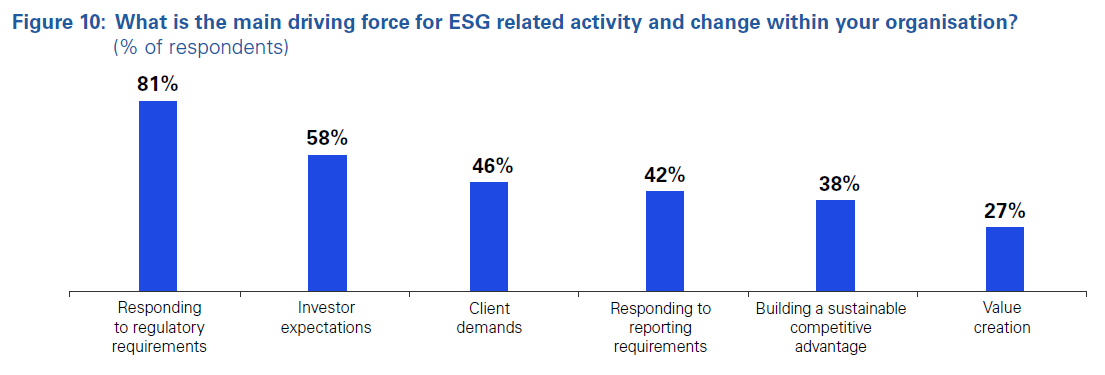

ESG: investor and regulator demands for ESG action are growing, imposing a significant burden on asset managers and third party servicers to respond via capital allocation, innovation, reorganisation, training, data gathering, personnel hiring, and reporting.

Costs: a huge majority of players across the asset management value chain are deeply concerned about cost pressures, particularly in the context of cross-sector fee compression and rapid interest rate rises.

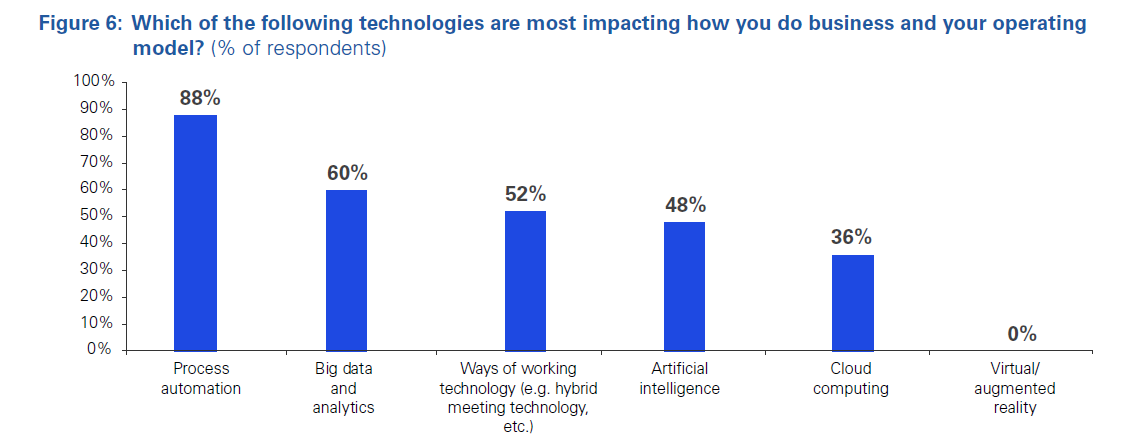

Technology: recent hype around AI is forcing widespread reflection on its likely industry impacts. At the same time, the sector is relying on automation to cut costs and still has a significant task to update a sprawling legacy tech stack to meet investor, client, and regulator expectations.

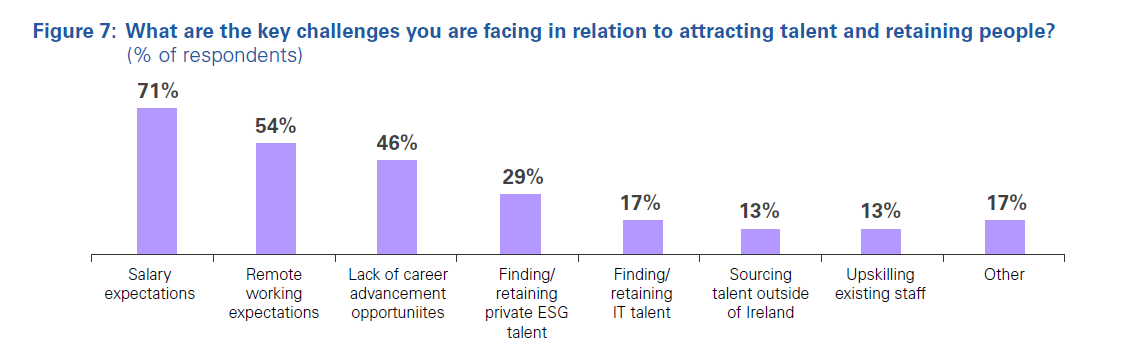

Talent: despite Ireland’s strong position as a talent hub and the welcome tailwind provided by Brexit, a clear majority in the industry see attracting and retaining talent as a challenge.

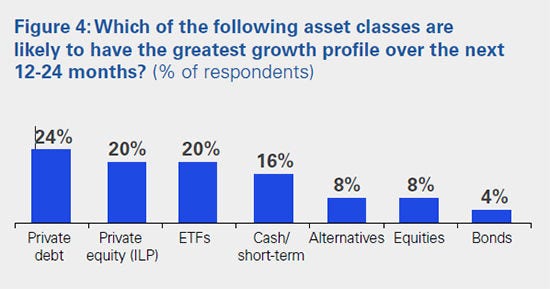

Product mix: the rise of alternatives is expected to continue as asset managers seek to diversify their portfolios and develop strategies that for the most part cannot be replicated by passive vehicles. This will also lead to an expected opening up of access to these investments to retail investors.