Market deals

2025 outlook

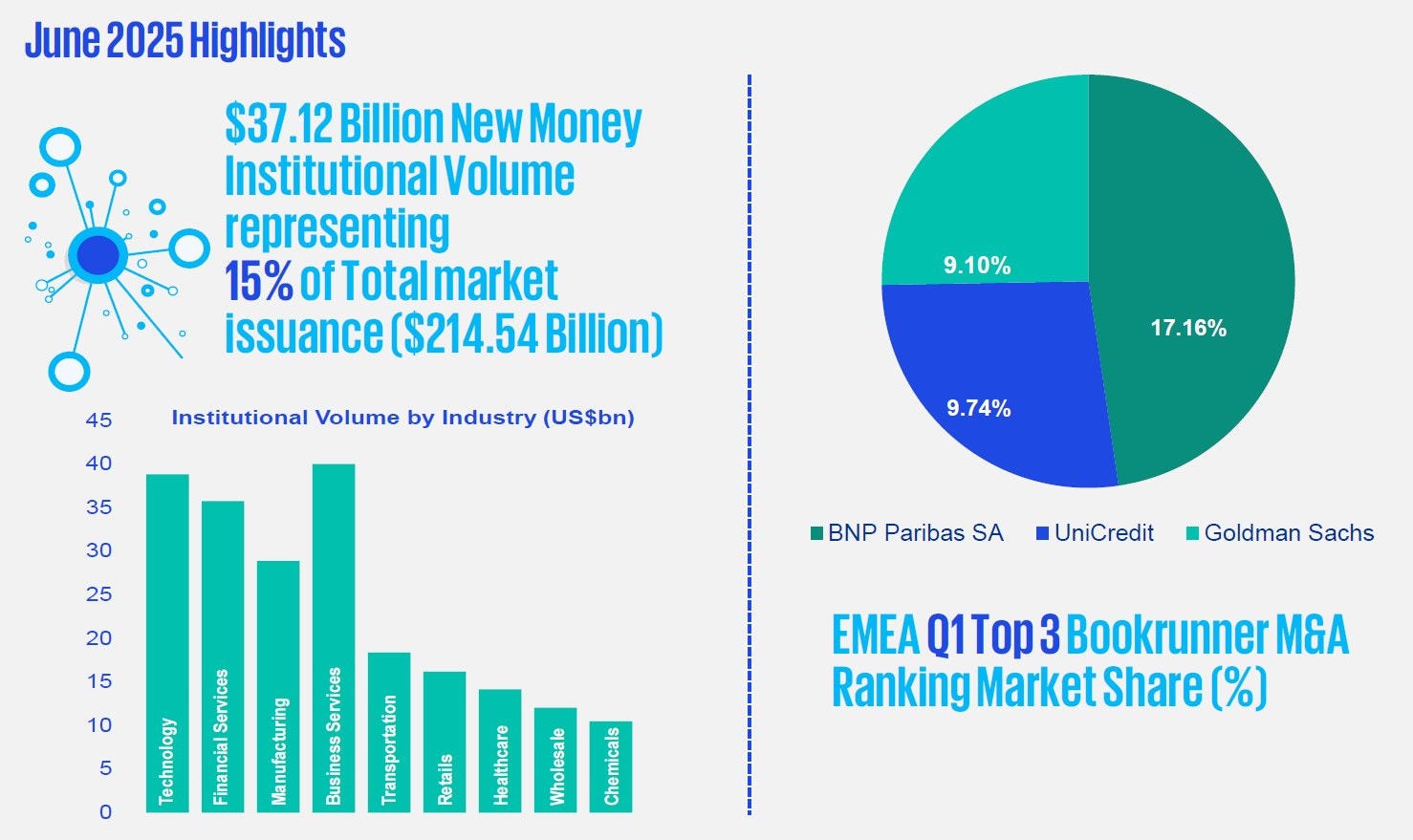

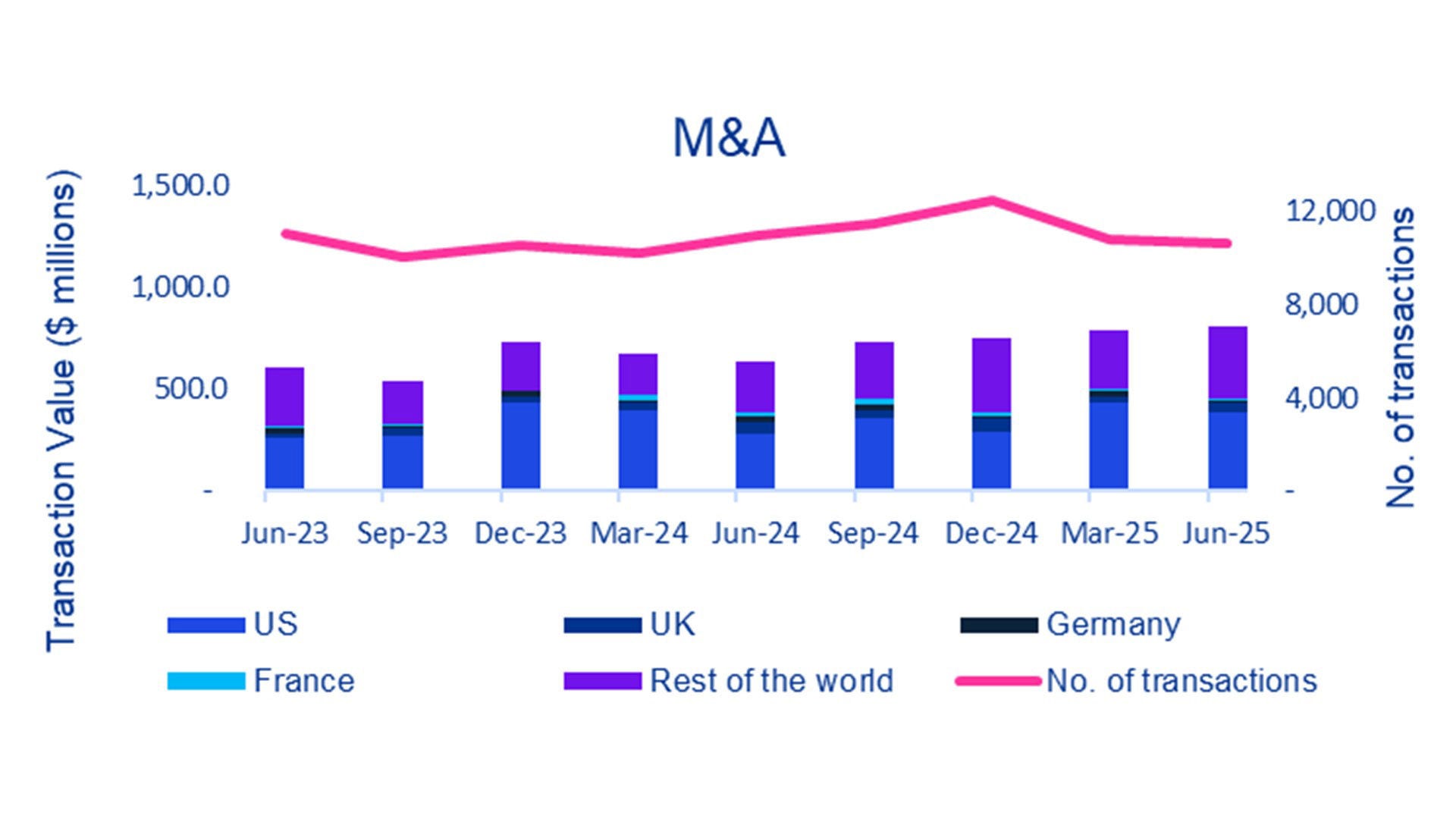

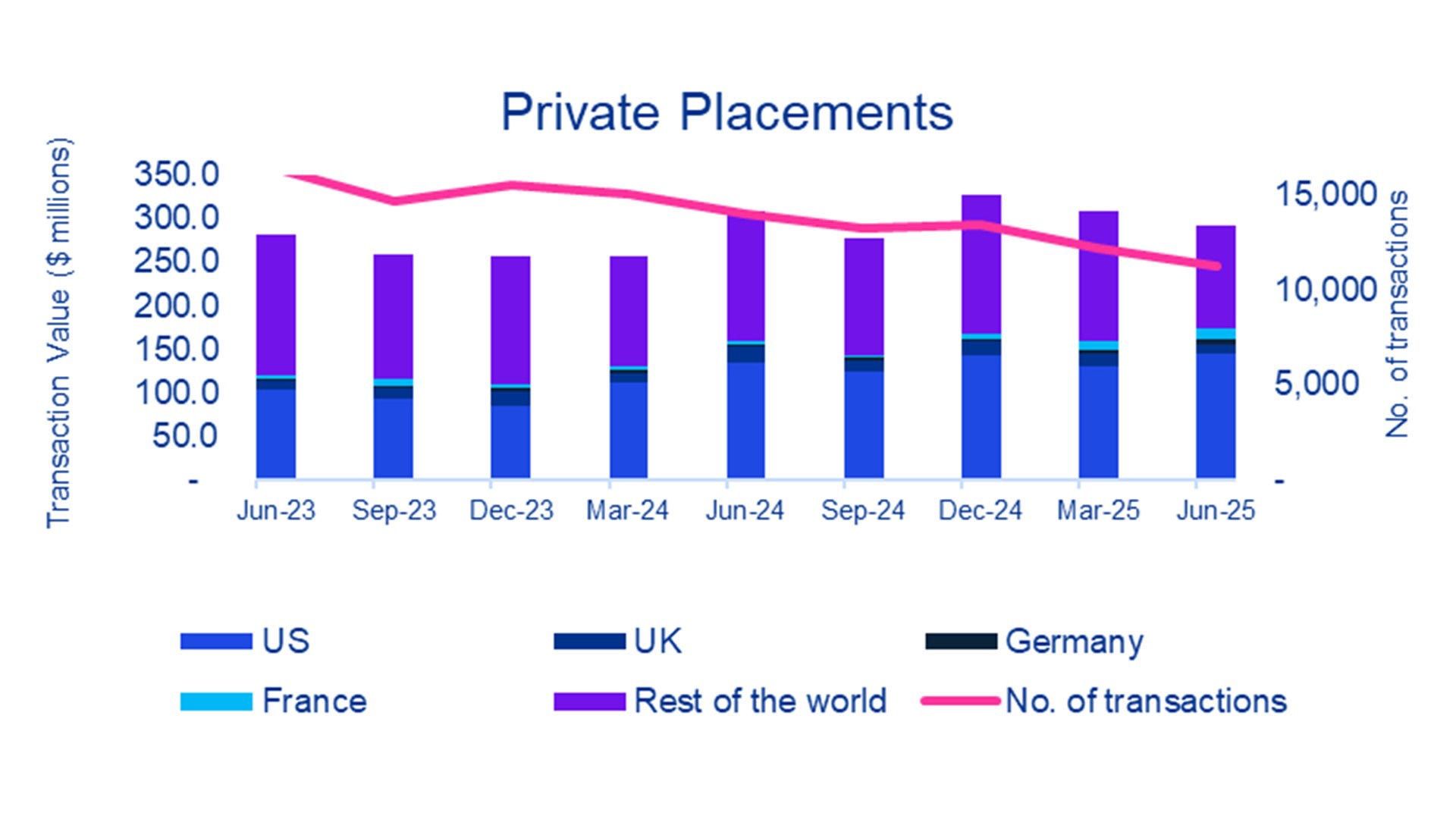

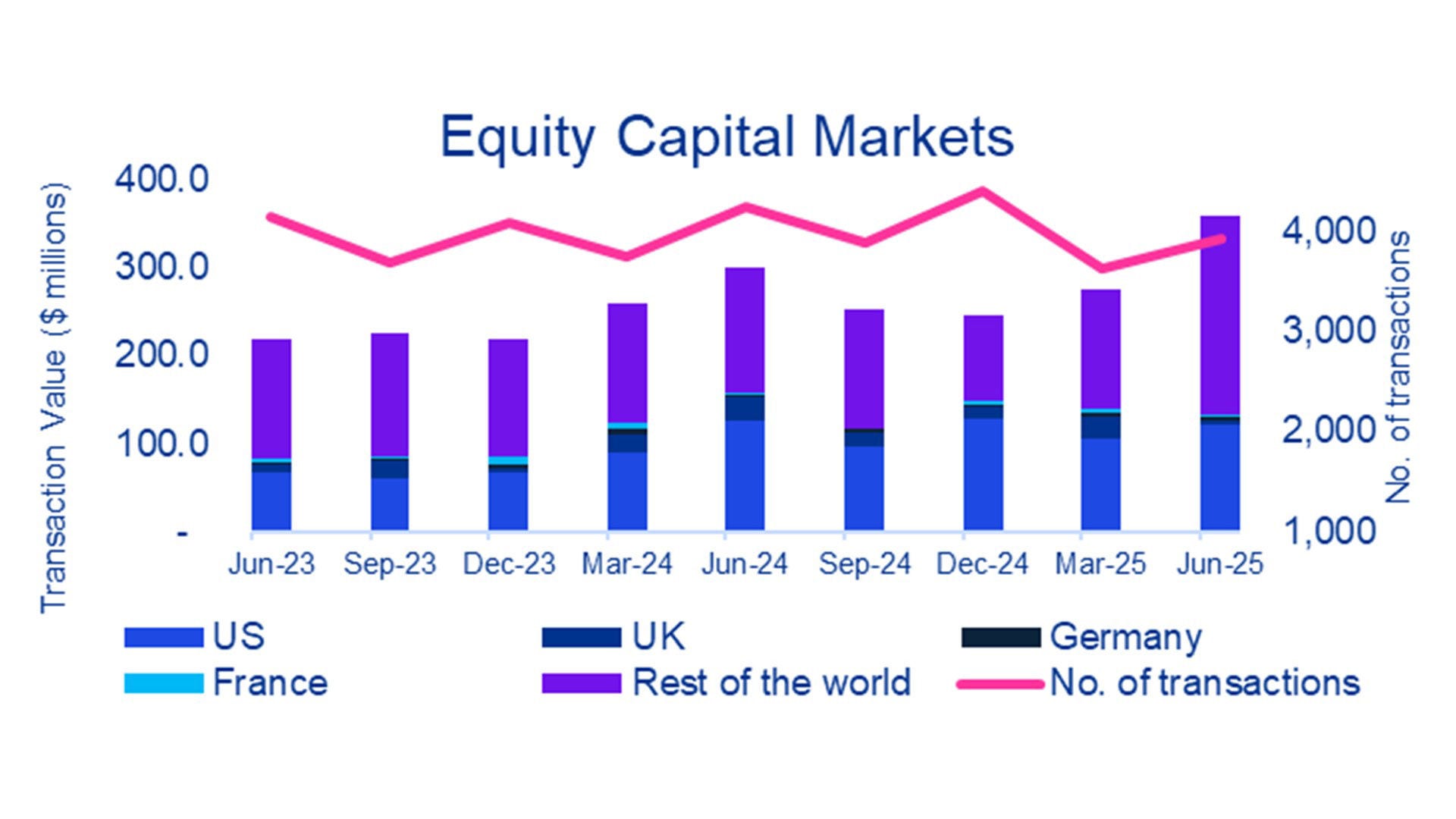

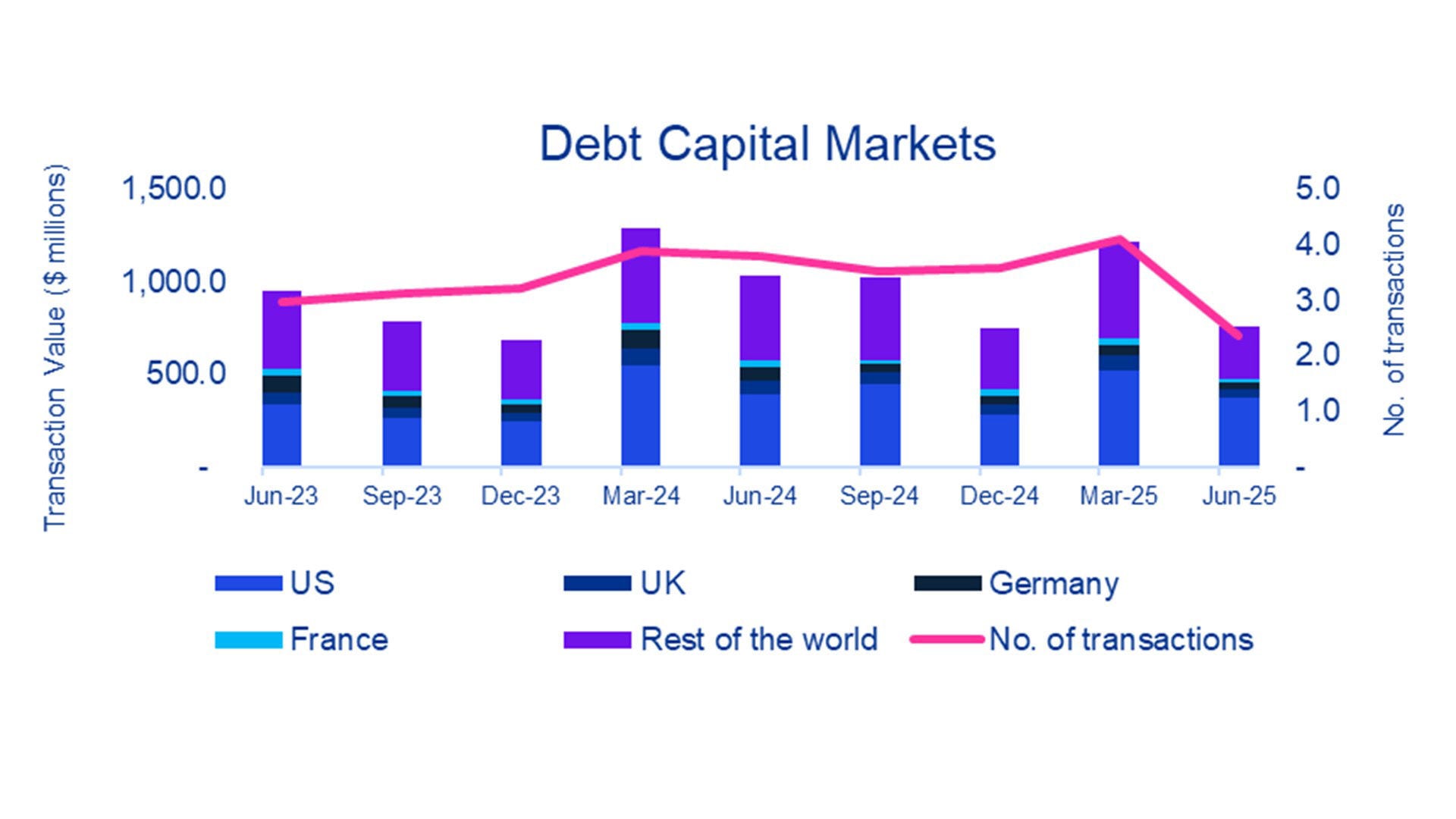

Despite the introduction of tariffs and broader macroeconomic shifts, companies continue to pursue M&A, Equity Capital Markets (ECM) and Private Placements whereas the Debt Capital Markets (DCM) witnessed a significant decline both in volume and transaction value.

M&A volume declined slightly while transaction value particularly in M&A increased from Q1 2025 to Q2 2025. It signals a shift toward fewer but higher value transactions. This reflects a broader pivot from expansion to resilience, with firms prioritizing strategic consolidation and long-term positioning.

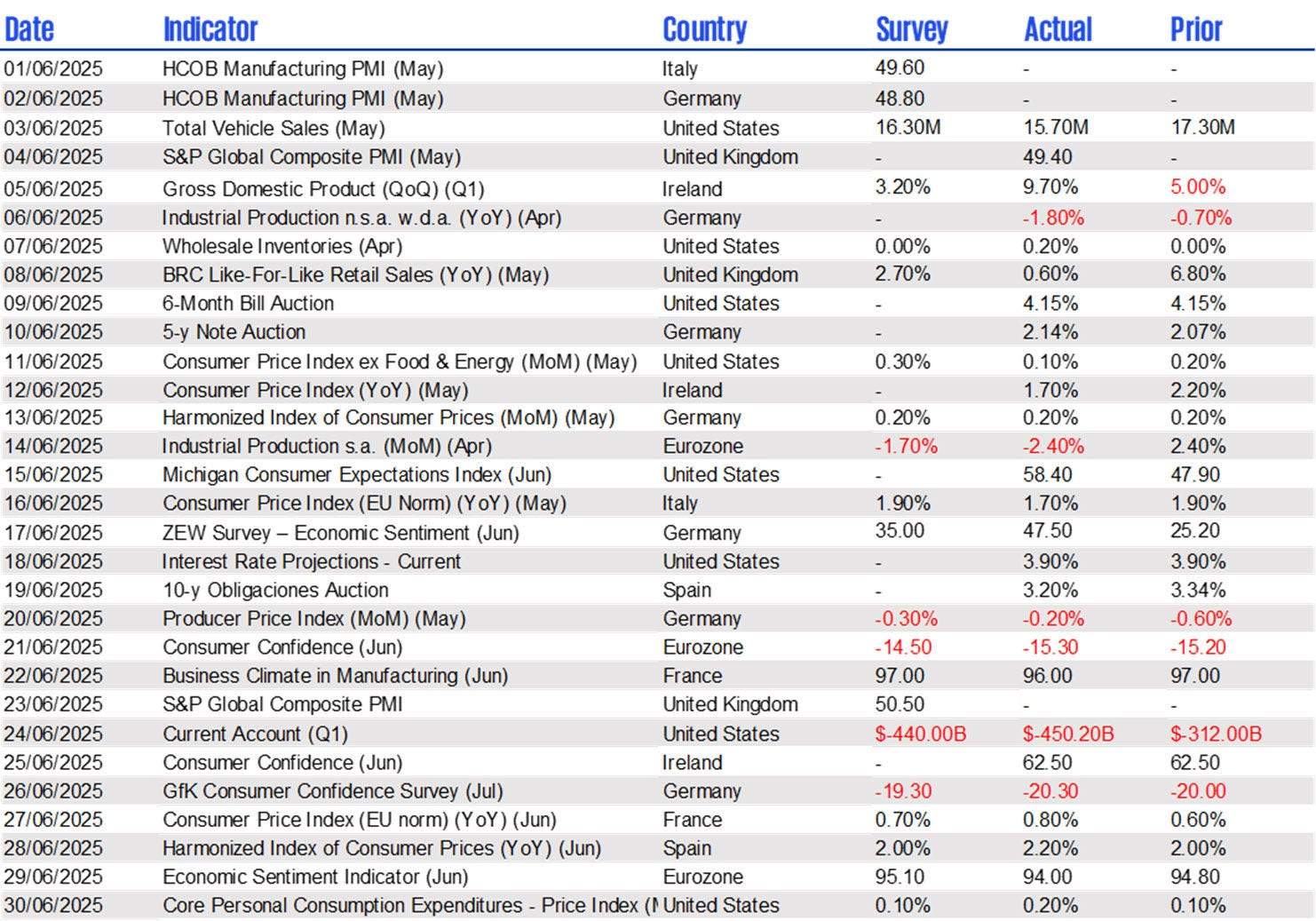

The United States led in transaction values across all categories, while the UK, Europe, and other regions showed varied but significant participation. According to the IMF’s April 2025 World Economic Outlook, global growth remained moderate and uneven, shaped by tight monetary conditions, geopolitical uncertainty, and structural shifts in capital allocation.

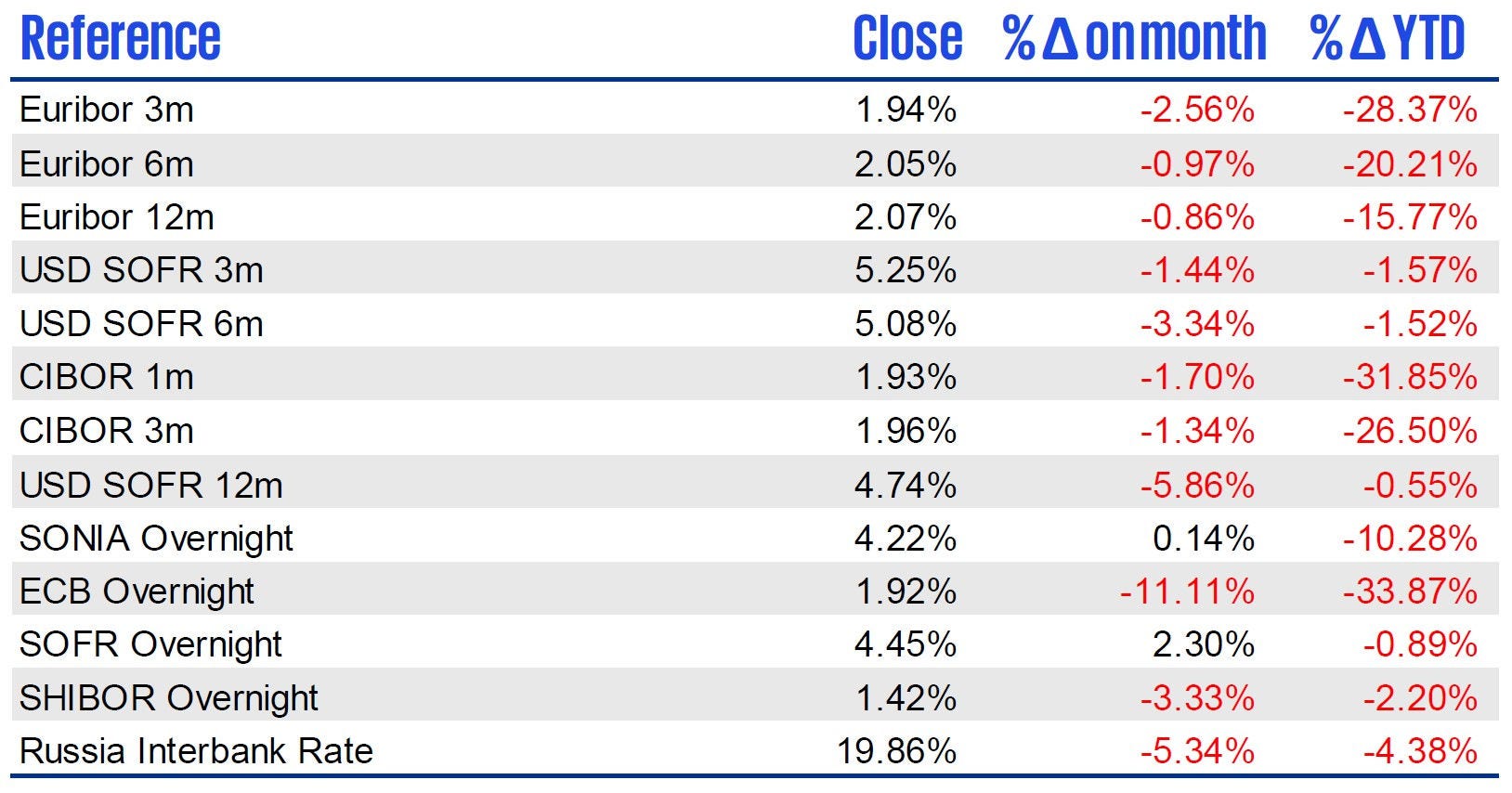

Executives are becoming more adept at navigating volatility, supported by stronger balance sheets, leaner operations, and enhanced resilience. This enables a sustained, strategic approach to M&A, even amid elevated U.S. interest rates, ongoing ECB rate cuts, and persistent regulatory scrutiny.

Meanwhile, firms must also adapt to rapid technological change particularly from generative AI while balancing capital allocation across emerging priorities.

United States

The United States remained the undisputed leader in global deal activity across mergers and acquisitions (M&A), private placements, and debt capital markets (DCMs). It consistently accounted for approximately half of global transaction values in each of these categories.

A decline in M&A activity was observed in the U.S. in the second quarter of 2025 compared to the first quarter. Market activity continues to reflect a strong appetite for strategic consolidation, particularly in sectors such as technology and energy.

Equity and debt markets also experienced robust issuance, supported by stable investor sentiment and refinancing needs.

United Kingdom & Europe

The United Kingdom demonstrated strong momentum, particularly in mergers and acquisitions (M&A), with a significant increase observed in the second quarter of 2025 compared to the first quarter.

Germany and France contributed steadily to overall activity, albeit on a smaller scale. Across Europe, deal activity especially in private placements and debt issuance reflected a cautious yet strategic approach to capital raising.

Rest of the World

Emerging and non-traditional markets played a resilient and increasingly important role. The Rest of the World consistently contributed between 20% and 40% of global deal values, particularly in mergers and acquisitions (M&A), private placements, and equity capital markets (ECMs).

Although overall deal volumes remained modest, the region reported steady growth in M&A and ECM activity, indicating rising investor interest. Private placements, however, continued a trend of modest decline in transaction value that began in the fourth quarter of 2024.