The rules

The rules, which are complex, are in force in Ireland for in-scope entities with fiscal years beginning on or after 31 December 2023.

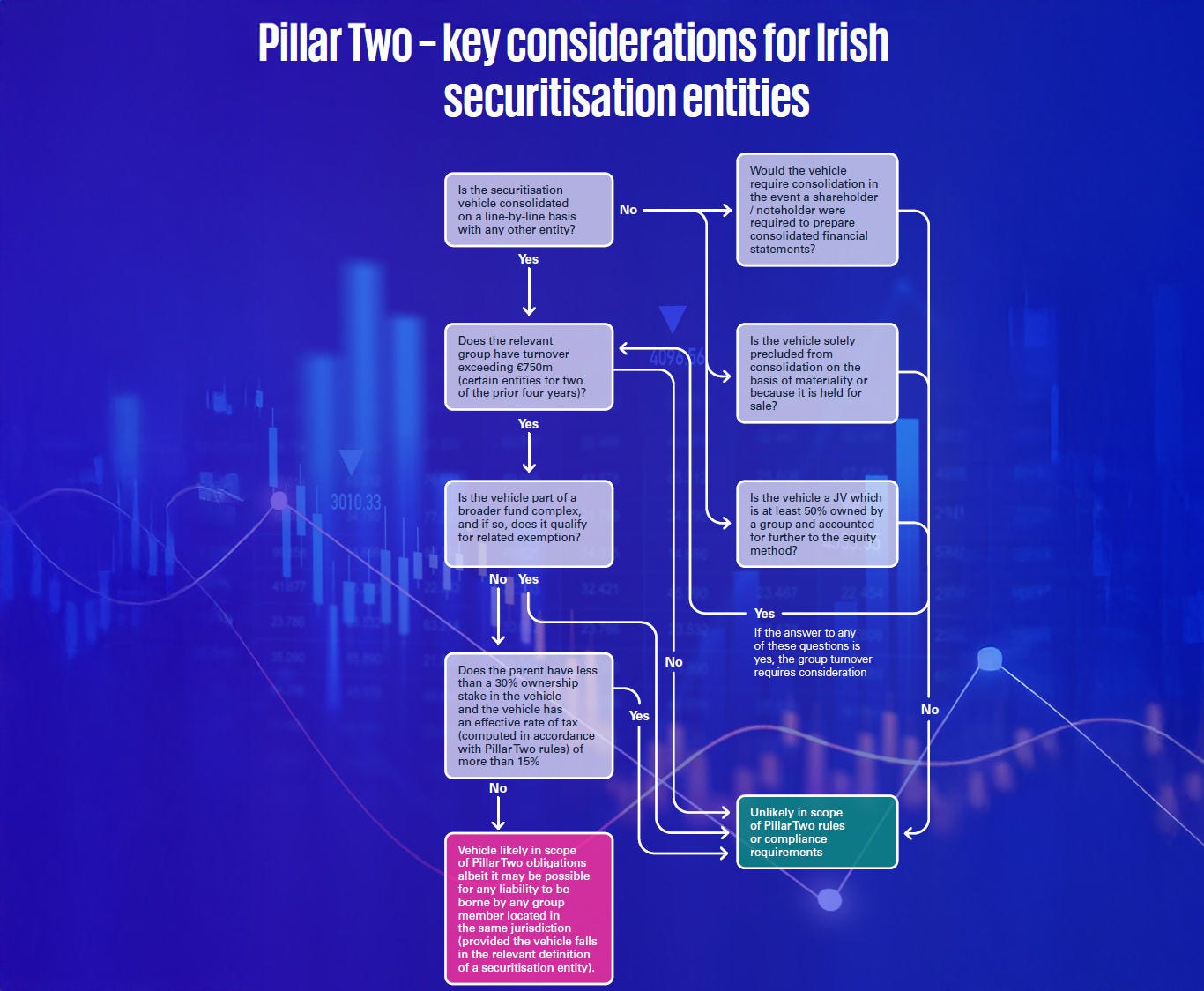

An Irish tax resident entity should only potentially be in scope of the rules (i.e. ignoring any specific exemptions that might apply) where it is part of a multi-national (MNE) group or a domestic group which has consolidated revenue exceeding €750m for at least two of the preceding four fiscal years.

The two key starting points in assessing whether a securitisation entity is in scope are to determine:

- Is the entity part of an MNE group or domestic group? and

- If so, does the group exceed the consolidated revenue threshold?

To be part of an MNE or domestic group an entity must generally be consolidated on a line-byline basis. Many securitisation entities are legally established as orphan vehicles meaning that the expectation might be that they are not consolidated into any other entity.

That said, there are circumstances where consolidation could be required, such as the warehouse phase of a CLO where a proportion of the funding will be provided by the CLO manager.

In addition, securitisation vehicles are often included in broader fund complexes where there can be consolidation required in certain instances.

Consideration is therefore required on a case-by-case basis. It is worth noting that a securitisation vehicle may have Pillar Two compliance obligations even where it is not subject to Pillar Two tax.