Financial reporting for power purchase agreements (PPAs) require a careful analysis of each contract as different clauses or a combination of them and the design of the electricity market can result in different financial reporting considerations and accounting treatment.

Overview of financial reporting considerations

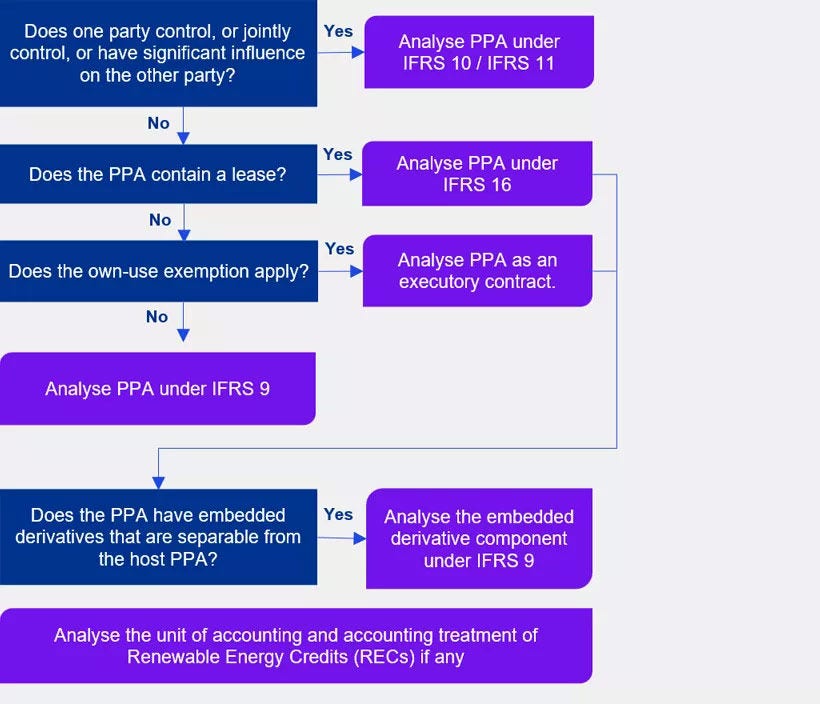

Broadly, the following outline of applicable accounting standards need to be considered in an assessment under IFRS® Accounting Standards:

Key questions

- Is the entity operating in a gross or net pool electricity market?

- Are PPAs recognised in financial statements on signing date or commercial operation date?

- Is the buyer involved in the design and operations of the power generating asset?

- Does the buyer have the right to obtain substantially all the economic benefits from the use of asset?

- Does the buyer intend to use all of the energy purchased as part of the contract?

- Does the PPA contain embedded derivative component (floors, caps, inflation adjustments)? Is it closely related?

- Would the PPA qualify for hedge accounting treatment?

- How to determine the market electricity forward curve if it is not observable?

- How will the proposed amendments to IFRS 9 impact your PPA contract?

How we can help

KPMG offers guidance and support to clients that are contracted in, or are looking to enter into power purchase agreements at every stage throughout the life-cycle of the PPA.

It is crucial that the entity understands the accounting implications associated with these complex instruments, especially with the proposed amendments to IFRS 9 that will impact renewable electricity contracts.

Before contract signing

- KPMG specialists will conduct an in-depth review of the clauses from an accounting perspective of the contract to determine the applicable accounting treatments that are used under different scenarios. We help you understand the accounting implications when entering into a PPA contract and how it may impact your financial statements over time.

At contract signing

- KPMG specialists will assist in the preparation of accounting memos outlining the accounting treatment of the PPA over the contractual term.

- We also provide help in the set-up of your hedge accounting framework and design of formal hedge documentations, as well as building and calibrating the appropriate valuation models customized to your PPA.

At contract signing

- KPMG specialists will assist in the preparation of accounting memos outlining the accounting treatment of the PPA over the contractual term.

- We also provide help in the set-up of your hedge accounting framework and design of formal hedge documentations, as well as building and calibrating the appropriate valuation models customized to your PPA.

Get in touch

If you have any queries related to Power Purchase Agreements, please don't hesitate to contact our team. We'd be delighted to hear from you.

Discover more in Energy, Utilities & Telecoms

Something went wrong

Oops!! Something went wrong, please try again

The contents of this webpage are for information purpose only and does not constitute accounting advice for a specific transaction. A detailed analysis of the contract and applicable accounting requirements is necessary to ascertain appropriate accounting treatment for a PPA contract.

This publication contains copyright © material and trademarks of the IFRS® Foundation. All rights reserved. Reproduced by KPMG Ireland with the permission of the IFRS Foundation. Reproduction and use rights are strictly limited. For more information about the IFRS Foundation and rights to use its material please visit www.ifrs.org

Disclaimer: To the extent permitted by applicable law, the IASB, the ISSB and the IFRS Foundation expressly disclaims all liability howsoever arising from this publication or any translation thereof whether in contract, tort or otherwise (including, but not limited to, liability for any negligent act or omission) to any person in respect of any claims or losses of any nature including direct, indirect, incidental or consequential loss, punitive damages, penalties or costs.

Information contained in this publication does not constitute advice and should not be substituted for the services of an appropriately qualified professional.

IFRS®’, ‘IASB®’ and ‘IAS®’ are registered Trade Marks of the IFRS Foundation and are used by KPMG Ireland under licence subject to the terms and conditions contained therein. Please contact the IFRS Foundation for details of countries where its Trade Marks are in use and/or have been registered.