What are the Principles?

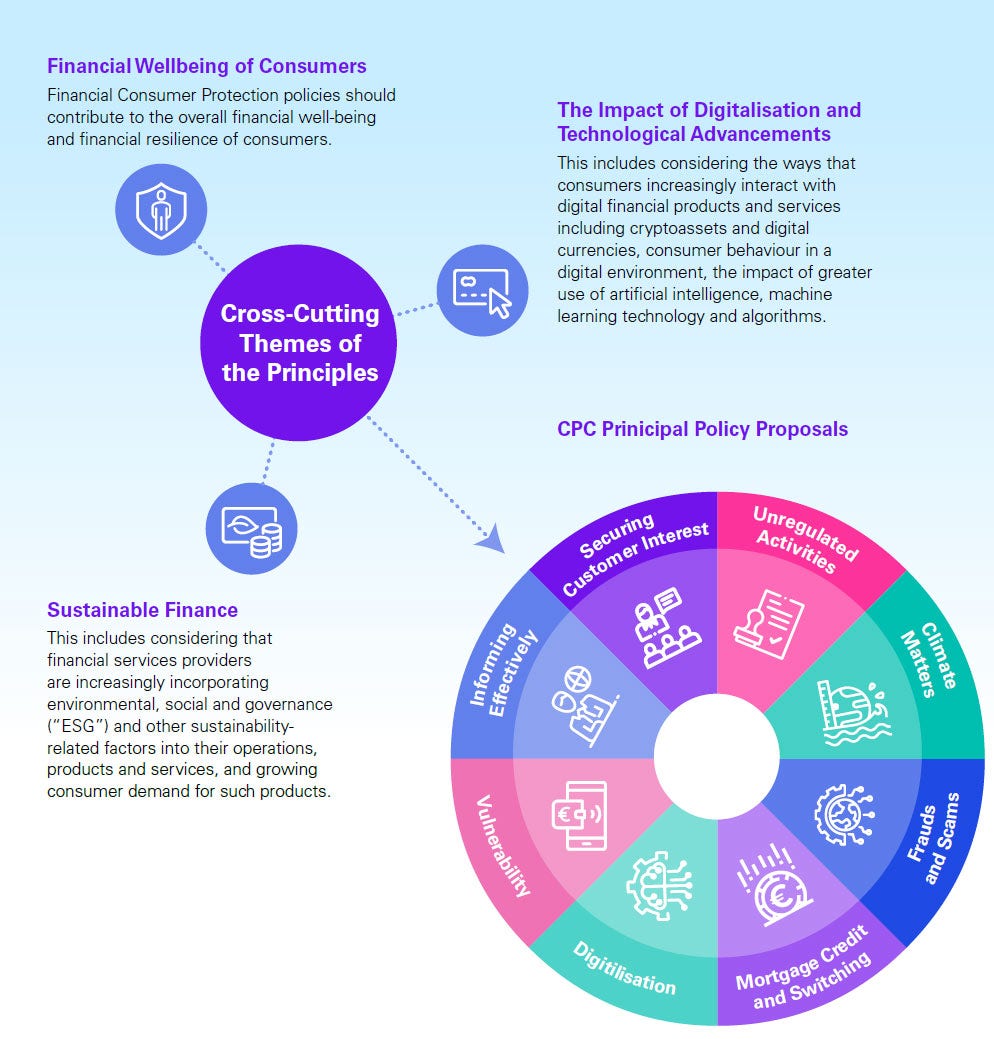

The G20/OECD High-Level Principles on Financial Consumer Protection (“the Principles”) are the leading international standard for comprehensive Consumer Protection frameworks. The Principles set out the foundations for a functioning financial services market which serves the interest of consumers.

They are designed to be applicable to a variety of circumstances and sectors, such as banking and insurance and have been adopted by many countries to enhance existing Consumer Protection frameworks. The Principles are a key focus of the Central Bank of Ireland (“CBI”) and are used to help shape the Consumer Protection Code (“CPC”).

Yvonne Kelleher and our Risk Consulting team explain the impact of the Principles below.