Domestic businesses and entrepreneurs shared their perspectives on Ireland’s tax system and its influence on entrepreneurship and business expansion. They highlighted several obstacles and potential remedies related to the existing tax framework.

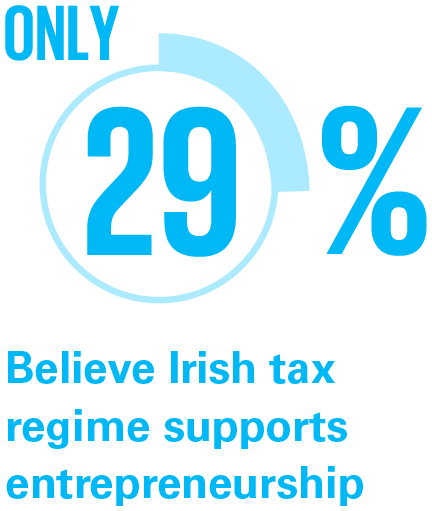

Our research found nearly three in ten (29 percent) felt that the current tax regime encourages entrepreneurship and growth, a slight increase from 24 percent in 2023.

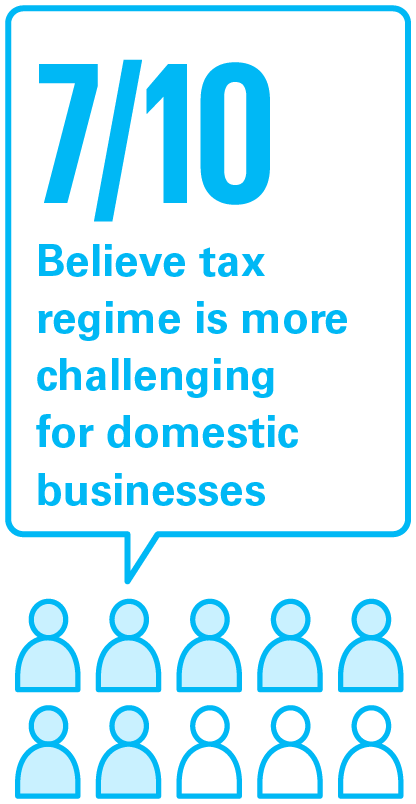

Seven in ten believe the Irish tax regime is more challenging for domestic businesses, while six in ten voiced concerns about the administrative complexity associated with the Irish tax system, particularly for smaller enterprises and entrepreneurs.

Over a third (36 percent) anticipated that the €10 million cap on capital gains tax retirement relief, set to take effect from January 1, 2025, would affect Irish businesses. From that date, a limit of €10 million will apply to the market value of assets that qualify for the relief where the disposal is made to a child and the disponer is aged between 55 and 69. A €3 million cap will apply from age 70 onwards (instead of 66). This will have a detrimental impact on lifetime inter-generational transfers of affected Irish businesses.

Many business owners will be reluctant to jeopardise the sustainability of their businesses by burdening them with capital gains tax liabilities on a transfer, which means that affected businesses will be deprived of the injection of entrepreneurial energy and vision that arises on the inter-generational transfer of a business.

In many instances, this new policy will restrict the growth potential of many Irish businesses and reduce the capacity of the Irish economy to develop additional businesses of international scale. It may also cause owners to consider selling where they previously would have sought to develop and grow the business. KPMG’s pre-Budget 2025 submission calls for the planned introduction of the €10 million cap on retirement relief next year to be cancelled or paused and given further detailed consideration and analysis.

When looking at family businesses, there is no doubt that as Ireland matures economically, it is becoming more difficult to involve the next generation in a family business as the options available to that generation outside the family business continue to widen. Recent changes to the capital gains tax rules, which place an upper limit on the value that can transfer to children via retirement relief, could also have a significant impact.