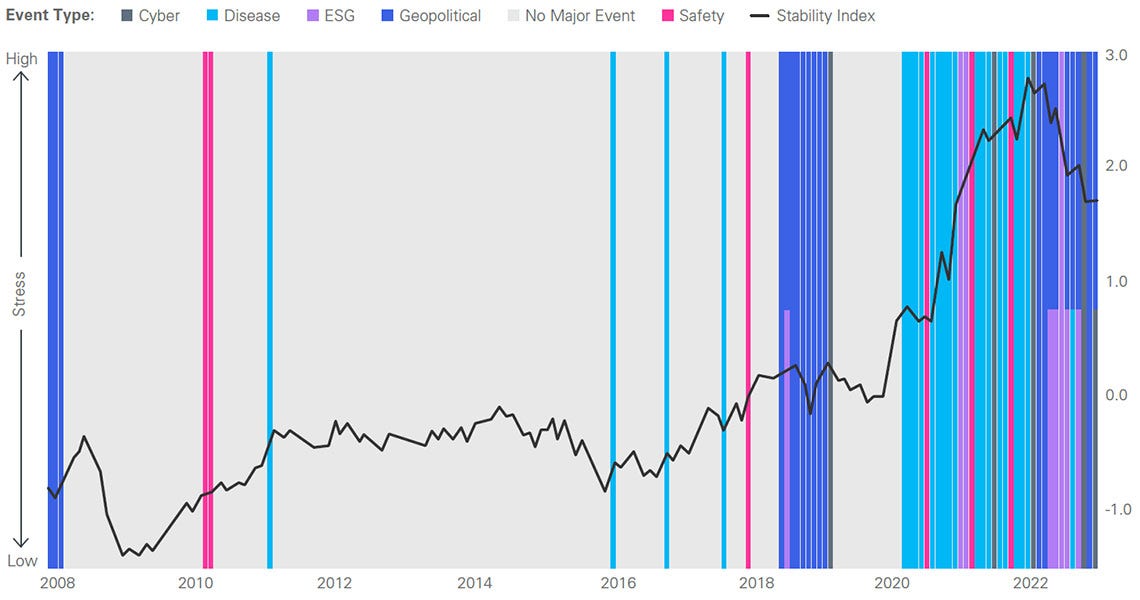

In recent years, both supply chains and the broader economy have experienced an extraordinary series of shocks. The effect of these has been to create volatility and disruption on a massive scale, which has started to look less like a brief blip and more like a new operating normal for manufacturers and consumers.

With the pandemic now firmly behind us, it's important to consider what this new normal means for Ireland's supply chains, and how businesses can enhance their resilience in the face of this rapidly evolving geopolitical landscape. Willam Taylor and our Strategy team explain below.