Introduction

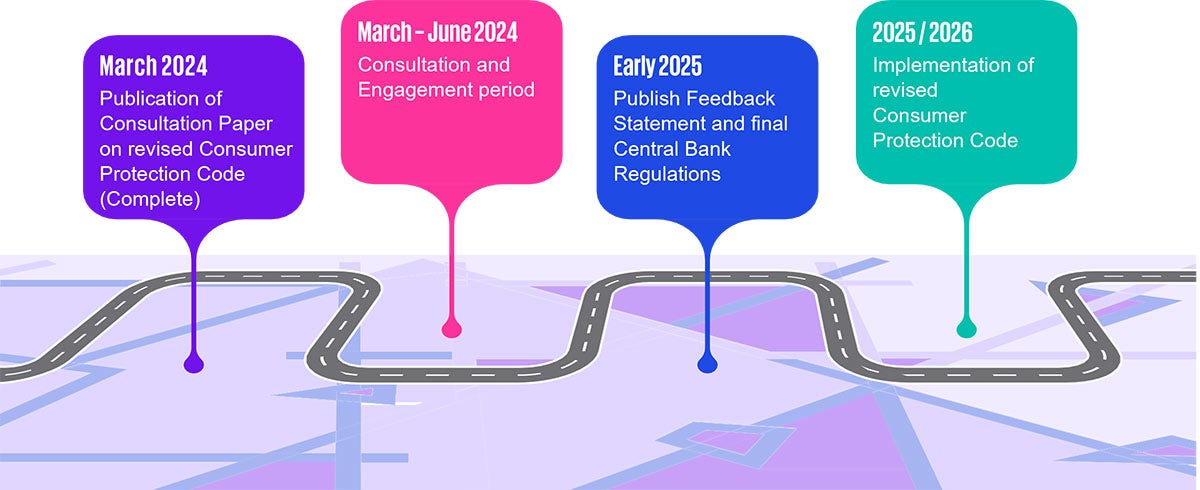

Following an extensive engagement period, the Central Bank of Ireland (hereinafter “CBI”) has issued a Consultation Paper on the Consumer Protection Code (hereinafter “CPC” and “the Code”). Our Consulting team explain the proposals and their implications below.

This Consultation Paper will allow for stakeholders and the CBI to engage with each other on the proposals suggested by the CBI. The consultation period will run until June 2024.

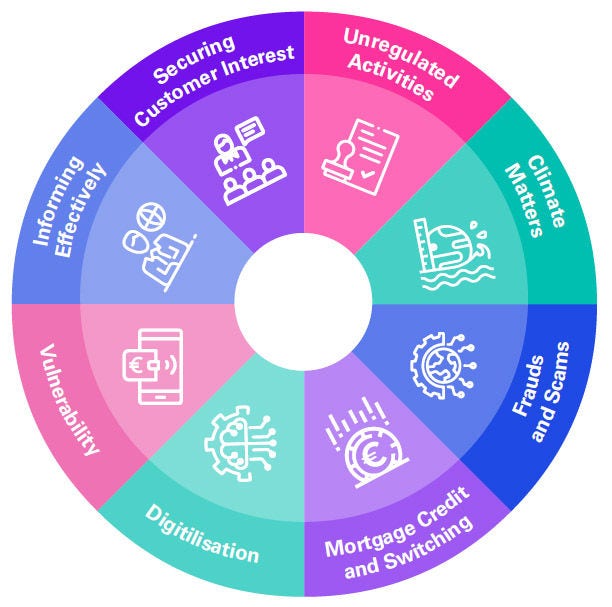

The CBI aims to deliver an updated and modernised Code that reflects the constantly changing financial environment of today. The CBI has clarified the renewed mandates of the CPC by providing insight into how firms should meet their modernised regulatory obligations.

Accessibility to the CPC for consumers is also provided through the creation of a Consumers’ Guide, as well as various online tools to aid firms in understanding their specific consumer protection obligations.