Article Posted date

17 August 2023

1 min read

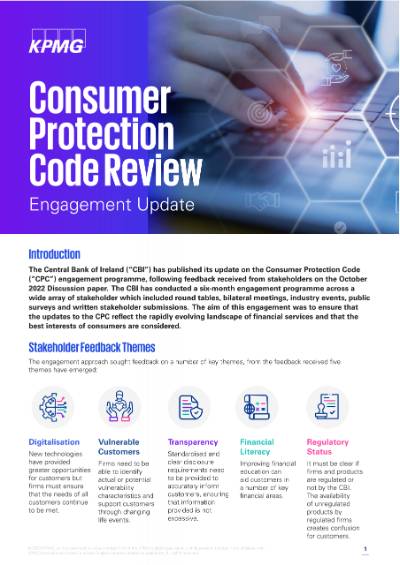

The Central Bank of Ireland has published its update on the Consumer Protection Code engagement process. The CBI has conducted a six-month engagement programme across a wide array of stakeholder which included round tables, bilateral meetings, industry events, public surveys and written stakeholder submissions. Our Risk Consulting team discuss the update below.

The aim of this engagement was to ensure that the updates to the CPC reflect the rapidly evolving landscape of financial services and that the best interests of consumers are considered.

A number of key themes emerged in the feedback received from stakeholders:

- Digitalisation: New technologies have provided greater opportunities for customers but firms must ensure that the needs of all customers continue to be met;

- Vulnerable Customers: Firms need to be able to identify actual or potential vulnerability characteristics and support customers through changing life events;

- Transparency: Standardised and clear disclosure requirements need to be provided to accurately inform customers, ensuring that information provided is not excessive;

- Financial Literacy: Improving financial education can aid customers in a number of key financial areas;

- Regulatory Status: It must be clear if firms and products are regulated or not by the CBI. The availability of unregulated products by regulated firms creates confusion for customers.